Oil prices rose with stock markets last week as tightening expectations were reigned in. Supply restrictions are also starting to bite, although China’s weak recovery continues to weigh on sentiment, and the IEA cut its forecast for global demand for the first time this year. European gas prices meanwhile continue to slide. For agricultural commodity prices, the Black Sea Grain Initiative is once again in focus, as Russia today refused to extend the deal, while demanding changes to the conditions for its own exports.

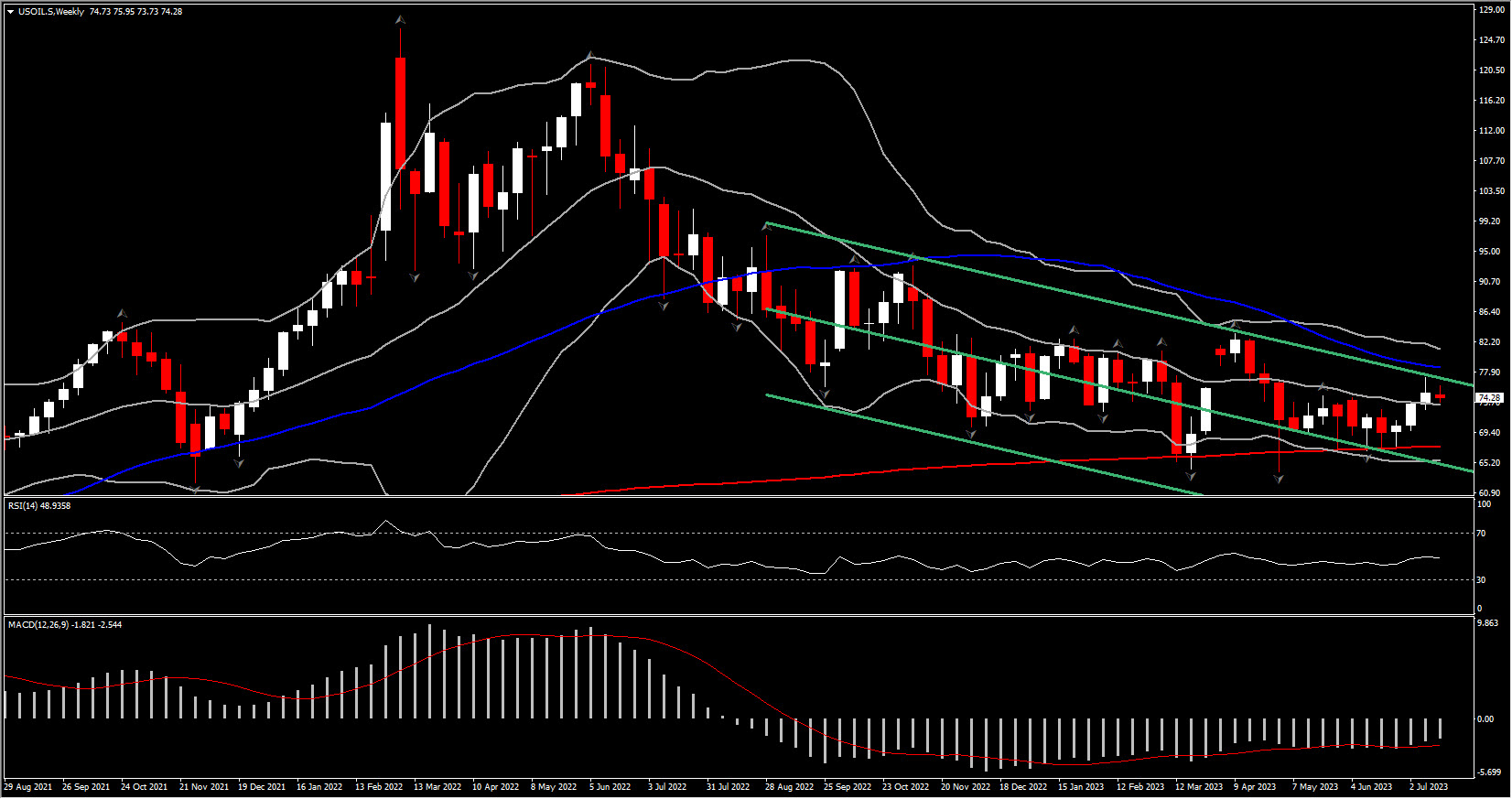

USOIL continued to move higher last week, as output cuts are starting to take effect. The IEA said in its latest monthly report that “world oil supply rose 480 kb/d to 101.8 mb/d in June but is set to fall sharply this month as Saudi Arabia makes a sharp 1 mb/d voluntary output cut.” There are also signs that Russia is finally making true on its output cut announcement. So far Russia’s restrictions have been falling short of what Moscow announced, but vessel tracking data showed shipments through Russia’s western ports falling substantially in the four weeks to July 9.

The IEA still expects global production “to increase by 1.6 mb/d to 101.5 mb/d, as non-OPEC+ expands by 1.9 mb/d. In 2024, global supply is set to rise by 1.2 mb/d to a new record of 102.8 mb/d, with non-OPEC+ accounting for all of the increase.” Demand meanwhile is likely to be lower than previously thought. The IEA now expects global demand to “climb by 2.2 mb/d in 2023 to reach 102.1 mb/d, a new record. However, persistent macroeconomic headwinds, apparent in a deepening manufacturing slump”, have led the organization to revise its “2023 growth estimate lower for the first time this year, by 220 kb/d. Buoyed by surging petrochemical use, China will account for 70% of global gains, while OECD consumption remains anemic. Growth will slow to 1.1 mb/d in 2024”, according to the report.

Bloomberg today reported that Japan plans to propose a gl obal stockpile for natural gas, similar to the emergency oil stockpile, which requires member nations, such as the US and Japan to hold an oil reserve equivalent to at least 90 days of net imports. The government will reportedly suggest that the IEA should create an equivalent gas framework for member nations, with a proposal due to be set out during the LNG Producer-Consumer Conference with the IEA in Tokyo tomorrow. Bloomberg said Japan is pushing for its proposal to be included in the agenda for an IEA ministerial meeting in February.

obal stockpile for natural gas, similar to the emergency oil stockpile, which requires member nations, such as the US and Japan to hold an oil reserve equivalent to at least 90 days of net imports. The government will reportedly suggest that the IEA should create an equivalent gas framework for member nations, with a proposal due to be set out during the LNG Producer-Consumer Conference with the IEA in Tokyo tomorrow. Bloomberg said Japan is pushing for its proposal to be included in the agenda for an IEA ministerial meeting in February.

The USOIL contract is currently at $74.36, slightly higher on the day, but still down -0.6% compared to Tuesday last week as China’s sluggish recovery is keeping a lid on demand expectations. On top of that two of the three Libyan oil fields that were shut last week re-opened over the weekend, which lifted output capacity this week.

Gold prices jumped higher last week, as the US Dollar declined on growing conviction that the Fed is approaching peak rates. US data on consumer sentiment on Friday halted the slide in the USDIndex and capped the advance of gold, with prices little changed on the day on Monday at around $1,960 per ounce. Today bullion got a boost from the rally in bonds, triggered by comments from ECB hawk Knot, who pushed back against expectations of a September hike. Treasuries underperformed versus Eurozone peripherals in particular, but the US Dollar still struggled and held below 100 at currently 99.25. Gold is currently between 1963-1972, the highest level since the middle of June. Global central bank outlooks, and in particular the Fed’s policy path, will remain in focus.

Base metals meanwhile are keeping a close eye on China’s growth indicators, and prices dropped today after second-quarter GDP numbers missed estimates. Hopes of stimulus from Beijing had helped to boost sentiment earlier in the month, but so far official announcements of support have been falling short of expectations.

Agricultural commodity markets remain focused on the Ukraine war and weather conditions. The FAO’s Food Price Index dropped -1.7 points (-1.4%) in June, but wheat prices have jumped in recent days following Russia’s refusal to extend the Black Sea Grain initiative that secures a safe trade corridor for Ukrainian exports via Black Sea ports. Russia today pulled out of the UN brokered deal that had kept food deliveries flowing from the Ukraine to the wider world. Russia claimed that its own food and fertilizer exports were undermined by “hidden” Western sanctions and had effectively started to strangle the deal before killing it off today – just before the start of this year’s harvest.

Kremlin spokesman Dmitry Peskov said that until Russia’s demands for alterations to its memorandum of understanding (MOU) with the UN had been met, it would no longer support the initiative. “The grain deal has halted”, Peskov said, although he added that “as soon as the Russian part of the deal is fulfilled, the Russian side will resume the fulfillment of this deal without delay”. Turkey, which helped to break the original deal, remained optimistic that a solution can be found, ahead of a meeting with Russia tonight. The USDA meanwhile lifted domestic supply and output forecasts for wheat for the 2023/24 season, and suggested that recent dry weather conditions are unlikely to hamper production.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.