At this point, you are all aware of the brief attempted and aborted uprising in Russia over the weekend, led by businessman and mercenary Yevgeny Prigozhin and implemented by the private military group Wagner. It is not our purpose to delve into further geo-political scenarios here, but yes, to see the effects on the financial markets of what at one point appeared to be the biggest crisis in the former Soviet country in 30 years. And the fact is that there has been practically none: Crude oil futures are totally flat at the time of writing, as are corn futures; wheat is rising slightly, but has been doing so for at least a couple of weeks; and the same can be said of natural gas (Henry Hub), which, having reached a statistically low level of $2, has found bids again within a very normal market logic.

Strange that in a situation that still seems to be very uncertain, no risk premium is yet appearing on these markets in which Russia has a high specific weight.

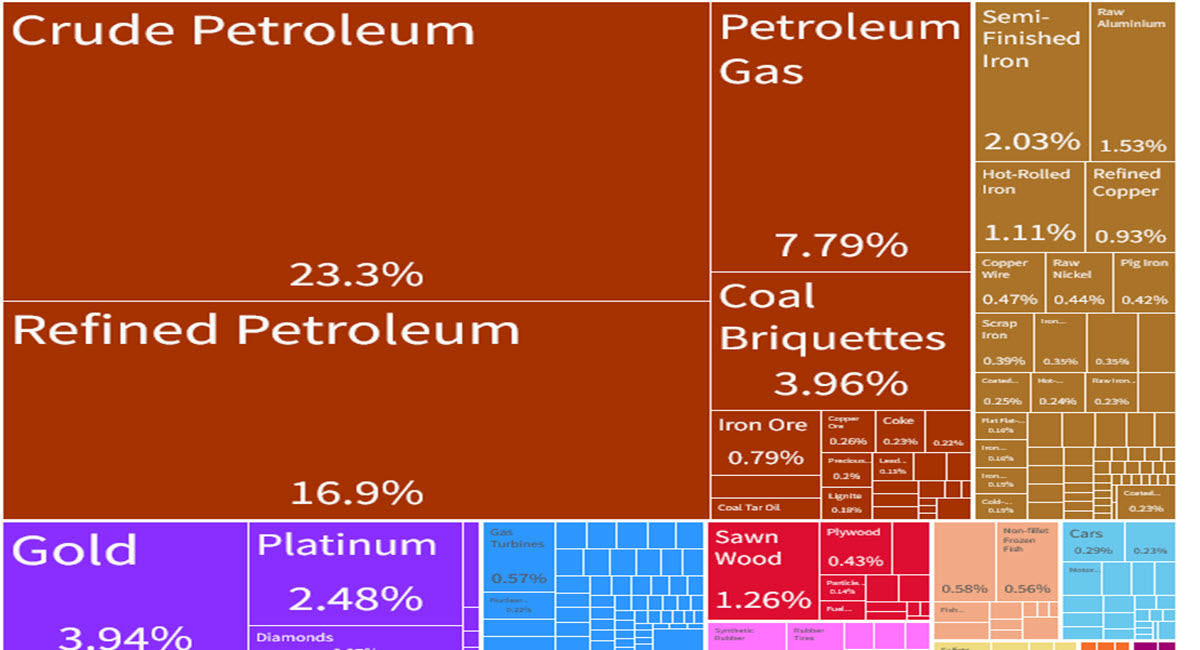

Relevant Russian Exports by category, 2021 ($484B total). Source: OEC

The Putin-ruled country was the world’s third largest oil producer in 2022, behind the US and Saudi Arabia: around 10.3 million barrels per day are produced there and considering an expected IEA demand for 2023 H2 of 103.2 million b/d we are talking about 10% of world production. This is the largest voice among Russian exports and accounted for 47.99% of the total in 2021: the national government budget itself is calculated on the basis of price forecasts for this commodity.

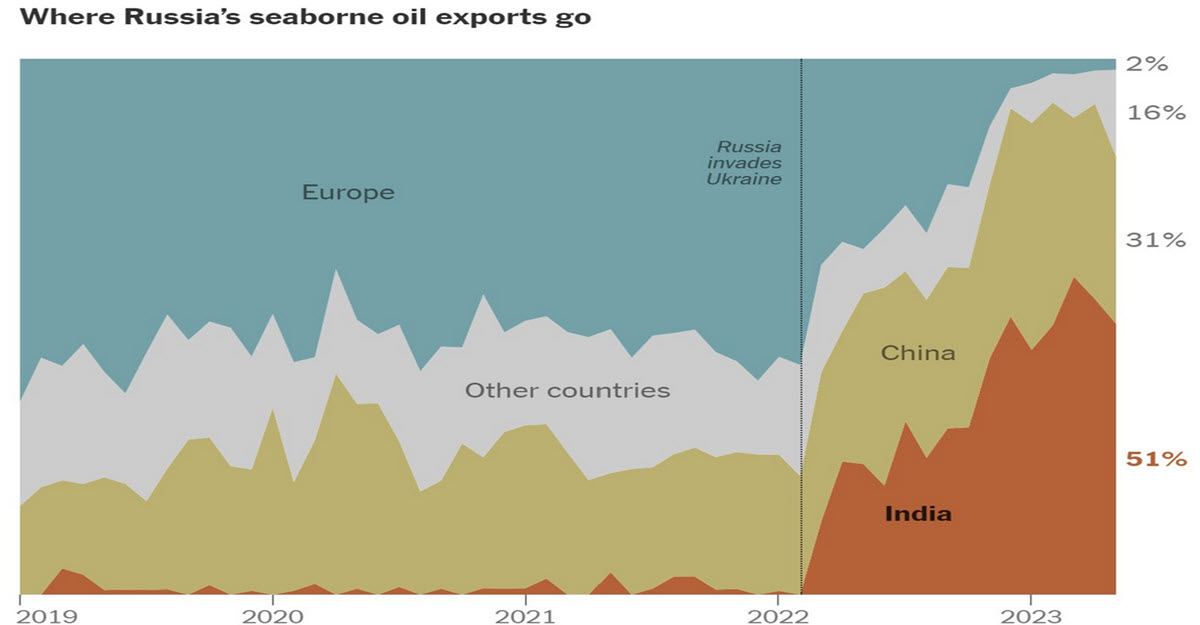

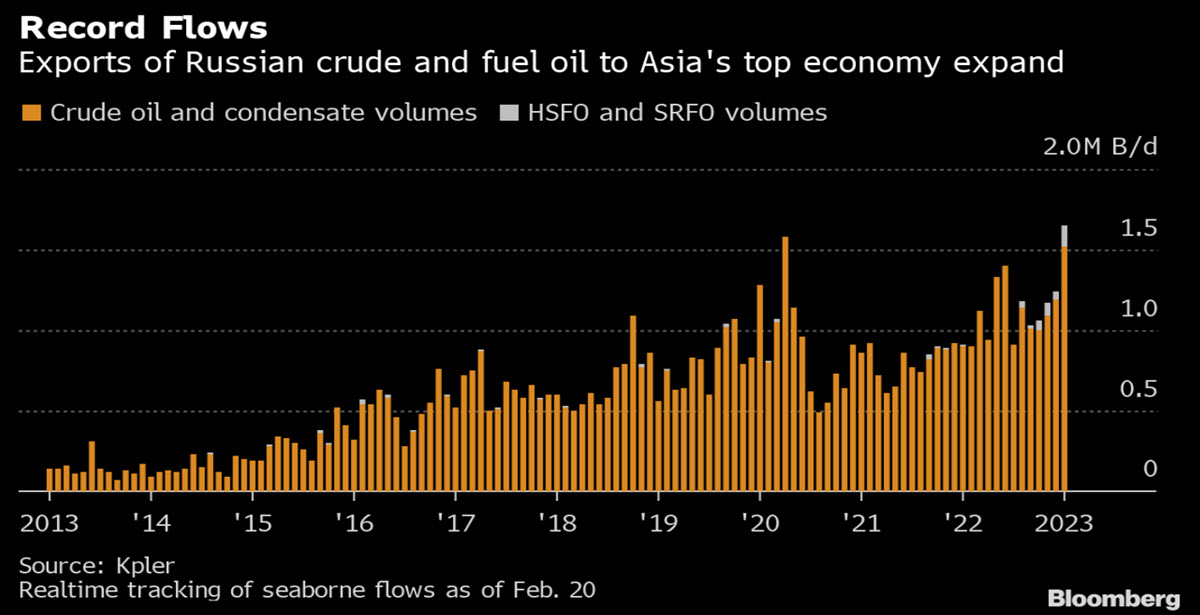

Those who think that with the sanctions and the war the blow suffered has been heavy are partly wrong: according to the IEA’s May report, Russia produced 9.6 million b/d of which 8.3 were for export: revenue for the month reached $15 bn, up $1.7 bn from Apr 2023 (but officially down -27% from the previous year). Certainly, the mix has changed: exports to Asia but also Saudi Arabia have increased significantly with India currently buying half of Russian seaborne oil as new refining capacity is driving a continued shift east in forecast crude runs for the remainder of the year, mirroring regional demand strength.

Consider also that Blend Urals, ESPO and Sokol -typical Russians- all trade at a discount between $13 and $5 against crude. Obviously, exports to Europe have plummeted even though one EU state – Greece – is responsible through its tankers for 60 per cent of exports from the Black Sea.

Consider also that Blend Urals, ESPO and Sokol -typical Russians- all trade at a discount between $13 and $5 against crude. Obviously, exports to Europe have plummeted even though one EU state – Greece – is responsible through its tankers for 60 per cent of exports from the Black Sea.

But as some investment banks, including GS and RBC, have pointed out, the potential risks go beyond Russian territory and the Rostov on Don area, an important strategic hub for oil distribution from the Sea of Azov: Wagner is present and active in Libya, for example, and any blockades have the potential to take an additional 1.1 million b/d out of the market. Yet crude oil marks +0.22% at $69.65 without -we repeat- any extra premium being demanded by traders and speculators.

TECHNICAL ANALYSIS

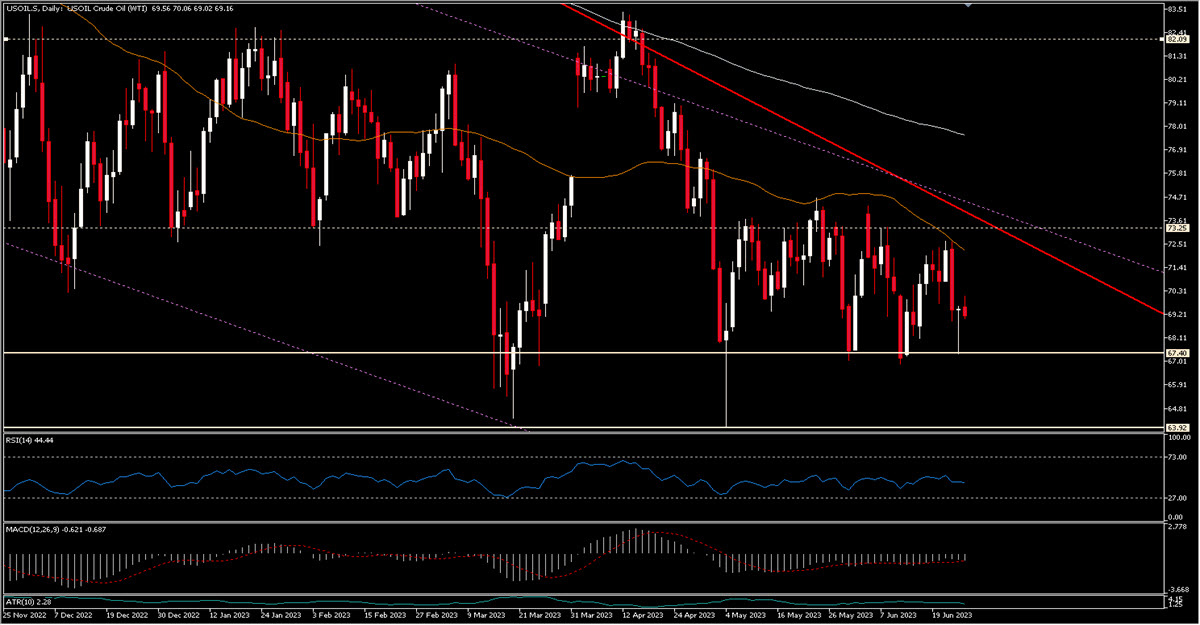

On the daily crude oil chart nothing has changed and we are still in a sideways consolidation phase within a broader descending structure (originating in early 2022). The range within which the price has been moving since the beginning of May is $67.40 – $73.25. Previously, from December 2022 until Mar 2023 with greater charitableness, oil had still moved in a wide range, between $73.25 and $82. If at some point in the year we were to trade again at those levels it would most likely be a bullish signal, as the red trendline and the upper part of the violet channel would have been broken and we would most likely be above the 50 and 200MA. But we would hardly feel comfortable taking a bullish stance before a break of $73.25 – $74.50, from which we are still a long way off.

Crude Oil Daily, Nov 2022 – Today

In the meantime, we continue to monitor very carefully $67.40, which has been tested a few too many times lately (4 since the beginning of May) and that if it were to be broken it would immediately open the doors to $64 (which if broken would in turn take us to the $58.50 area.

How this fits in with an increased risk of stability in the world’s third largest producer is difficult to justify at the moment: what is certain is that there is no real reaction to this increased geopolitical risk at the moment and the best thing you can always do as a trader is to just follow the money.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.