It is a rough opening to Wall Street amid the chaos and fear emanating from the failure of SVB and Signature Bank. Financials are weighing heavily with weakness across the banks and especially smaller, regional institutions. The US100 has opened with a -1.76% loss, while the US500 is off -1.10%, while the US30 is off -0.70%. Not surprisingly there is a lot of jostling going on currently as investors digest the BTFP’s impacts. Many of the smaller bank shares have been halted due to volatility. President Biden addressed the nation and tried to assure SVB and Signature depositors will be made whole, and that this was not a taxpayer bailout. Nevertheless, there is a lot of uncertainty coursing through the system.

So far efforts in the US and the UK to limit the fallout have had limited impact.

European stock markets are off session lows, but still sharply down on the day, as the SVB crisis continues to rattle markets despite efforts by officials to shore up confidence in the financial system. The US FDIC said over the weekend it will resolve SVB in a way that “fully protects all depositors” while the Fed announced a new “Bank Term Funding Program”.

In the UK the Treasury and the BoE brokered a deal that saw HSCB buying the UK arm of SVB. In the Eurozone, the head of the Eurogroup said the Eurozone had little exposure, but still said Eurozone Finance Ministers would discuss the issue. The problem of course is that the headlines suggesting that Finance Ministers will discuss developments seems to imply that there is a problem to discuss, which isn’t helping at the moment. GER40 and UK100 are still down -2.15 and -1.7% respectively, peripheral Eurozone markets are underperforming and the MIB is posting a -3.4% loss, although all are off session lows.

Oil Action: Oil prices have corrected as the collapse of SVB reverberates through markets. Risk aversion spiked, global stock markets struggled, and rate hike bets were trimmed. The WTI contract is down 3% on the day and currently at $72.34 per barrel, Brent at $78.30 per barrel from $83.29. Looking ahead, confidence in a rebound of China demand has picked up again, which should help to limit the downside, if and when officials manage to calm SVB nerves.

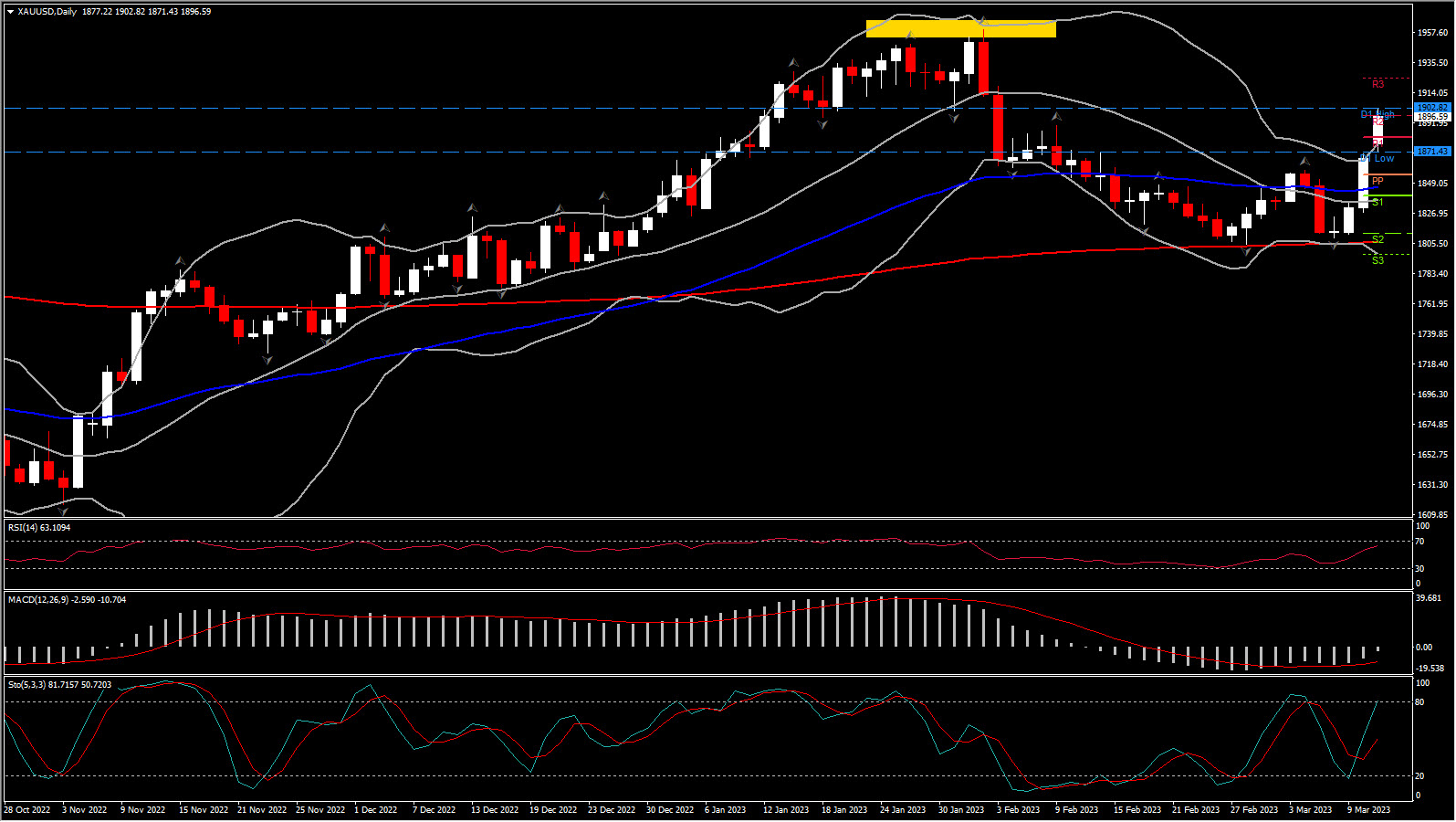

Metal Action: Gold has benefited from the jitters in global stock markets and the correction in the Dollar and the precious metal saw a session high of $1902 per ounce. Risk aversion has spiked and with markets adjusting rate bets, bullion is once again looking attractive as a store of value.

FX Action: The USDindex saw a session low of 103.32, as Treasuries yields plunged the most since the 1980s! Markets scaled back expectations for the terminal rate and briefly priced out any further tightening in the US. EGBs also rallied, but while EURUSD and Cable are off session highs, they remain up on the day at currently 1.0712 and 1.2125 respectively. The Yen outperformed and strengthened across the board, as risk appetite spiked, leaving USDJPY at 132.27.

Fed funds futures have surged amid a massive safe haven bid and as the market prices out any further Fed action. Reflecting how quickly the world has changed, implied rates are now pointing to rate cuts through the year versus a 50 bps hike on March 22 and 25 bps in the subsequent May and June meetings. The actions to provide liquidity via the “BTFP” and attempt to calm and stabilize sentiment have had only modest impact. The March implied rate has dropped to 4.633%, while May is priced at 4.580%, with June at 4.535% and July at 4.310%. December is trading at 3.905%. Goldman Sachs has dropped its projection for a rate hike. Concurrently, the 2-year Treasury yield has tumbled some 54 bps on the day to 4.04%. It tested and bounced off of 3.99% earlier, and was at 5.3% overnight. The 10-year rate is 26 bps richer at 3.44%. The curve steepening has seen the curve inversion unwind to -64.5 bps versus -82 bps overnight and -108 bps late last week.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.