The US Dollar was -3.32% down from 102.86 at last Thursday’s close to 99.45 at yesterday’s settlement. This is how far the USD basket against six other majors (USDX) has fallen in the last five sessions building up on some very positive data in the US, while on both the consumer and producer prices side data have been falling steadily and rapidly as well as on the labour market side.

It was mainly the sell-offs against the Japanese currency that initially caught the eye due to the USDJPY‘s rapid descent from 145 to the current 138.05 (-4.8%) and the subsequent breaking of various supports including the psychological one at 140; but the truth is that GBP, EUR and CHF (+3.34%, +3.39% and +4.40% respectively from 06/07 open) have also been advancing steadily against the Greenback for days now while other currencies such as the antipodeans and some EMs have only played catch-up in recent days. Let’s take a look at a roundup of a few of these latter ones, some of which are less under the radar.

USDZAR

The South African Rand has been weak for a long time due to a difficult national economic picture in several respects but has lately regained traction. This week there was another clean break of the trend at 18.28 and currently the price trades just below the MM200 at 17.97. Note the strength of the previous bearish leg that began in June. A continuation of the move should easily have room up to 17.68 although a pause might be due right now.

USDHUF

The Hungarian Florint is an EM currency (CEEMEA to be accurate) that has been appreciating for some time (since October 2022) against the USD and has accelerated this process again in the last week (-6.03% since the 06/07 settlement price). It is inside a clear long-term descending channel and seems to have further room to fall, with the lower end of the channel passing near 320 at present (334.30 price). It is trading below its MM50 and MM200, both of which are negatively inclined. There is long-term congestion in the 327 area. An interesting one to follow.

USDMXN

The Mexican Peso is another emerging currency with a long-standing positive trend, since the cross reached a high near 25.75 in April 2020. It currently stands at 16.89. Gains since 06/07 have also been more moderate, -2.37%, due to this continued strength. In this weekly chart we see that it is below the support zone at 18.45 and, if it closes at the current price, it would do so below an important long-term trendline. The next support area is 16.32.

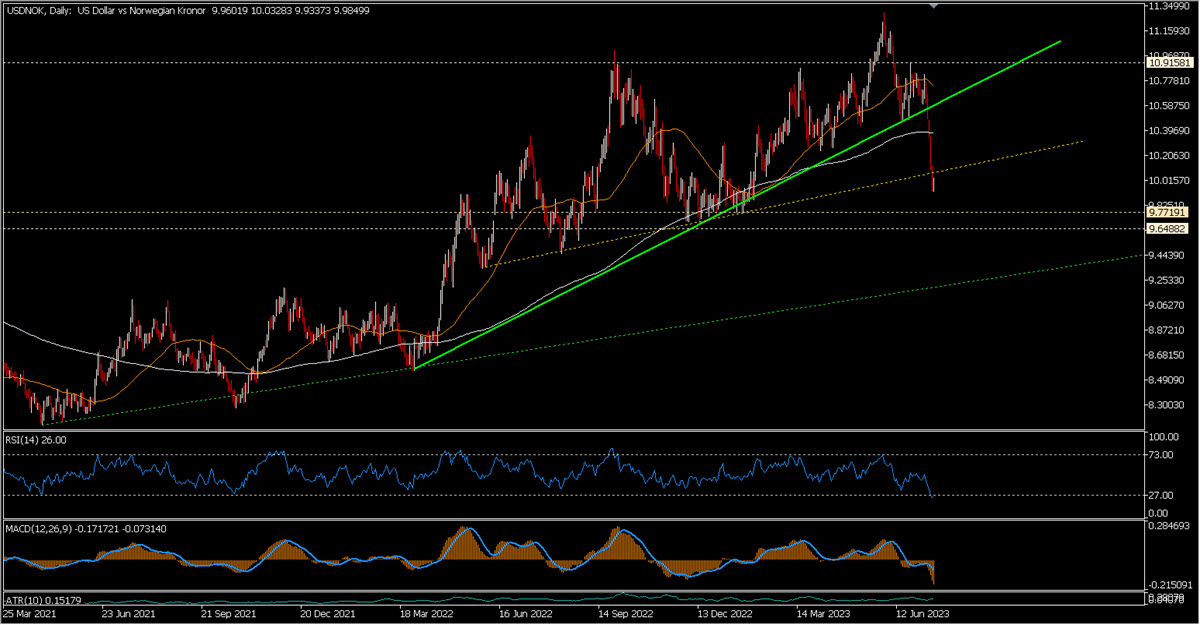

USDNOK

The movement of this cross was very strong and clean, which, also in light of the Norwegian ”trading mix”, is very sensitive to the price of oil, which has been rising in recent days. The break of the trendline at $10.57 was very clean and from there the movement accelerated downwards to the current $10.03 (-5.01%). The movement is now a bit stretched but a continuation could reach $9.77 first and then $9.65. Another interesting one to monitor.

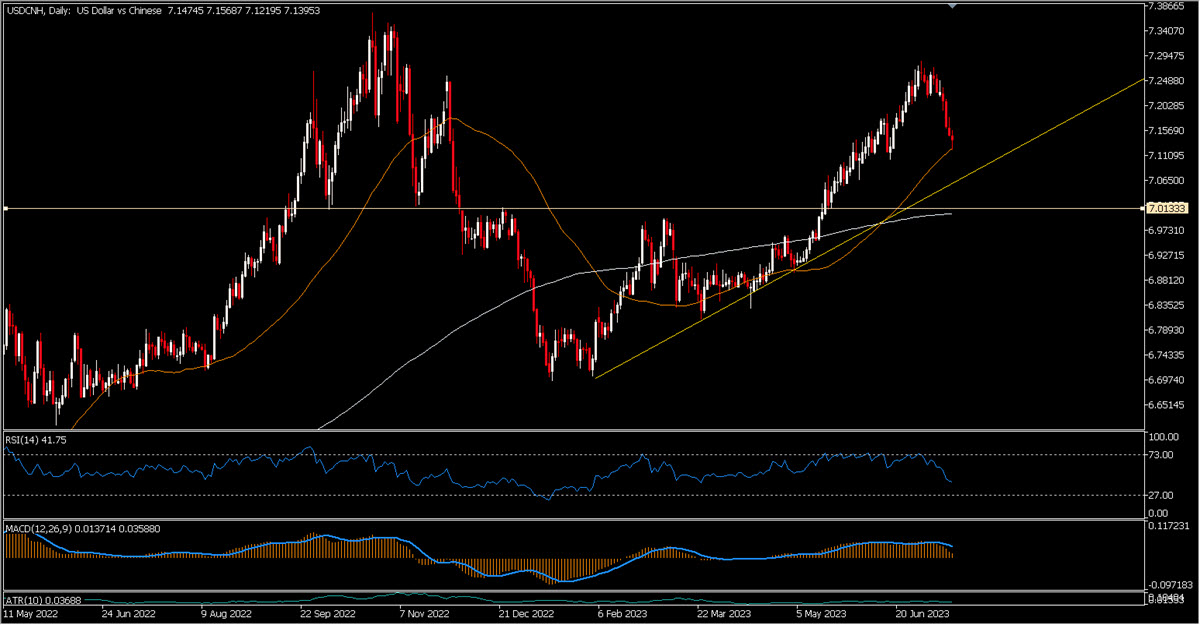

USDCNH

The all-important cross against the Chinese Yuan has taken a breather after touching 7.28 and is currently at 7.1356 (-1.94%), sitting just above the MM50. The combination of data from the US plus expectations of more stimulus in the Asian country could extend the move down to 7.06 -where the first trendline passes while the MM200 is in the 7 area now.

USD Index

Following the CPI release the USD Index has brutally broken downwards through the 101.15-100.50 zone and is currently pausing slightly and trying to slow its fall to 99.26. In case the movement – however stretched – continues downwards immediately there is 98.75 to monitor, 97.62 being the next really important level. At the beginning of 2021 the USDX was trading in the 90 area. Amid all this, the FED’s hawk Bullard has resigned and will leave office in August.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.