Eli Lilly is an American pharmaceutical company founded in 1876, which actively engages in the discovery, development, manufacture and sale of pharmaceutical products covering the treatment of diabetes, oncology, immunology, neuroscience and many more.

The company’s share has been up massively over the past few years, from below $100 before Q3 2018, to higher closing prices at $131, $167, $278, and $366 respectively by the end of the next 4 years.

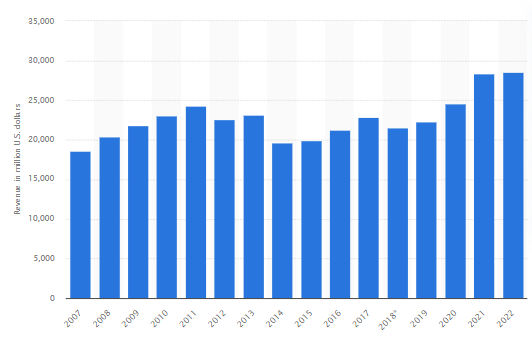

Eli Lilly’s Revenue. Source: Statista

Revenue of the company for the past 4 years stood at $22.3B, $24.5B, $28.3B and $28.5B. Such healthy growth of sales revenue was driven by Eli Lilly’s continued market share gains for some of its drugs used in treating diabetes (Trulicity), metastatic breast cancer (Verzenio), and glucose control (Jardiance), as well as Covid-19 antibodies.

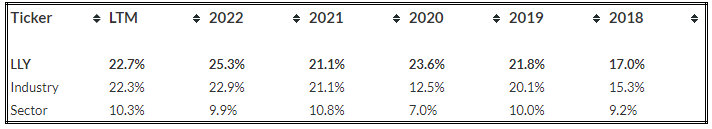

Operating Margin: Eli Lilly vs Industry & Sector. Source: Trefis

Fundamentally, Eli Lilly has generally been ahead of its peers from the Pharmaceutical industry and also the Health Care sector for the past few years, reflecting the company’s efficiency at turning sales into profit through its core operations.

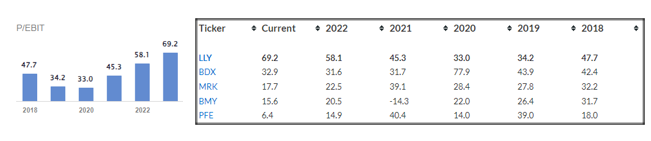

P/EBIT: Eli Lilly and its Peers. Source: Trefis

Price to Operating Income Ratio (P/EBIT) shows a U-curve, and last year hit 58.1. An increasing P/EBIT could mean operating profit growth is accelerating. Eli Lilly has been trading more expensive than its peers. Cash flow wise, Eli Lilly is still in a good position to meet its near-term obligations despite the ongoing inflation shock.

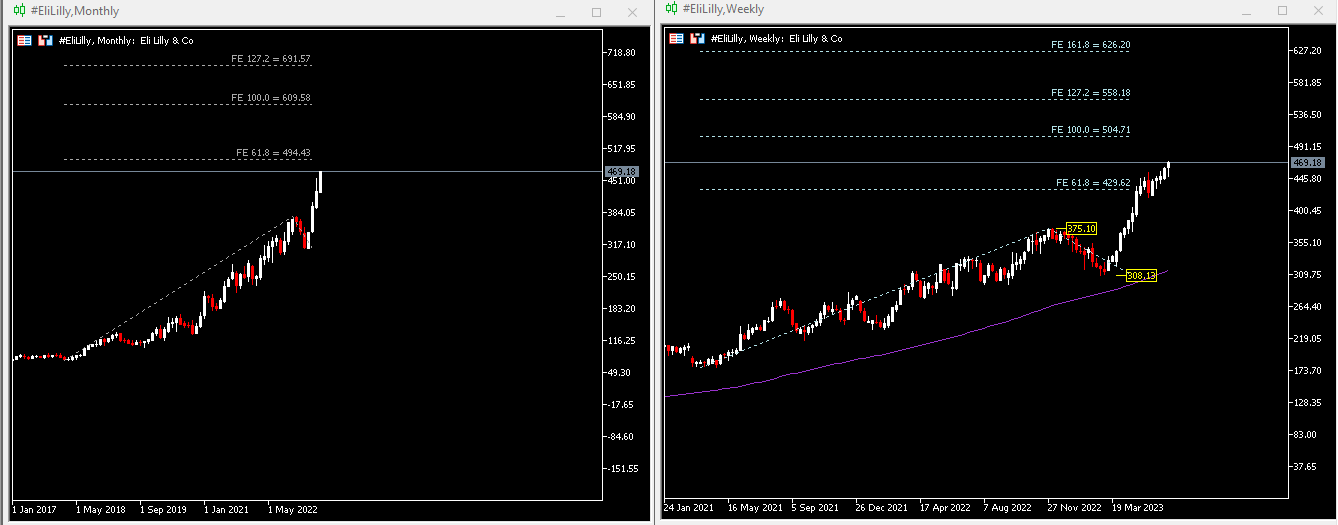

In 2023, its stock price surged higher and last closed at $469.18, with YTD gains over 28%. Besides being supported by solid fundamentals, a new weight-loss drug recently developed by Eli Lilly may lay an even better foundation for the company’s future. The drug – Retatrutide (currently still in clinical trial) – is shown to have helped patients lose an average of 24% body weight over the course of a year on the highest dose (not to neglect to mention there were indeed some side effects though). The resulting weight loss percentage is the highest among any drug of the same class.

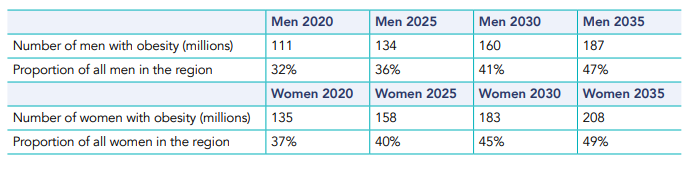

Obesity has been a global issue affecting children, adolescents and adults of both genders. In the US alone, the proportion of men and women with obesity amounted to 32% and 37% respectively in 2020. The percentage is expected to be on a rising trend, up over 40% for both genders by 2030 – and that could adversely impact the country’s economy at over $1.23 trillion, equivalent to 3.5% of the total regional GDP.

Back to Eli Lilly, it could take years for Retatrutide to complete several trials before being officially approved by the Food and Drug Administration. By achieving a great milestone in weight-loss drugs, considering there is ongoing demand worldwide, some experts even predict this could bring about $100 billion to the company by the end of the decade.

Technical Analysis:

The #EliLilly (#EliLilly) stock price closed bullish for four consecutive months. The trend in general skewed northward. By extending Fibo expansion on both monthly and weekly chart, we see nearest resistance at $494, followed by $505 and $558. On the other hand, $430 serves as the nearest support. A close below this level may encourage the price to retrace towards the highs formed in Q4 2022 ($375.10), followed by the lows seen in March 2023, at $308.13.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.