Apple.Inc is set to hold one of its biggest product launch events ever – the Worldwide Developers Conference (WWDC), at its corporate headquarters Apple Park. The event is scheduled from 5th to 9th June. Its videos and transcripts can also be watched here.

Some of the new features/products expected:

- Several new Macs

A variety of new Mac models will be launched, including a 15.5-inch large-screen MacBook Air. This is the largest MacBook Air in history, which claims to perform better in terms of battery life and resolution display. There is a rumor circulating that the new model shall be using a custom M2 (instead of M3) processor paired with 8GB of RAM, expected to be available in the market this year or early next year.

- Mixed-Reality Headset

A headset with augmented reality and virtual reality combined may be the biggest attraction of this conference (the product has been worked on for around 8 years). The helmet is said to be equipped with an M2 processor and two 4K displays, plus more than a dozen built-in sensors and cameras to assist users in achieving precise gestures and eye tracking. Its on-board xrOS operating system can be set up without an iPhone. The price of the equipment is expected to be around $3000 per unit. Could it be a hedge against threats to the company’s iPhone empire in the future?

- Operating System Updates

iOS 17 – Some of the rumored upgrades include smart home functionality on the lock screen (when the phone is locked and tilted horizontally, information such as weather, calendar appointments, notifications, etc will be displayed on the interface), additional functionality for Dynamic Island and improvement to Search. The company has previously announced assistive features to help disabled people, such as a function that helps users with aphasia to create synthetic voices.

iPadOS 17 – Equipped in iPad Pro models with OLED displays, may include the Health app (new mood tracking functionality) as well – expected to deliver next year.

WatchOS 10 – Additional update to the home screen, functional widgets, etc.

tvOS 17 – relatively minor updates, including HomeKit Hub improvements, user account updates, more calibration tools and new aerial screensavers.

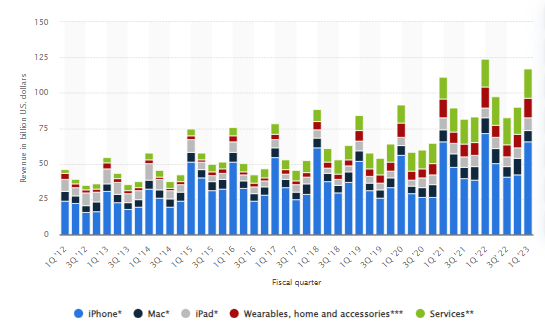

In Q1 2023, Apple surpassed 2 billion active devices (was 1.8 billion a year ago). In general, the figure has doubled in just seven years. Nevertheless, the company reported a year-on-year decline of -5% in revenue and -13% in net income following widespread macroeconomic challenges.

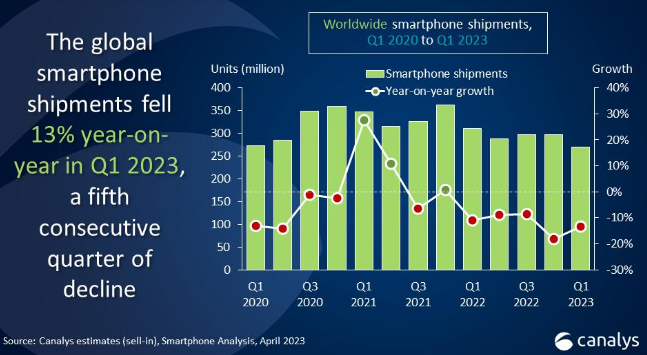

iPhone sales contributed to about 56% of Apple’s total revenue. In Q1 2023, its revenue was down -8% (y/y) to $65.8B. In fact, the global smartphone market has been hit hard, suffering a 5th consecutive quarter of decline, by -13% (y/y). It is still worth noting that solid demand for the iPhone 14 Pro series has successfully narrowed the gap of market share between Apple and its main rival Samsung (from 18%:24% in Q1 2022, to 21%:22% in Q1 2023). Recently, Apple launched its first two official stores in India. According to CEO Tim Cook, he is optimistic that there will be “big growth opportunities” as the country’s middle class expands.

Mac sales have been the most adversely affected, down -29% (y/y) to $7.7B. This was mainly due to the return of pre-Covid patterns (people tended to invest in the best PC they could afford when working remotely), tough competition, economic weakness, etc. According to Morgan Stanley’s analyst Erik Woodring, PC sales this year may hit their lowest rate since 2006. Wearables were also down -8% (y/y) to $13.5B. Services were up +6% (y/y) to an all-time record high at $20.8B, while iPad sales were surprisingly up +30% (y/y) to $9.4B.

To some extent, the outlook of most companies is closely related to the state of the economy. An economic recession could further dampen consumer confidence and demand, consequently prolonging the slump in companies’ sales and profit.

Technical Analysis:

#Apple (AAPL.s) has been on a strong bullish ride since it rebounded from its low in January this year, at $124.14. The asset price is testing an all time high (last seen January last year, at $182.85). Until its close on Friday, the company’s share price YTD gains were over 45%. A projected FE 127.2% at $184 and the last ATH $182.85 form the nearest resistance zone. While RSI (14) is approaching the overbought zone, Goldman Sachs and Google AI – Bard predict more upside potential of the share price, towards $199 by the end of 2023. On the other hand, nearest support is seen at $171. A successful breakout below this level may encourage more selling pressure, towards dynamic support 100-week SMA and $153.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.