And so suddenly the JPY became the star currency among the majors. The movement from 145 to today’s 139.64 reminds us a lot of the autumn of 2022 when a resounding BOJ intervention helped kick-start the temporary appreciation of the Japanese currency. In that case, the move was a striking one: the central bank had got its hands on its own foreign exchange reserves by selling them on the market in a rather clumsy manner – a gigantic at-the-market order extremely unusual among institutions that was certainly also a message. Only later did we learn that the movement had continued as the large local pension and insurance funds had brought back funds from overseas in the belief that the YCC on the Japanese 10y would soon come to an end, finally guaranteeing investment and profit possibilities. Instead, this was not the case and we saw the USDJPY at 145 once again.

This time it is different: there has been no gigantic intervention by the BOJ, but a gradual and decisive movement. It is likely – among other options – that some data have given hope for a change in monetary policy in the near future: many regional areas of Japan are seeing small and mid-sized firms aggressively raise wages and a spike in raw material costs has pushed inflation above the BOJ’s 2% target and kept it there for more than a year.

Source: Japanese MOF

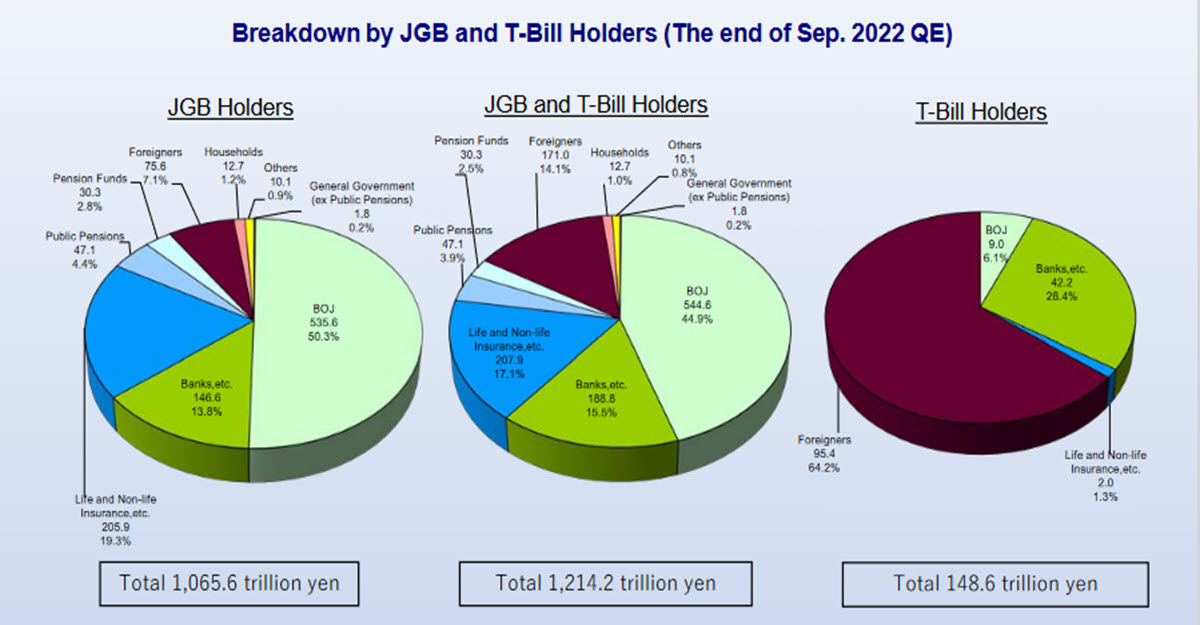

There are 2 ”restrictive” options for the BOJ: raise the official rate (currently at -0.1%) or tweak its YCC policy from 10Y to 5Y. The latter is definitely seen as the most effective. But we don’t think it will happen. Japan’s debt structure is incredibly long-term oriented, with a gigantic chunk of debt over 10 years of maturity (32%): many other countries have an average duration close to 6/7 years. To stop artificially holding the 10y at 0.5% would expose the market to huge capital losses and – although 50% of the issuances is in the hands of the central bank – the other major holders are pension funds, insurance companies and Japanese banks. This would be a disaster, although it is precisely the insurance funds that have been very active in selling these positions in recent months. Besides, what would be the advantage of controlling the 5y, which already yields 0.139%?

Source: Japanese MOF

Raising the official rate from a negative level might be an option, but of very little long-term effect: the differential with all other countries rates would still remain enormous. Since it is foreign investors who hold 64.2% of the short end, that would do them a good favour from an international perspective.

Source: Japanese MOF

Structurally, the JPY would remain weak and headed in only one direction in the long term, despite the new appreciation in recent days.

There is another factor, however, that could prove a further weakening of the USDJPY: a global risk-off episode – yet to occur – which would lead to the unwinding of many risky carry trade positions and an overall repricing.

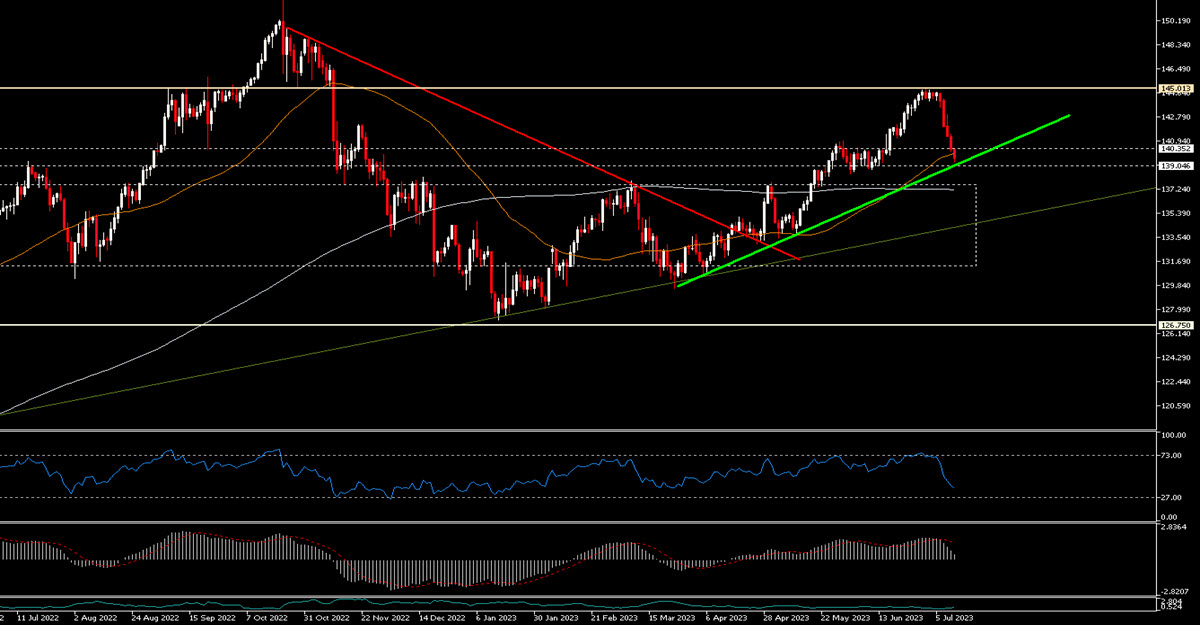

Technically, the situation can be seen on the chart: after the collapse of the last five sessions from 145, the pair is practically in contact with the shorter-term bullish trendline (from Mar 2023) and close to the support in the 139 area. Should this trendline be broken, it would not be a problem for the long term uptrend that started in August 2021 and whose bullish trendline currently passes around 134.30. Moreover, the 200 moving average is also flat at approx. 137.20.

That said, the current macroeconomic situation clearly continues to disfavour the JPY and we doubt that the BOJ can do anything about it in the coming months.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.