The Dollar rebounds at levels close to the yearly low on the back of increased hawkish rhetoric from FED officials.

Dollar

The Greenback rolls into midweek having found some significant support around the yearly low level at 100.50. Factors driving this buying pressure at a psychologically significant area can primarily be attributed to the hawkish comments made by several pertinent members of the FED. The general outlook from these members appears to maintain the outlook that inflation has eased, but not significantly enough to warrant a pivot just yet. On the contrary, there seems to be a growing consensus that there is room for more rate hikes and that they will be held at those levels for a long enough period until inflation is contained.

Additionally, the better-than-expected economic data coming from the world’s second largest economy (China) eased major anxiety over a global economic slowdown and led to the Dollar struggling to attract investors looking for safe-haven assets. This resulted in a minor correction for the Dollar yesterday; nevertheless it still trades above a significant buy zone and continues to be supported by the overall long-term FED dynamics.

Technical Analysis (D1)

In terms of market structure, Current Price action has formed a potential reversal pattern in the form of a descending channel. The pattern has been partially validated as an impulsive break of structure moving to the upside as bulls took control of the narrative, before the ensuing corrective wave. Henceforth price could remain bullish if buyers can defend the potential descending channel continuation pattern that is currently being formed. Conversely, if sellers break through the support level around 100.50, the narrative could shift towards the bears and break below the low of the year.

Euro

The European common currency heads into the middle of the week slightly under pressure as it loses some grip on the recent advances made. Factors driving this lack of enthusiasm from buyers can be linked to mainly dollar dynamics as well as the FED and ECB divergence on rate hikes. In a week devoid of major economic data besides the EMU final inflation rate, the EURUSD has been largely affected by hawkish comments made by FED officials as well as ECB officials, who both have a bias towards a monetary policy that’s tighter and for longer than anticipated at first. As it stands both central banks are expected to raise interest rates by 0.25% in May.

Technical Analysis (D1)

In terms of market structure, Current Price has approached an area with sell side pressure in the form of an ascending channel. This pattern gives bears the possibility of driving price if the current continuation pattern plays out successfully, which would confirm the larger double top reversal pattern potentially forming. Conversely if the bulls can sustain the pressure, price could break above the level and continue the uptrend if it invalidates the resistance area in an impulsive wave.

Pound

The Pound heads into the middle of the week registering a 3rd daily high in as many trading days. Factors driving this exuberance can be linked to upbeat UK inflation data coming in at 10.1% YoY in March versus the expected 9.8%, and the Core CPI coming in at 6.2% YoY compared to the expected 6.0% forecast. This data, coupled with the previous days’ employment figures, have caused optimism around the BoE’s rate hike cycle to continue and accelerate. Looking ahead, Cable will likely be influenced by dollar dynamics and any ephemeral comments made by Central Bank Officials.

Technical Analysis (D1)

In terms of market structure, the bulls have been in control of the narrative and price has tested the key 1.244 level and has since pulled back forming a potential bearish double top. As price retests this peak formation again, two scenarios present themselves. Namely, if the area is defended by sellers in this current rising channel continuation pattern it could result in the potential reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the middle of the week under some pressure on its way to retest the weekly low around the $1 989 level. Factors driving this reduced appetite from buyers of the yellow metal can be attributed to several factors driving the Risk Profile in the market this week.

- Geopolitics surrounding US vs China concerning Taiwan

- Geopolitics surrounding concerns over Russian hackers targeting Western infrastructure

- Fears of a US debt payment default, due to Joe Biden’s hesitance in lifting debt limits.

- Hawkish comments maintained by FED officials, which further cements the probability of a 25bps rate hike in May

All the above factors have led to a strong Risk-Off mood in the global market which has flowed buyers to the Dollar as investors seek safer assets to the detriment of the yellow metal.

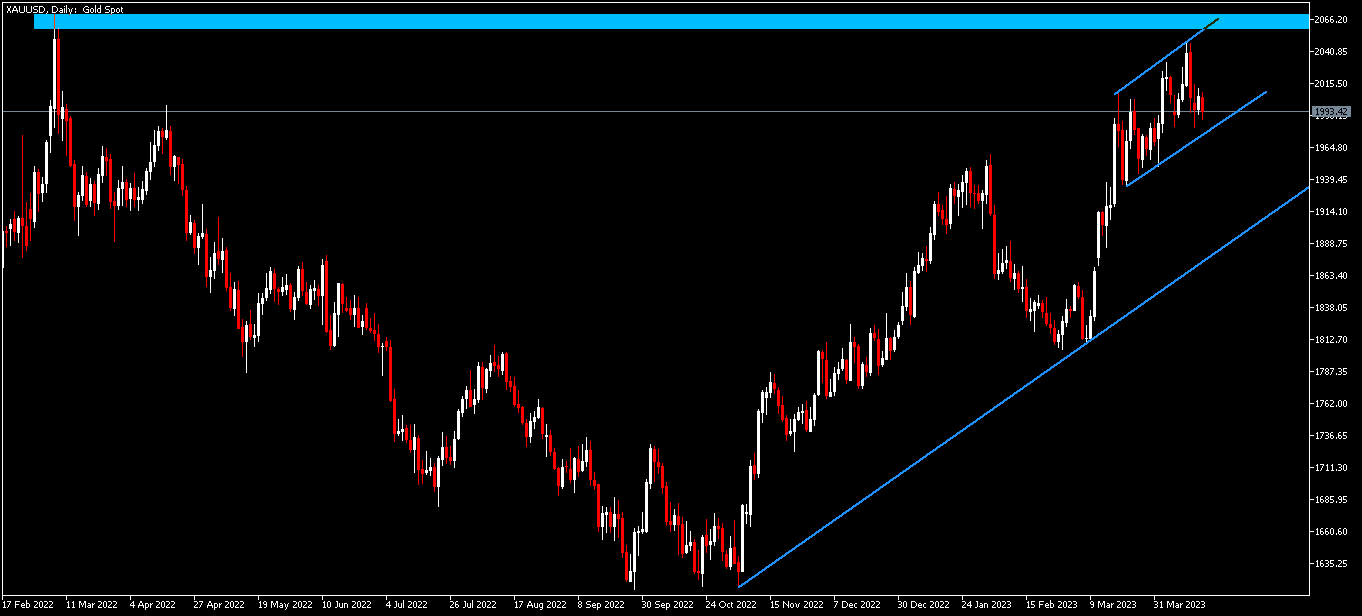

Technical Analysis (D1)

In terms of market structure, price action has been mostly bullish, with clear higher-highs and higher-lows being printed out. Current Price action is approaching the Feb 2022 high in a corrective wave associated with a potential rising channel reversal pattern. Henceforth price action should be given the chance to print itself out to either validate the reversal pattern or to invalidate it by continuing to move up impulsively towards the aforementioned high.

Click here to access our Economic Calendar

Ofentse Waisi

Financial Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.