The (Walt Disney),a diversified international family entertainment and media enterprise founded since 1923, shall release its Q2 2023 earnings result on May 10th (Wednesday), after market close. The company operates via two main segments: Disney Media and Entertainment Distribution (DMED) and Disney Parks, Experiences and Products (DPEP). The former covers the company’s global film, television content production and distribution activities, while the latter encompasses parks and experiences and consumer products.

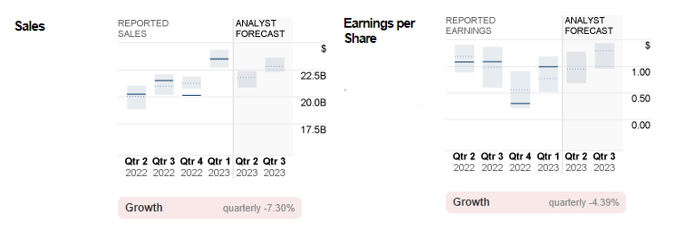

Fig.1: Walt Disney Revenue (in billion US dollars). Source: Statista

Fig.1: Walt Disney Revenue (in billion US dollars). Source: Statista

Walt Disney generated $23.5B revenue in Q1 2023, up 16.67% from the previous quarter, and up 7.75% from the same period last year. According to the official report, $8.7B revenue was generated from the Disney Parks segment, up 21% from the previous quarter. This also reflects its segment operating income being up 25% (q/q) to $3.1B, boosted by higher guest volumes and guest spending at the hotels, parks and cruises.

Fig.2: Revenues and Operating Income, Disney Media and Entertainment. Source: Walt Disney

On the contrary, the company’s Media and Entertainment Distribution generated an increase of only 1% in total revenue for the quarter to $14.8B. Both domestic and international channels reported losses, leading to Linear Networks down -5% (q/q) to $7.3B. Operating income for the segment was also down -16% (q/q) to $1.3B. Despite Direct-to-Consumer (DTC) reporting 13% quarterly gains to $5.3B, its operating losses expanded to $1.1B (previously $0.59B), following higher programming and production costs and a decrease in advertising revenue. These costs were too large to the extent that they could not be offset fully by subscription revenue growth and a decrease in marketing costs.

Fig.3: Disney Plus Subscribers. Source: Statista

Fig.3: Disney Plus Subscribers. Source: Statista

The company reported a loss of approximately 2.4 million in Disney+ subscribers to 161.8 million in the previous quarter, which is believed to have resulted from the recent price hike for the streaming service. Its other DTC products, ESPN+ and Hulu, recorded a 2% increase in subscribers to 24.9 million and 48.0 million, respectively.

Fig.4: Average Monthly Revenue Per Paid Subscribers for DTC Products. Source: Walt Disney

In terms of average monthly revenue per paid subscriber, Disney+ reported losses both in its domestic and international segments, at -2% and -4%, to $5.95 and $5.62, respectively, while ESPN+ and Hulu were up 14% and 2%, to $5.53 and $12.46, respectively.

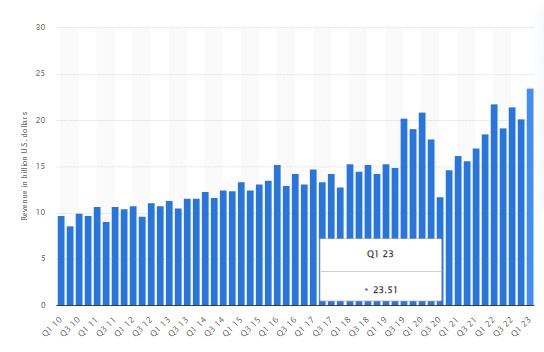

Fig.5: Reported Sales and EPS of Walt Disney Co. Versus Analyst Forecast. Source: CNN Business

Cost-cutting measures are the main priority for the Walt Disney company in the midst of recession threat. The company shall resume its third wave of 7,000 layoffs before the beginning of the summer. Also, there will be a $3 billion pull back on content spending and other non-content cuts, hopefully to turn streaming businesses profitable in the long run.

Analysts forecasts do not look optimistic either. Consensus estimates for sales of Walt Disney stood at $21.8B, down -7.23% from the previous quarter. In the same period last year, sales was $20.3B. EPS was expected to remain flat at $0.95, almost flat with the previous quarter ($0.99) and down -12% from the same period last year.

Technical Analysis:

The #Disney (DIS.s) share price remains consolidated at a relatively low area since the latter half of 2022. It saw its lowest point last year at $84.05, which together with the low of March 2020 ($79.05) forms a solid support zone to watch, if the asset breaks $91.50 prior. Breaking below the blue support zone may indicate more bearish pressure, towards the next support at $63.80. On the contrary, $105.60 serves as the nearest resistance. A break above this level may encourage the bulls to test $117.75, the highest point seen so far this year, followed by $126.40 and dynamic resistance the 100-week SMA.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.