USDCHF, Daily

The sharp fall in US and European financial stocks did not help the US Dollar, which underperformed last week and remained sluggish during trading on Monday due to the coordinated central bank actions announced at the weekend. A Fed tightening cycle that may be materially downgraded and system stability concerns that would normally give it a safe haven boost, saw the USD get crushed. The Swiss franc to Dollar exchange rate has remained floating in the last 3 days of trading, but could strengthen this week, if global markets stabilise ahead of the Fed and SNB rate decisions.

The Swiss National Bank is scheduled to announce its monetary policy decision on Thursday, hours after the Federal Funds Rate is announced, but the meeting has been overshadowed by the Credit Suisse crisis. If the emergency takeover of Credit Suisse by UBS is enough to prevent a wider fallout, then it may be possible for the SNB to proceed with its planned rate hikes. Although there is uncertainty about the magnitude of the expected increase and how many additional tightening signals policymakers will give.

The Swiss franc, usually a haven in risky conditions, was rendered helpless by the banking storm, after a panic sell-off over the health of US banks sent tremors through the market, this prompted Credit Suisse’s largest shareholder reluctant to prop it up with more money.

The latest conditions have at least tempered the hawkish rhetoric, as the need for financial stability takes precedence now. Previously, a 50 basis point rate hike was fully anticipated for March, but the possibility of a 25 basis point hike was more appreciated. Even after a dramatic re-evaluation of rate hike expectations, as many as two additional rate hikes of 25 bps were priced in for the SNB. However, the consumer price index unexpectedly rose higher since January, above the central bank’s target range of 0-2%, suggesting that it may not have peaked yet.

The policy rate is of course not the only tool the SNB uses in the fight against inflation, as it has also been selling its foreign currency reserves to buy Swiss francs in an effort to lower import prices. This was unthinkable a year ago when policymakers considered the franc to be significantly overvalued and were still actively selling it.

Technical Review

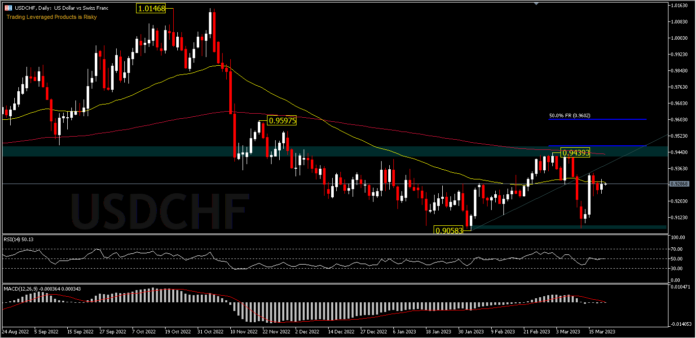

USDCHF, D1 – A dovish hike could put pressure on the Swiss franc, bringing the USDCHF currency pair moving above the 50-day exponential moving average (yellow line). Further upside could test 0.9439 resistance which is below the 200-day EMA and 38.2%FR level. While moving above this level, USDCHF could test 0.9597 resistance which is below the 50.0%FR level from 1.0146 – 0.9058 drawdown. However, if the SNB maintains a hawkish bias, then USDCHF could again test the 0.9058 level and further to the 0.9000 round figure. RSI and MACD are currently neutral at the centre line, waiting for volatility signals to be sent by the Fed and SNB.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.