After an impressive rebound in Q1 2023, gold prices seem to be in a bull market. The XAUUSD price has increased by more than 8% since the beginning of the year. This is an impressive recovery after a slow 2022, as it experienced challenges caused by aggressive interest rate hikes.

Gold prices slowly declined after reaching a third peak of 2048.61 in April, and since then have traded flat with points of interest at the psychological 2000.00 level. In Monday’s trading (01/05), XAUUSD tested the important level again, but closed lower at 1982.21 after the release of stronger ISM Manufacturing PMI and Yield data.

The US ISM Manufacturing PMI rose to 47.1 in April 2023 from a three-year low of 46.3 in the previous month and slightly above the market consensus of 46.8. However, the latest reading showed economic activity in the manufacturing sector shrank for the 6th consecutive month, as higher borrowing costs and tight credit depressed activity and increased the risk of a recession this year. The employment rate stabilised after two periods of decline (50.2 vs. 46.9). The survey also pointed to faster deliveries and shorter lead times from suppliers. On the price front, input costs increased again in April after declining slightly in the previous month.

The 10-year US Treasury yield rose to 3.55% near a one-month high of 3.6% from 16 April amid evidence of high inflation and easing concerns over turmoil in the banking sector. JPMorgan agreed to acquire the assets of First Republic Bank and take its deposits in a government-led deal, ending the risk posed by troubled lenders to the financial system and lowering demand for US Treasury security.

PMI data from ISM and S&P showed that inflationary pressures accelerated in April. The market is in full consensus that the Federal Reserve will raise rates by 25bps this week and swap prices suggest that investors are reconsidering bets that the central bank will still deliver rate cuts this year.

Technical Review

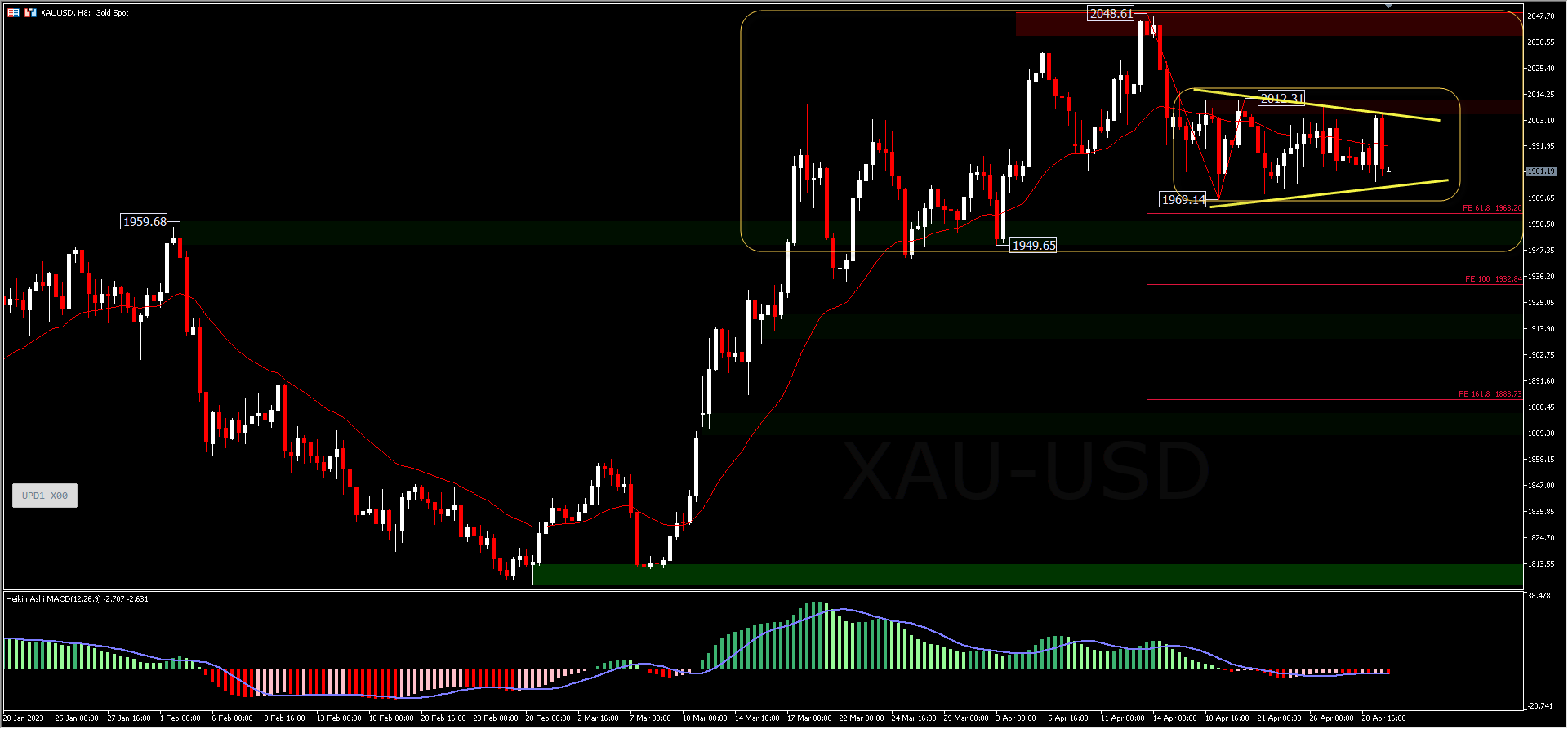

XAUUSD – Divergence and weakening momentum of the gold rally was demonstrated throughout the month of April as gold topped 2048.61. A break of 1969.14 support, and a downside move for FE61.8 from 2048.61-1969.14 drawdown and 2012.31 at 1963.20 is projected, while support and resistance zones around +/- 1950.00 will be an important focus, as these price levels are crucial. Moving below this level, gold prices are projected to reach FE100 at 1932.84. As long as +/-1950.00 holds, the outlook for gold prices in May is likely to consolidate. On the upside, a break of 2012.31 resistance then the possibility for a test of the recent peak is again open.

On the H8 period, the XAUUSD price seems to form a symmetrical triangle pattern between the 26 EMA, while the MACD histogram bars tend to thin in the sell zone, and don’t show any momentum gain yet. It looks like the market is still waiting for some monetary decisions and important data that will take place this week.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.