Wells Fargo & Co. (WFC.s) is a financial services company with operations around the world and the third best bank in the US by asset quality and capitalization of $148.2B. The bank is expected to report earnings for the fiscal first quarter ending March 2023 on Friday, April 14 before the market opens.

Zacks positions Wells Fargo Rank #3 (Hold) in the Fund 22% position #197/250 of the Banking industry – Regional Majors. EPS of $1.15 is expected for this report (as for Nasdaq) with an ESP of 6.32% although the most accurate estimate is $1.22, marking a 30.68% year-over-year increase. A profit of $20.29B is expected, which would be an increase of 15.36% y/y.

The estimate has 4 downward revisions and 1 upward revision in the last 60 days. Wells Fargo has a P/E ratio of 8.20 and a PEG ratio of 0.80. The company has reported results above the estimate 9 times out of the last 10 reports, the only negative in July 2022.

Last quarter the company reported better than expected EPS of $0.67 vs. expectation of $0.63 with a surprise EPS of 6.35% and revenue of $19.66B down -6% y/y, due to various issues surrounding litigation and regulatory affairs.

The annual price outlook for Wells Fargo marks the lower forecast at $36.00 (-8.6%) and the higher expectation at $65.00 (+65.1%) while the average price is at $48.15 (+22.3%).

The situation of the regional banking crisis in the US is likely to be beneficial to Wells Fargo (and other large institutions), as investors can strengthen their confidence in large banks, considering them safer due to their crisis management, coupled with the fact that deposits that were withdrawn from other smaller institutions are expected to migrate to larger institutions like WFC.

Another favorable matter is the slowdown in the rise in interest rates by the FED (which expects a last increase of 25bp this May 3), since although inflation is currently still high at 6.0%, it has consistently decreased, falling a total of 3.1% compared to its June maximum, which may open investors’ appetite for risk, although fear of recession remains latent.

The worsening in consumer credit last quarter, due to high rates, is expected to continue to affect the bank.

On the employment side, although the unemployment rate came out better than expected at 3.5%, only 236k jobs were added last month, worse than expected against the 239k forecast. Average hourly earnings came out low at 4.2% vs 4.3% YoY while monthly held at 0.3%, data which suggest that the labor market is softening, which WFC analysts say is consistent with the Fed’s 2% target.

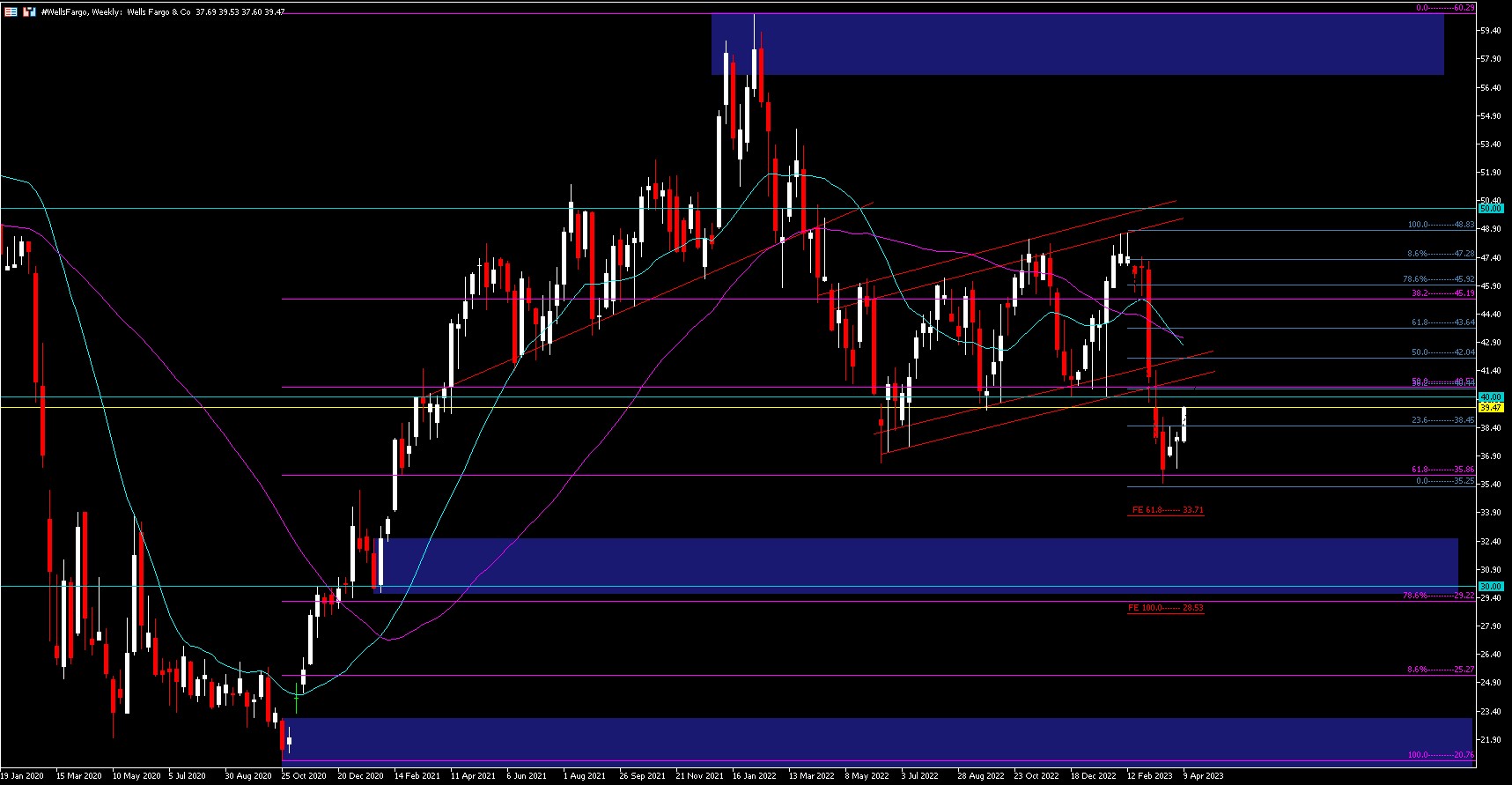

Technical Analysis- Wells Fargo W1 – $39.47

#WellsFargo (WFC.s) started a bearish flag pattern in April 2022, and in this first quarter the price had one last upward rebound, leaving highs at $48.83 to fall -27.6%, breaking the pattern downwards and leaving lows at $35.25.

Currently, the price is making a pullback in line with the pattern to the area between the Fibo 38.2% at $40.44 and the Fibo 61.8% at $43.64, although the $40.00 level will serve as an immediate border, with a rejection at this level or area expected before a fall back to the target of the pattern close to the lows of January 2021 at $30.00-$31.20.

On the contrary, to recover the bullish bias, the price should exceed and maintain $45.00. If this is done, the price could test the highs of this first quarter and if it exceeds them, it could go to the highs of February 2022 at $60.20.

Click here to access our Economic Calendar

Aldo W. Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.