This was a bad week in terms of economic data for Germany: it started on Tuesday with a contraction in manufacturing PMI for the 11th month in a row (42.9, well below the contraction threshold of 50), in a country where industry is its strong point; it continued with rather negative measurements from the prestigious economic institute IFO on the current state of the economy. Finally on Friday, first the very bad consumer confidence data and then the certainty that Germany has entered recession, after 2 quarters in a row of contraction (-0.4% last, –0.3% this, Q/Q). Consumption was weak as ”households spent less on food and beverages, clothing and footwear, and on furnishings”, in the words of the Statistisches Bundesamt Deutschland, which compiles the data. Finance Minister Christian Lindner recently stated in Berlin that “we must turn economic policy around and put an end to the abandonment of our competitiveness”, in a clear reference to energy and industrial policy. Finally, a drop in purchasing power, thinned-out industrial order books as well as the impact of the most aggressive monetary policy tightening in decades, and the expected slowdown of the US economy all argue in favor of a continued weak economic activity.

GER40, German GDP Growth Rate

Despite this the DAX is one step away from all-time highs, reminding us once again that the economy is not the markets – or at least they do not move together (in the chart, to be fair, one can see a certain lag between the index price and GDP growth, with the former seeming to precede, at least after 2020)

Technical analysis

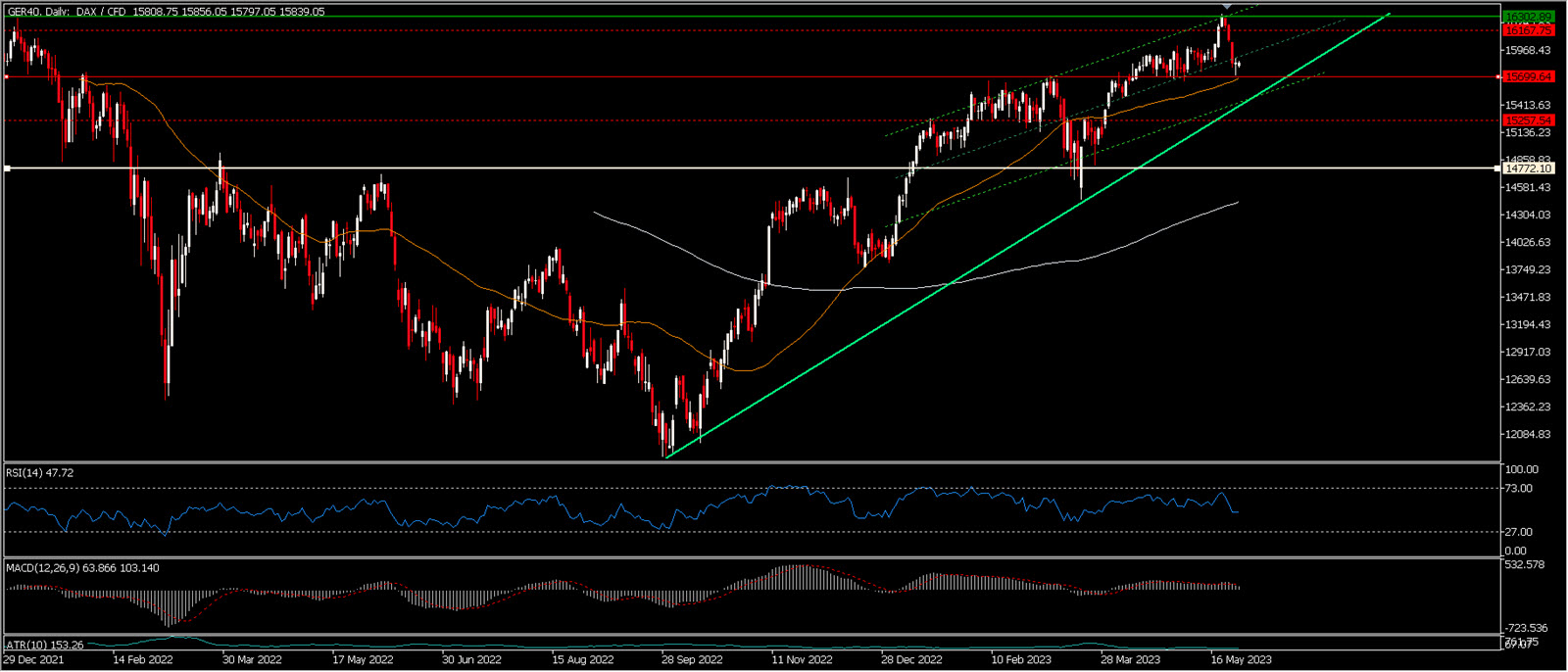

Last Friday, the DAX touched its all-time high of 16,331 compared to a previous high on the 5th of January 2022 at 16,285. Since then, it has not had a good week and currently trades about 3% lower at 15,848; a performance, however, in line with other European indices such as the French FRA40(-3.5%) (that interestingly enough has printed lower highs in respect to its Apr 2023 ones).

GER40 vs FR40

The GER40 is still showing a clear bullish trend that started at the end of September 2022 (light green) and slowed down at the beginning of this year (dark green channel). After the descent of the last few days, the index managed to bounce off the most important support of 2023 till now, 15,700 (which is also where the MM50 is passing). It could break this level without compromising the longer-term trend, which would still be safe at least until around 15,475. The fact is that once that level is reached, there could be further space down to 15,250 and that would clearly be below the 8 month long trendline. The next most important support, taking into account the prices of 2022, is in the 14,725 area, where the GER40 would probably also trade close to its MM 200.

Currently the levels to watch carefully for an indication of the direction in the coming days are 15,700 – 16,000.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.