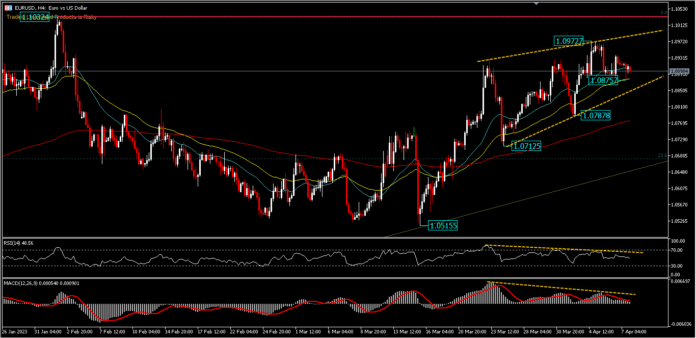

EURUSD,H4

Last week’s non-farm payrolls data showed that the US labor market remains resilient, but also confirmed a continued slowdown in job growth, while also revealing job losses in several sectors of the economy. The USD was widely but briefly bought, after the Bureau of Labor Statistics said non-farm payrolls rose 236k in March, down from an upwardly revised 326k in February but higher than consensus.

Federal Funds rate futures showed lending rates increased somewhat on Friday, but the March payrolls report and other recent statistics have some analysts expressing concern that non-farm payroll growth may only reach 50,000 over the next two months.

Interest rate markets have shifted abruptly in recent weeks, prompting a pullback for the Dollar and helping to lift the Euro-Dollar exchange rate briefly ahead of the Easter holidays.

This week is not only shortened after the Easter weekend, it is also tied to hard-hitting economic data. From Europe, the ECB Account will be of interest given recent events as well as the central bank’s decision to raise interest rates by 50 basis points amidst the banking turmoil.

Technical Analysis

The intraday bias remains neutral for consolidation below the temporary high of 1.0972. Further gains are expected as long as the 1.0787 support and the 200 EMA hold. A move above 1.0972 would continue the 1.0515 rally to retest the 1.1032 peak. A strong break there would resume a bigger uptrend, but a break of 1.0787 would turn the bias back to the downside for the 1.0712 support. RSI declined to the 48 level and MACD is showing divergence which requires downside confirmation below 1.0875 minor support.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.