Prologis, Inc. ( PLD.s ) is one of the world’s largest manufacturing and real estate investment trusts, investing in California-based logistics facilities. The company has a capitalization of $110.59B.

The company is expected to report earnings for the fiscal first quarter ending March 2023 on Tuesday, April 18, before the market opens.

Zacks positions Prologis at Rank #3 (Hold) in the Fund 37% rank #159/251 in the Real Estate Investment Trust (REIT) – Equity Trust and Others industry. EPS of $1.21 is expected for this report (as for Nasdaq) with an ESP of -1.37%, marking a year-over-year increase of 11.01%. A profit of $1.63B is expected, which would be an increase of 50.97% y/y.

The estimate has 1 downward revision and 1 upward revision in the last 60 days. PLD has a P/E ratio of 21.72 and a PEG ratio of 3.09. The company has reported results above the estimate 19 times out of the last 20 reports, the only negative in July 2022.

Last quarter the company reported EPS of $1.24, beating expectations by $0.03, and revenue of $1.59B, higher than forecast by $135.7M. Profitability and net margin increased by 7.71% and 56% y/y respectively thanks to cost management and good industry conditions, and these factors are expected to continue during this quarter.

For several quarters the company has managed to exceed the absorption mark of 100 msf (“thousand square feet” = 30,480 meters) for which this trend is expected to continue. In addition to last year, the industrial market signed 757 msf.

New deliveries last quarter remained high, with 437.6 thousand square meters of industrial products completing construction, increasing competition.

The price outlook for the next 12 months has its lower forecast with an increase of 4.4% at 125.00, the higher price with an increase of 61.1% at 193.00 while the average price is estimated at 16.9% at 140.00.

Institutions and hedge funds that hold more than 75% of PLD shares have increased their positions by buying new shares. Leading investors such as SevenOneSeven Capital have increased their purchase by 2.3%, Harbor Investments 3.6%, Centaurus Financial 6.1%, Covington Capital increased 11%, thus showing optimism among investors. Wells Fargo raised the PLD target to 141.00.

The company’s strong business model and customer experience-focused operating strategy along with its sustainable practices and high-quality logistics centers are expected to maintain the company’s good standing during this ongoing period.

On the other hand, the lack of demand amid global economic pressures and tight market conditions is likely to affect certain factors of the company.

Despite the fact that rents increased in 2022, they showed moderation in the last quarters, while the average industrial rental rate rose +1.0% last quarter to $29.07 per square metre. This marked the strongest year in history for annual rental rate growth.

The company’s cost structure and expansion efforts based on acquisitions and developments are expected to provide momentum at the top line.

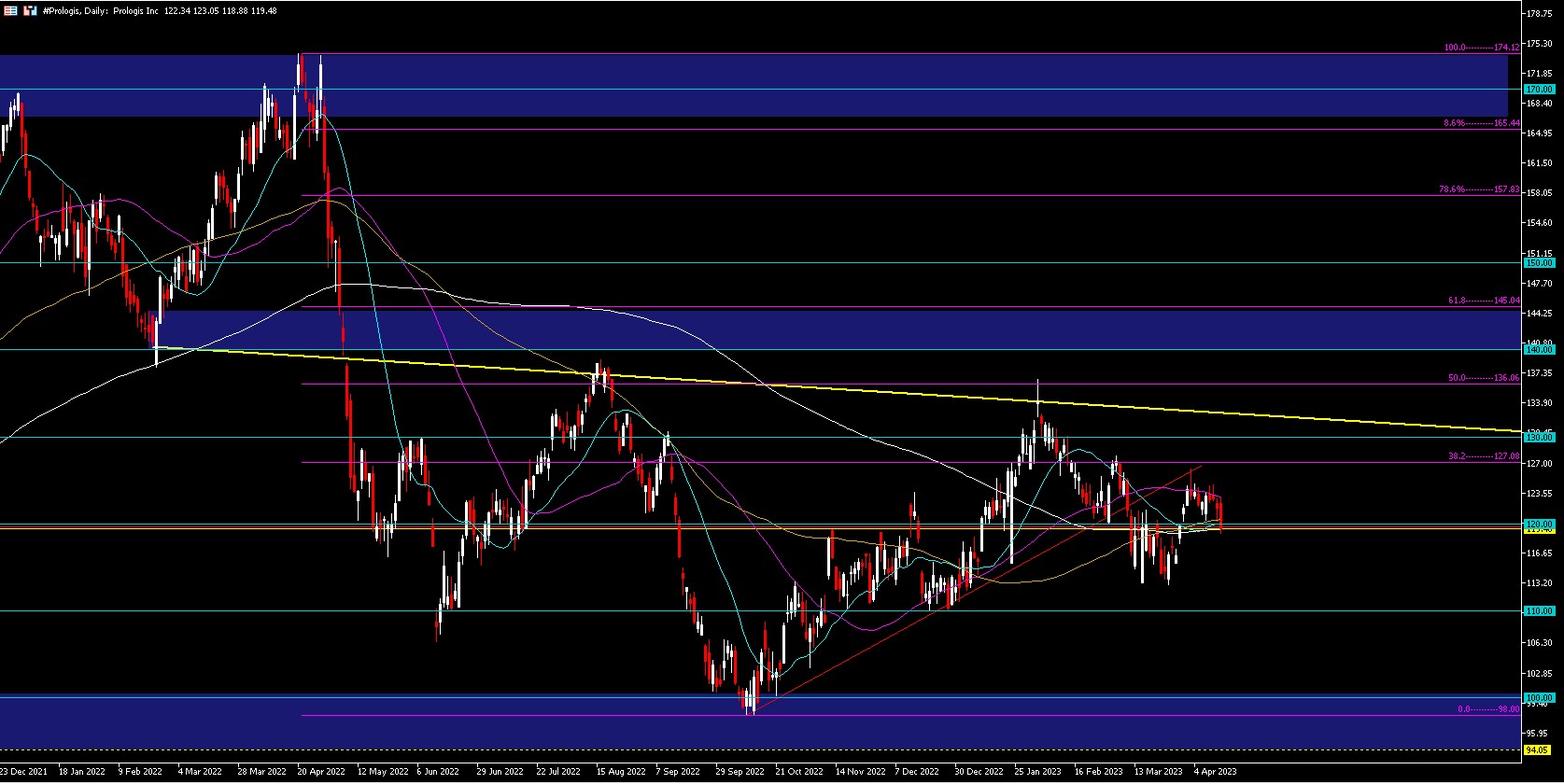

Technical Analysis – Prologis D1 – $119.48

During this quarter, the price of Prologis rose from a minimum of $112.25 to a maximum of $136.61; however, the price fell back, leaving a minimum of $113.00. Currently, the price is at $119.48.

You can see the formation of a “head-shoulder-shoulder” without confirmation, to do this the price should break the yellow neckline that is between the psychological level of $130.00 to Fibo 50% at $136.06. If it remains above this range, the price could be boosted to the maximum zone of April 2022 around $170.00.

On the other hand, the price has broken the bullish guideline that it maintained and is now testing the psychological level of $120.00 downwards. In the case of breaking the psychological level of $110.00, the price may go on to test the key support level at $100.00 to October lows at $98.00.

Click here to access our Economic Calendar

Aldo W. Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.