Chevron Corporation, an American multinational energy company mainly engaged in oil and gas, is scheduled to report earnings on Friday, 28 April 2023 before the market opens, along with Exxon Mobil, TC Energy Corp. and others in the energy group. Chevron’s report is for the fiscal quarter ended March 2023. Chevron currently has a market capitalisation of $320,422,106,521.

Chevron has maintained its position as one of the world’s most reliable and prosperous energy brands, with a vast portfolio of assets spanning many countries, despite market uncertainty and oil price variations over the past few years.

Revenue for Q4 2022, came in at $7.9 billion, up 61% from a year earlier, but short of the record quarterly revenue of $11.4 billion reported for the second quarter. Q4 earnings per share of $4.09 fell short of the $4.38 per share forecast from analysts polled. But revenue in the quarter of $56.5 billion surpassed estimates by nearly $2 billion and was up 17% from a year earlier. Full-year revenue of $246.3 billion was up 52% from 2021. The record profits came mainly from soaring oil prices throughout the year, not from increased production.

The average oil company benefited from a surge in oil prices during 2022, after Russia’s invasion of Ukraine. While Russia, one of the world’s leading oil exporters, sent relatively little oil to the United States, sanctions imposed on Russia after the invasion shook global commodity prices that dictated oil prices.

In its Q1 2023 report, analysts expect Chevron to announce earnings of $3.36 per share for the quarter, reflecting the current strong performance of the oil industry. The reported EPS for the same quarter last year was $3.36. This news follows Chevron’s recent announcement of a substantial quarterly dividend payment on 10 March, indicating strong performance and growth for the company.

Statistics show that institutional investors have recently modified their holdings in Chevron stock, such as Shepherd Financial Partners LLC, Bluesphere Advisors LLC, Annandale Capital LLC, TFB Advisors LLC, Arabesque Asset Management Ltd. This is certainly a clear indication that these entities remain optimistic about future growth prospects for one of America’s premium oil companies.

Technical Outlook

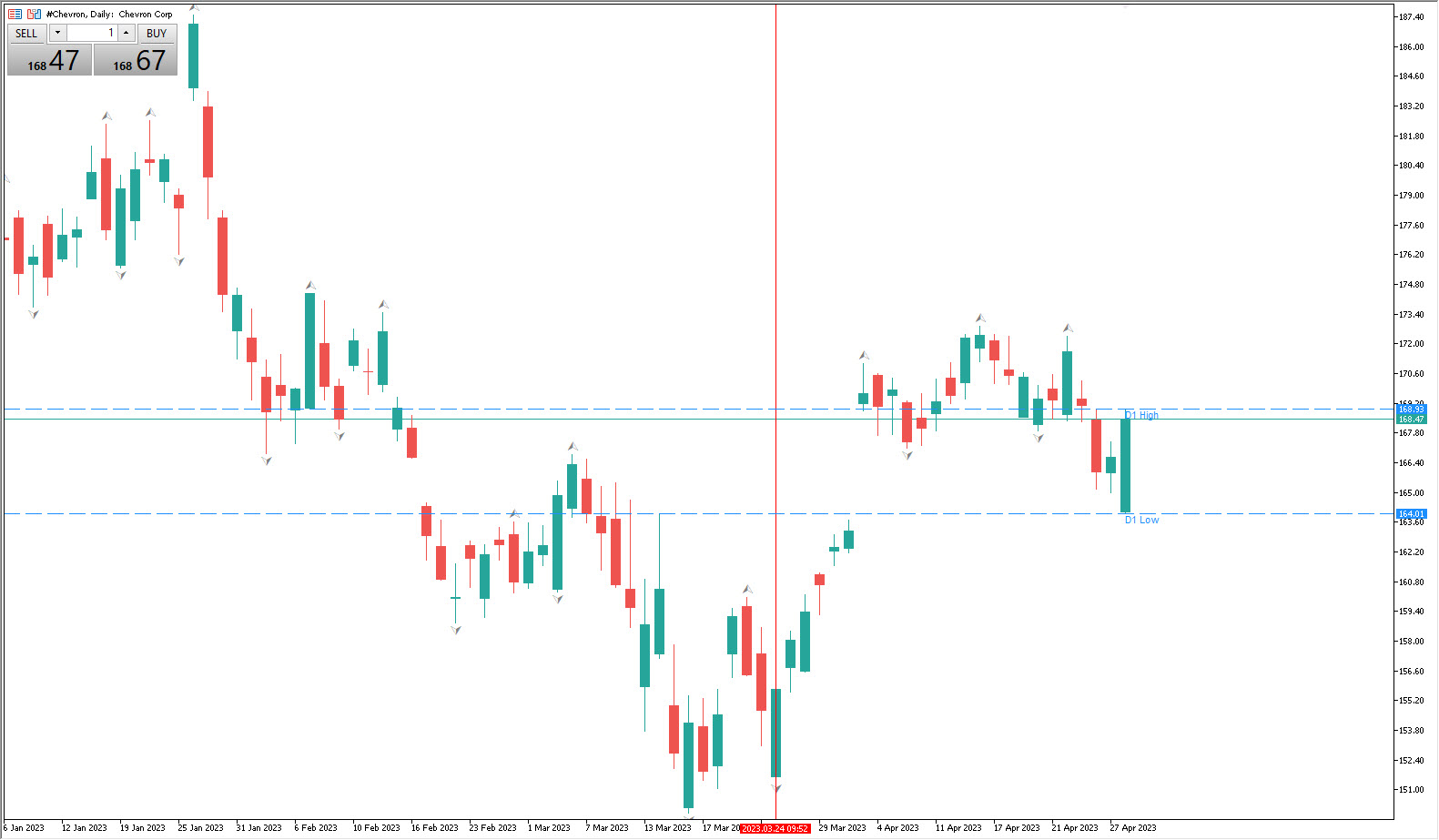

#Chevron,D1 – is still seen strong to continue the 149.90 rally seen at the beginning of this week. The closest support is at 172.83, and a move above this level could move to test the 174.38 (61.8%FR) resistance and the possibility of testing the median line also looks possible, given that the daily candle is still moving above the 26-day and 52-day EMAs and the support indicators depicting RSI at a level that is not overbought and MACD still in a solid buy zone. Major resistance is seen at 187.53 and 189.66.

But a below-expectations earnings report could bring downside as well. A move below 167.09 support could test 158.86 support. The recent strength in oil prices, however, looks set to contribute to Chevron’s earnings this time around. At the time of writing, USOil is trading at $78.65 and UKOil at $82.50, each strengthening specifically since OPEC+ reduced production.

Several asset managers have also rated Chevron stock, including : Truist Financial raised their price target on Chevron from $179.00 to $193.00 and gave it a “buy” rating – BNP Paribas upgraded Chevron from an “underperform” rating to a “neutral” rating and set a $200.00 stock price target – Scotiabank upgraded its “sector perform” rating to a “sector outperform” rating and raised its target from $195.00 to $200.00. According to MarketBeat, Chevron presently has a consensus rating of “Moderate Buy” and an average target price of $192.00.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.