Canadian CPI recorded 3.4% year-over-year in May last year (the smallest increase since June 2021), in line with market expectations and the previous value of 4.4%; YoY, the figure recorded 0.4%, below market expectations of 0.5% and the previous value of 0.7%. Core CPI excluding auto sales stores recorded 3.7% year-on-year last year, the smallest increase since November 2021; YoY last month, the data recorded 0.4%, lower than the previous value of 0.5%.

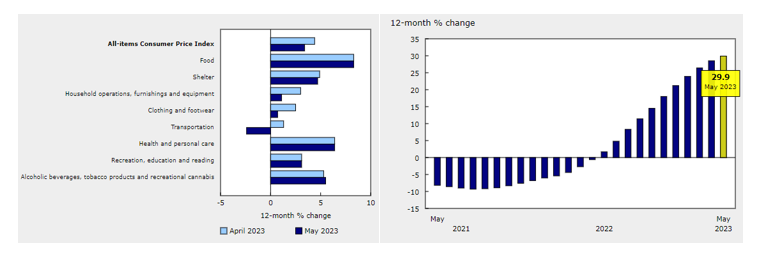

Statistics Canada reported that the catalyst for the decline in headline CPI came mainly from the decline in gasoline prices (-18.3% year-over-year last year). Lower oil prices also drove a slowdown in transportation inflationary pressures (-2.4% year-over-year vs. 1.3% previously). However, a number of sub-data suggest that price pressures remain, with mortgage interest costs making the largest contribution to annual CPI growth (up nearly 30% year-over-year (-2.7% year-over-year) and at a record high for the third consecutive month).

CPI and mortgage interest costs for all items in Canada. Source: Statistics CanadaStatistics Canada

Earlier, the Bank of Canada raised its benchmark interest rate to 4.75%, a 22-year high. Money markets expect a 59% probability (previously 64%) that the Bank of Canada will raise rates by 25 basis points on July 12 after a continued slowdown in headline CPI. They believe there is a 100% probability that the central bank will raise rates again by 25 basis points at its September meeting because “core inflation remains sticky and has yet to show signs of a protracted slowdown”.

On the other hand, the yen depreciated further against the dollar, hitting 144 yesterday, a new low since November last year. The exchange rate is getting closer to the 145 that people are concerned about, a key level at which they expect the Japanese government may be ready to intervene in the foreign exchange market. Recently, Finance Minister Shunichi Suzuki and the top official in charge of foreign exchange affairs, Makoto Kanda, have made it clear that if the yen falls too far, “we will respond in due course” and “do not rule out the possibility of intervention”. In any case, the effect of intervention is expected to be limited, due to the persistence of the interest rate differential between Japan and the U.S. (and other major countries). As long as the BOJ has no inclination for a policy turn, a weaker yen seems reasonable.

Technical analysis:

CADJPY: The monthly chart shows the exchange rate opening a wave of gains since bottoming in March 2020, extending from a low of 73.80 to a peak of 110.516 in September 2022 (which is a new high since January 2008). The exchange rate faced a technical pullback in the fourth quarter of 2022 and is about to record a three-month close after bottoming again in March 2023 (94.061). The exchange rate is trading above the 100-month SMA with a bullish MACD configuration.

The daily chart suggests that the currency pair’s long momentum may show signs of slowing in the near term. However, the direction remains biased to the upside as long as support at 103.70 and 96.95 is intact. Near-term resistance is the peak of 110.516 last September and then the major area of 113.30 to 116.75.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.