Yesterday, the debt ceiling bill finally passed in the House with 314 votes in favour and 117 against and is ready to advance in the Senate. It is likely that in the end the resolution will be a positive one, as many analysts predicted, as they did not expect US politicians to let their own country fall into economic “’chaos” now.

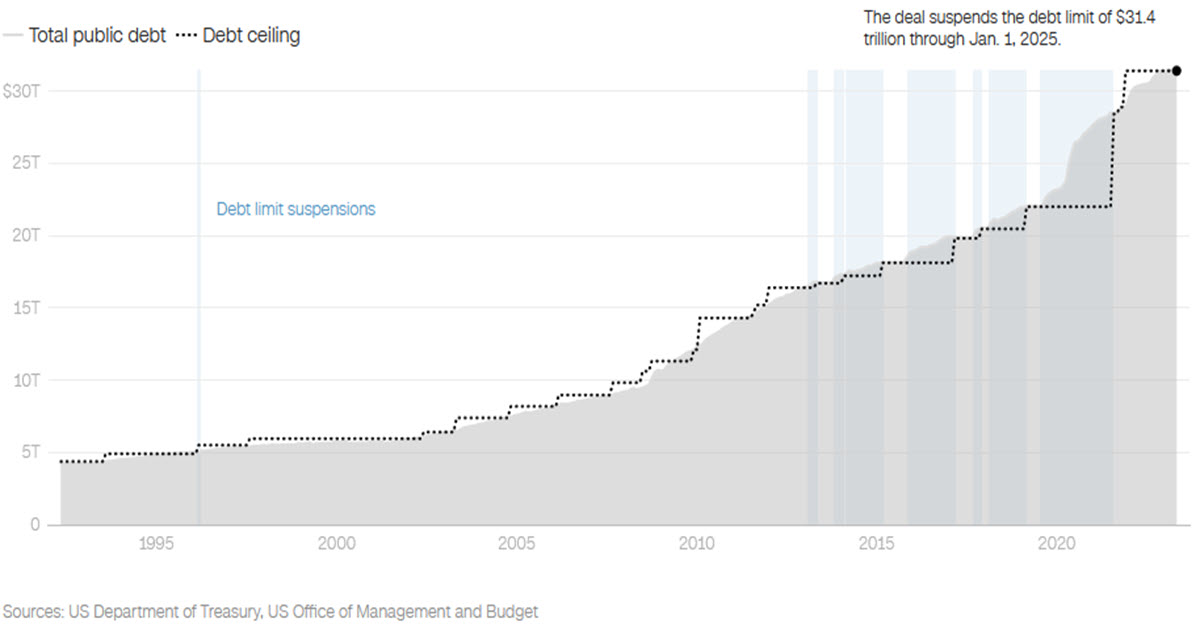

US debt and limit

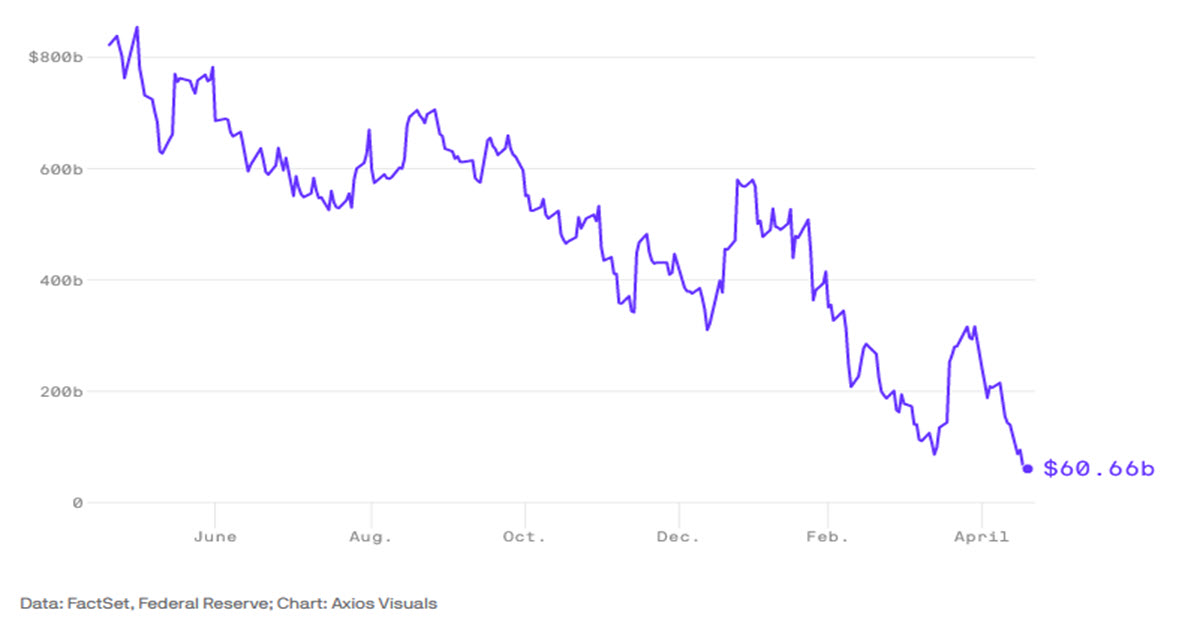

This means that the US will suspend its $31.4 trillion debt limit until January 2025, after the next election. This is certainly a relief as the Treasury General Account – the money available to the state to spend – has fallen to below USD 60 billion and investment banks like Goldman and JPMorgan calculate that it will be practically exhausted in a few days, somewhen between 7 and 9 June (Secretary Yellen had indicated today as the possible deadline).

US Treasury General Account

When the agreement will have finally finished its legislative process, the Treasury will be able to resume auctions for the sale of US bonds and thus finance the public accounts. The increase in issuances and supply could have the effect of pushing prices down and yields up, but since demand for bond products is always very substantial and exceeds supply many times over, the opposite effect of lowering yields cannot absolutely be ruled out.

To this we have to add that several Fed speakers are suggesting that the foot should be lifted off the rate hike accelerator: just yesterday both Jefferson and Harker were of the opinion not to act in June in order to have more time to assess the real repercussions of the current monetary policy. The chances of a pause rose sharply yesterday, from 33.45% the previous day to 59.89% at yesterday’s close, according to the EuroDollar futures chain. Let’s see what could happen to the King of the financial markets, the 10 Year US Treasury Note.

Technical Analysis

US10YR.F hit a low on 21/10/2022 in the 108.90 area (equivalent to a 4.34% yield) and since then – despite much volatility and the Fed’s current policy – has basically stayed sideways and even seems to be framed within a bullish channel. The recent high was in the 117 area (tested 3 times between March and early May, equivalent to 3.29%). RSI is rising as well as MACD which is still negative; price is between MA50 and 200. The dominant long-term bearish trend is not yet broken and is currently in the area of 115.60 or so (equivalent to 3.45%). Should it succeed in reaching this level, US10Y would be above the 2 long-term moving averages, with probably positive indicators and with a structure of rising highs built during the last 8 months. If it were able to break it would probably hint to a BIG change in the interest rates market from the last 2 years. The first target would be 117, this time with a trend break in the pocket that could ensure a further climb above 118. It would mean seeing the US 10-year rate in the 3.25% area, at lows since Aug 2022. Downward attention should be placed on 113.50, 112.65 and then very important area of 112.

US10YR.F, Daily

Please note that US10YR.F is a Future tied CFD with the next expiration date on 29/08/23.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.