”It may be tough to deny that we have already entered a new normal that differs from the period of low for long inflation.” This is the latest statement by the new BOJ governor, Kazuo Ueda, released only a few hours ago. And it is just the latest sign of how – at the same time as he is cautiously maintaining his predecessor’s commitment to an ultra-accommodative monetary policy – he is slowly paving the way for a future change in monetary policy.

Indeed, the plan to revise past monetary choices was officially announced at the end of April, stating that it would be very gradual. Japan has had decades of low wages and price growth, hence the gigantic stimulus in place, long ineffective. Those who have studied economics will surely be familiar with the liquidity trap concept, of which Japan is a symbol, which can be summarised as the fact that at a certain point monetary stimulus stops having a tangible effect on the economy.

But something is changing: speaking to parliament a few weeks ago, Ueda admitted that the trend and inflation expectations are positive and at the moment the 2% target will be considered as sustainably achieved, the bank will abandon yield curve control and then move towards shrinking the bank’s balance sheet. Yield curve control (YCC) is quantitative easing and under it the BOJ has set a short-term interest rate target of -0.1% and capped the 10-year bond yield around zero by directly buying bonds (actually the BOJ IS the 10-year market, there have been several days in recent years when there has been no buyer other than the central bank). The caution and gradualness that has been widely flaunted is maybe one of the reasons for the JPY’s recent weakness.

Hence, when news broke yesterday of an emergency trilateral meeting of the BOJ, MoF and FSA – at the same time that the top currency diplomat Kanda was admitting that they were closely watching FX moves – the market pricked up its ears. And started buying Yen. The fact that the USDJPY had exceeded 140, the level where the BOJ had started to intervene in the market last autumn to reverse the currency’s devaluation, only added fuel to the fire. Sure, a weak JPY helps to import inflation , but it looks like there will be less and less need for it.

Technical Analysis

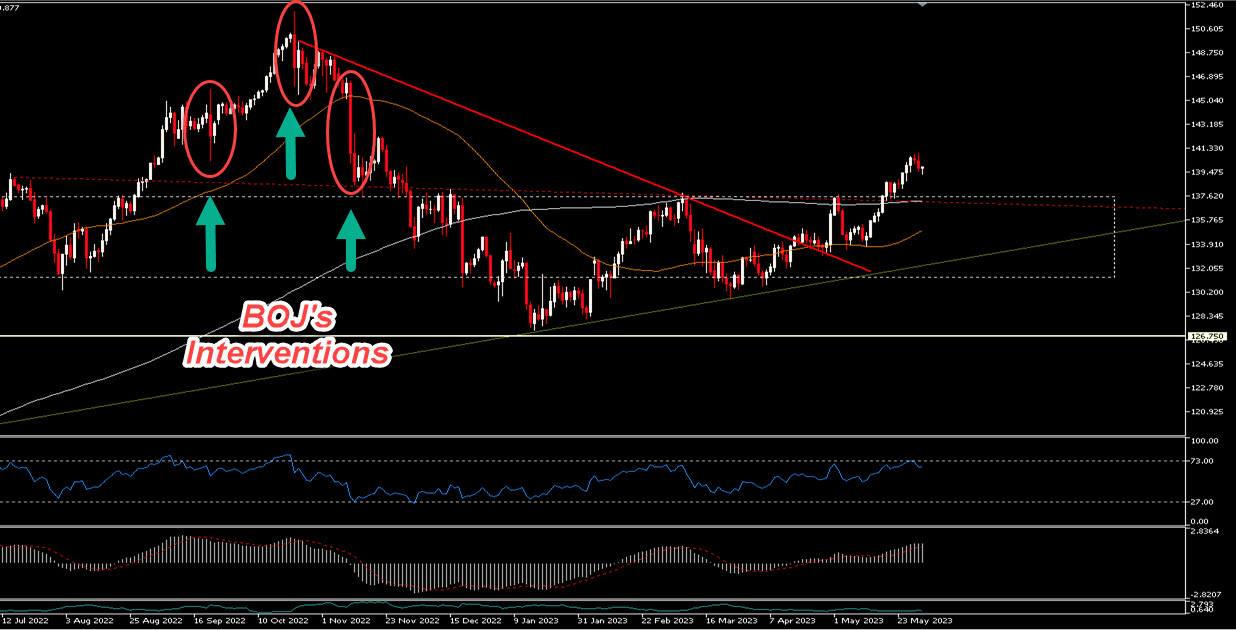

The USDJPY chart is clear: since the beginning of 2021 the Japanese currency has depreciated by 35% and, while following last year’s interventions it had returned to rise, a few weeks ago it was among the first major currencies to weaken against the USD and break the red trendline. What we want to observe is the area between 140 and 150.

BOJ’s Interventions above the 140 area

The candles shown between September and November 2022 are direct market interventions by the BOJ (or supposedly so): the bank was selling foreign currency to buy JPY and defend its currency from excessive weakness. And this indicates to us that levels above 140 are considered in principle to be incongruous and excessive for the Japanese economy, mostly the result of speculation. If this was the view only one year ago, the market expects something similar today, a defence of the local currency by monetary policymakers.

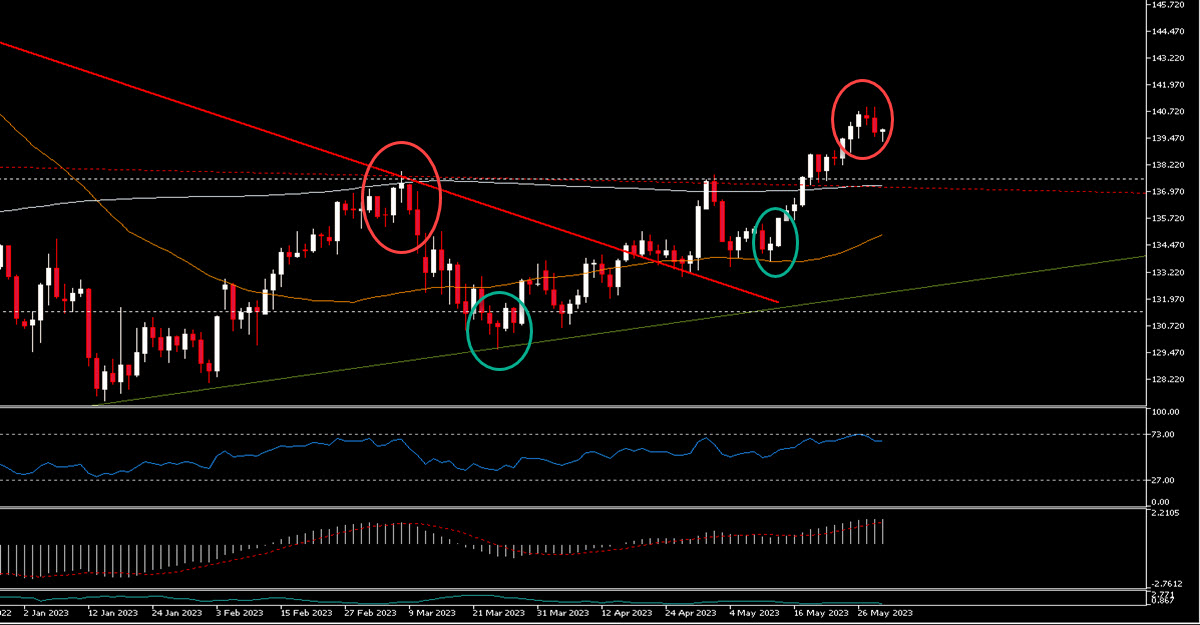

On the daily chart we see the MACD falling although still positive, as well as the RSI, which has come down from overbought levels. Candlestick-wise, an Evening Star has formed in the last 3 days, a potential reversal signal, especially at the end of a rally. (USDJPY has consistently reversed on similar patterns during the last months: check 08/03 or 24/03 for example)

Evening / Morning Stars on USDJPY, Daily

We are not trying to spot a top, as we believe that the possibility of USDJPY above 140 is real (among other things, 139 will act as support now, having been a key level last year). But it is not imprudent to say that above 145 the BOJ gets nervous and will likely try to curb a too fast devaluation by directly purchasing JPY in the market. If we add to this the prospects of an imminent (albeit not very imminent) change in monetary policy, we believe it is good to be cautious on this pair.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.