On Friday night, the Bank of Japan will announce its interest rate resolution until June 16. If nothing else, the central bank will maintain its negative interest rate policy since January 2016, with the benchmark rate remaining at -0.1% while the 10-year government bond yield target remains at 0%. A Reuters poll of economists showed that around 50% of participants expect the BoJ to likely remove easing, including adjustments to its yield curve control (YCC) programme, in July or September.

For the yen against the dollar, 145 is a threshold to watch – which is not impossible if the BoJ continues to maintain an accommodative monetary policy. The survey results also show that 54% of economists believe the BOJ would likely take action if the yen fell below 145 against the dollar, i.e. issue a warning or intervene in the currency market, while some 43% believe the central bank would not act until the exchange rate fell below 150.

It is worth noting that the Japanese government implemented additional intervention measures in September and October last year, which led to the yen reversing its trend after hitting a 32-year low near 152 against the US dollar. This was followed by an unexpected adjustment to the YCC by the Bank of Japan in December as well. At 14:30 GMT on the same day, BOJ Governor Kazuo Ueda will hold a press conference on monetary policy. Kazuo Ueta’s rhetoric so far in office has been dovish, and he has said that “the end of easing will depend on achieving the 2% inflation target as well as wage growth”. When will this be achieved? More than 70% of economists think this might happen when wages grow in 2024. So far this year, Japanese wages have risen by more than 3%, a 30-year high, against a backdrop of high inflation and a tightening labour force.

Technical analysis:

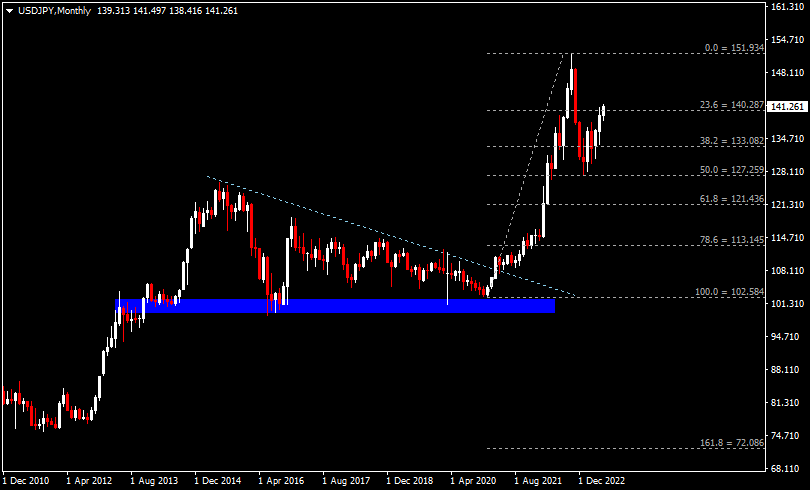

Throughout the last 20 years or so, the USDJPY hit lower peaks in August 1998, January 2002 and June 2007 at 147.71, 135.19 and 124.12 respectively. the downtrend continued into late 2011-2012 (when it hit a low of 75.56 in October 2011). The pair started a bullish rally in the fourth quarter of 2012 and recovered from the June 2007 to late 2011-2012 decline in mid-2015. For the next 5+ years, USDJPY traded in a descending triangle area until March 2021 when it broke the trend line and started the next round of rallies. In October 2022, the pair touched 151 for the first time since August 1990 and then started a brief pullback pattern before finding support around 127 in January 2023.

The “W” pattern on the weekly chart could signal a continuation of the long momentum.

The “W” pattern on the weekly chart could signal a continuation of the long momentum.

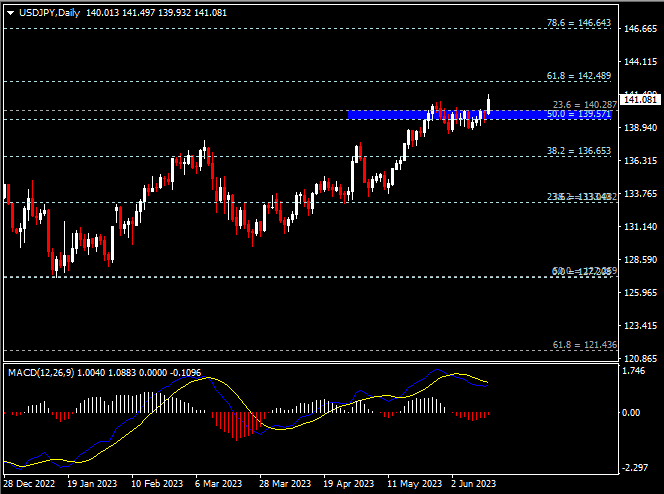

Looking at the daily chart, the exchange rate is currently trying to stand firm above the 139.55 to 140.30 area. As long as the exchange rate closes above this level, the upside action could still continue and test the 142.50 resistance, the minor resistance at 144.70, and 145 (very important!) . On the other hand, if the exchange rate falls below 139.55, we could see a technical correction with the next support at 139.65. The MACD double line remains positive.

Looking at the daily chart, the exchange rate is currently trying to stand firm above the 139.55 to 140.30 area. As long as the exchange rate closes above this level, the upside action could still continue and test the 142.50 resistance, the minor resistance at 144.70, and 145 (very important!) . On the other hand, if the exchange rate falls below 139.55, we could see a technical correction with the next support at 139.65. The MACD double line remains positive.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.