Despite signs of resilience in the labor market, attention is now turning to worrying inflation and developments in the US banking sector. More and more banks are under pressure, because credibility and trust are increasingly faltering. As the banking crisis develops, US regulators will eventually be forced to take action, which could result in the collapse of more banks. PacWest and First Horizon are now in the spotlight.

The disinflationary process is expected to lose momentum in the April inflation report, which could delay some prospects for a US central bank rate cut. US headline inflation figures are expected to grow by 0.4% and 0.3% core in April, after March’s increases of 0.1% and 0.4%, respectively. Core inflation may only have slowed a bit, but will start to fall more rapidly in the coming months, as the housing slowdown reflects falling rents and housing costs, as well as disruptions to global distribution channels and the war in Ukraine that has abated.

Such an outcome, however, is unlikely to lead to widespread rumors about a possible Fed rate hike in June. Even after Powell refused to rule out a June hike, investors are still pricing in a 90% chance of inaction, with the remaining 10% pointing to a quarter point decline. In fact, towards the end of the year, they anticipate rate cuts totaling more than 75bps.

For the price to turn around and start showing a decent probability of another increase in June, a strong upside surprise may be needed. The data may need to show, however, that the US economy is in better shape than many thought, and the Fed may need to defy market expectations by raising interest rates in June or by holding them steady over the summer for a full-scale reversal to be checked.

President of the Federal Reserve Bank of St. Louis, James Bullard, underlined on Friday that the decision to raise interest rates by a quarter percentage point is a good step forward.

Speaking at the Economic Club of Minnesota, Bullard also commented on the latest reading on non-farm payrolls that came in stronger than expected in April. The Fed official stressed that it will take time for the tight labor market to cool, as the cornerstone of the Federal Reserve’s policy is to slow growth, while avoiding the risk of a recession.

Technical Review

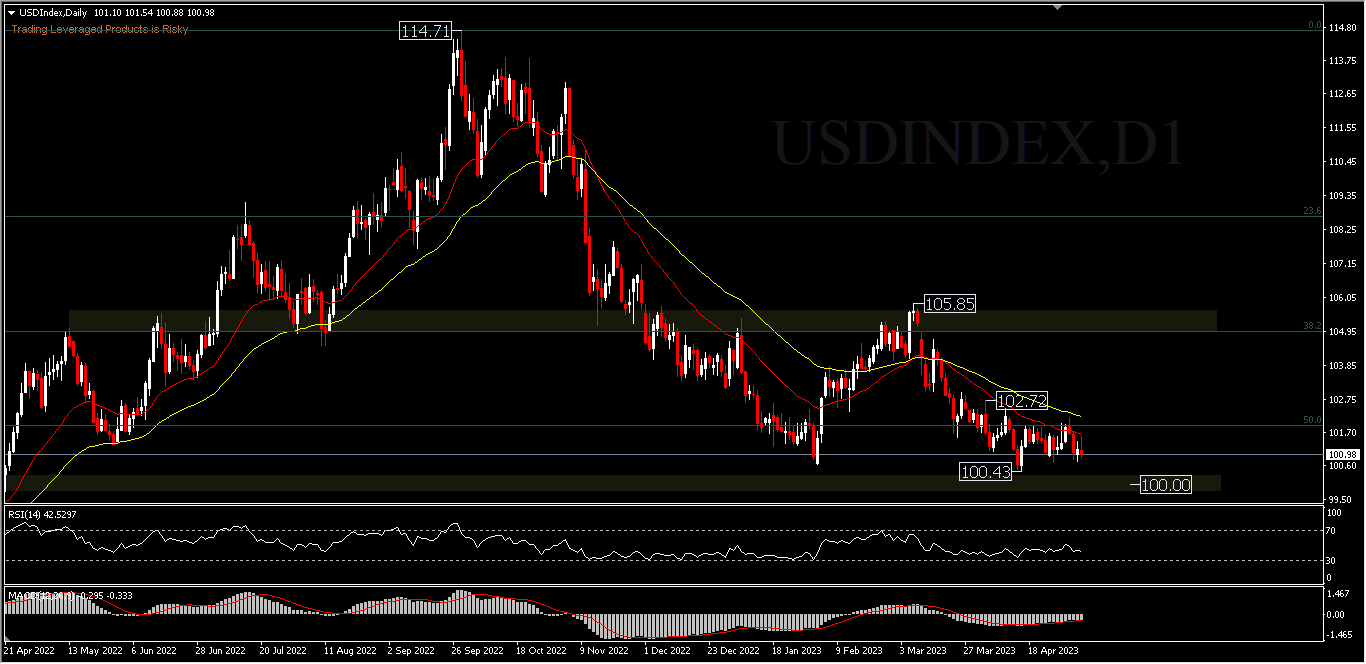

USDIndex, D1 – The slide from a peak of 114.71 on major time frames is still considered a corrective wave while a possible move below the triple bottom could test the psychological mark of 100.00 and the 61.8% FR level of 98.9 . As long as the base price of the triple bottom holds, a move above 102.72 could signal the end of the corrective wave and the index could move to the upside to test 105.85 resistance. Despite the divergence bias seen in the RSI and MACD, the index is still moving below the 26-day and 52-day EMA averages.

The weakening of the index in March-April is still related to public confidence in the US banking industry which has not yet recovered. In other news, PacWest Bancorp shares rose sharply on Friday, after the previous sharp decline, as worries in the US banking sector appeared to ease.

Previously, the company confirmed that it was holding discussions with potential partners and investors, after reports of potential sales broke. The broad rebound in the regional banking sector appears to have been fueled in part by JPMorgan Chase & Co. which upgraded Western Alliance Bancorp, along with Zions Bancorp and Comerica Bank, to an overweight rating, meaning that their shares are expected to perform better in the future.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.