The US stock market traded mostly in the green at the closing bell on Wednesday (10/05) amid tech giant updates, as well as April inflation data that was lower than the figure recorded the previous month. USA30 -0.09% at the close, USA100 surged +1.11% (with Datadog gaining +8.05%, Exact Sciences up over +10%, Akamai Technologies closing up over +8%). USA500 added +0.45%.

The CPI report supported speculations that the Fed may be able to pause the rate hike regime. US Apr CPI fell to a 2-year low of 4.9% y/y from 5.0% y/y in March, better than expectations of unchanged at 5.0% y/y. April CPI excluding food and energy fell to 5.5% y/y from 5.6% y/y in March, matching expectations. Meanwhile, the April monthly US budget report showed a surplus of $176.2 billion, lower than expectations of $235.0 billion.

Inflation is still well above the Fed’s 2% target, although the Fed has implemented one of the steepest hiking cycles in history from 0.25% in early 2022 to the current level of 5.25% after the last 25 basis points hike. However, the cooling of inflation gives room for the Fed to consider a pause in the June meeting. In the April meeting, Fed Chair Powell signalled that the central bank could pause rate hikes in the June meeting. Following the inflation data, the market has revised up expectations of a pause in hikes at the June meeting and a rate cut in July.

The rebound in US futures and decline in USD reflected the re-pricing of Fed expectations. Separately, the US debt ceiling impasse remains a big concern for investors as yesterday’s talks between President Biden and congressional leaders yielded no meaningful progress, but White House officials and Republican leaders promised additional negotiations. On Friday, Biden will meet again with congressional leaders, including House Speaker McCarthy. With around three weeks until the maturity date, a US default on its debt obligations could result in long term damage yet to be imagined and the cost of insuring a default is now greater than in some emerging markets.

Technical Review

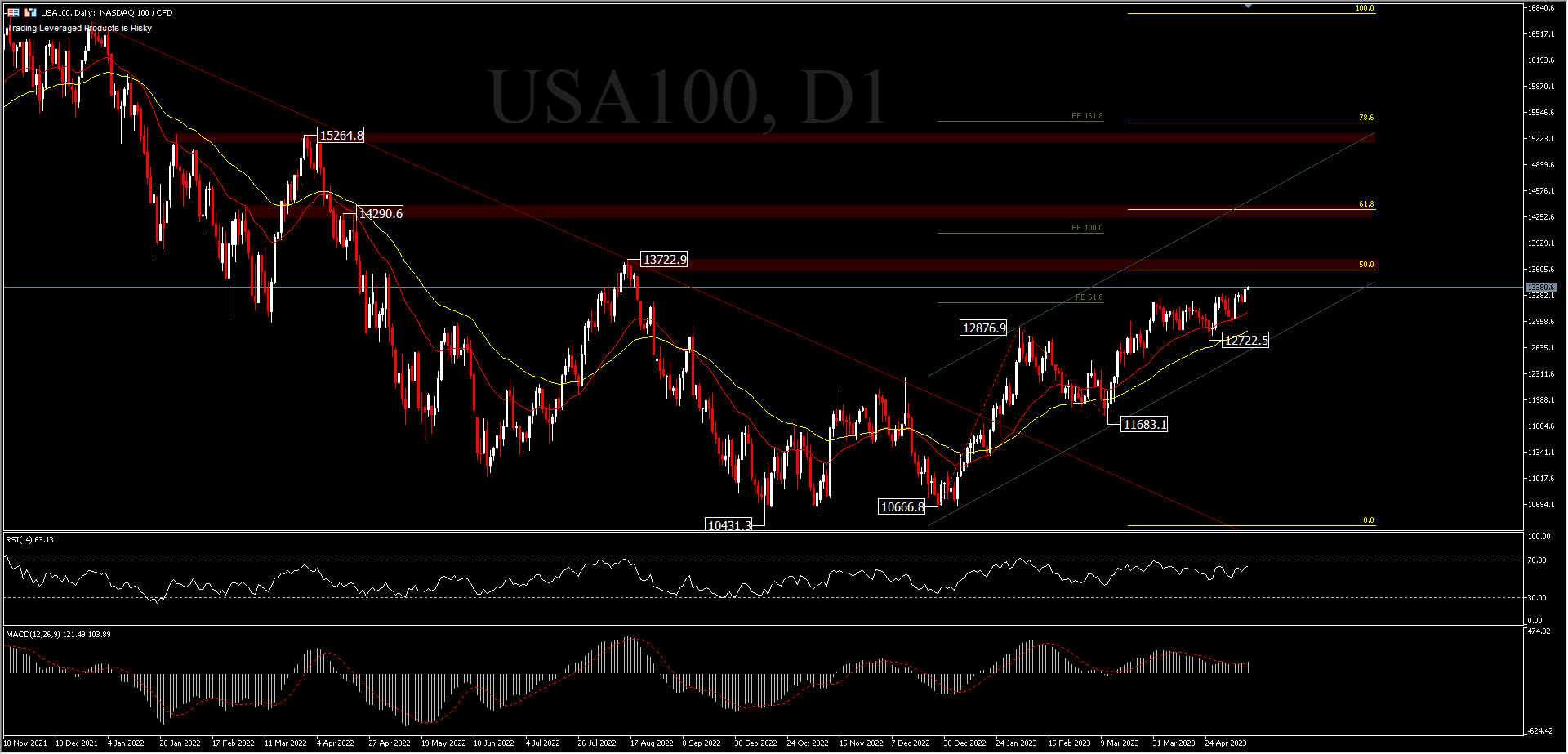

USA100, D1 – The index has broken the downtrend line support, and the RSI is above 50 which is yet to show overbought, making the bulls hopeful for further gains. The bulls have been struggling above the 13,000 resistance for quite some time now in hopes of extending the bullish move up to the August 2022 peak (13,722.9) which is still the current short-term priority, or at least at the 50% FR level (from the 16,767.8-10,431.3 downleg). A break above here could open the door to the 61.8% FR level. On the other hand, support can be seen at 12,722.5, and a move below this level would signal that the correction wave from the 16,767.8 peak is not yet complete.

Overall, the index is in bull dominance above the 26-day exponential moving average (red line) and MACD positioning still in the buy zone validates the recent moves.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.