Netflix Inc., one of the world’s leading entertainment services companies based in California which engages in paid streaming and the production of films and series, is scheduled to report its Q2 2023 earnings on 19th July (Wednesday), after market close. Netflix is ranked the world’s 56th most valuable company by market cap but topped at its consumer discretionary sector.

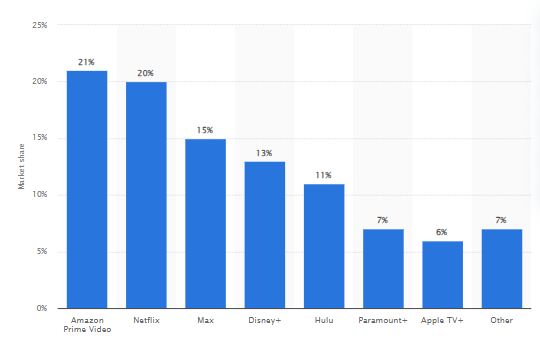

Data above shows that in Q2 2023, Netflix ranked 2nd in terms of market share of selected subscription video-on-demand (SVOD) services in the US, slightly behind Amazon Prime (21% vs 20%). Combined, the market share of Disney+ and Hulu has made Disney occupying the largest market share, at 24%.

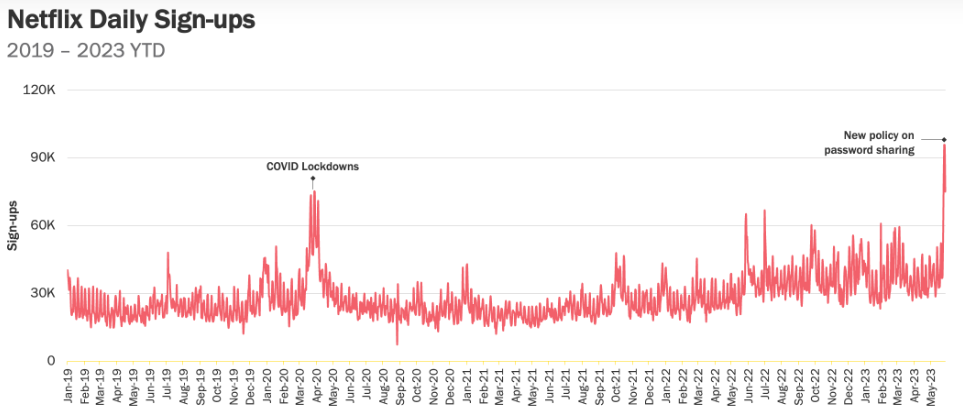

Average daily signups to Netflix from 24th-28th May achieved a wobbly increase of 102% from the prior 60-day average to 73,000, after the company announced crackdown on password sharing. On 26th and 27th May, new subscribers reached 100,000, hitting a new record high for daily sign-ups (was below 90,000 at early phases of Covid-19).

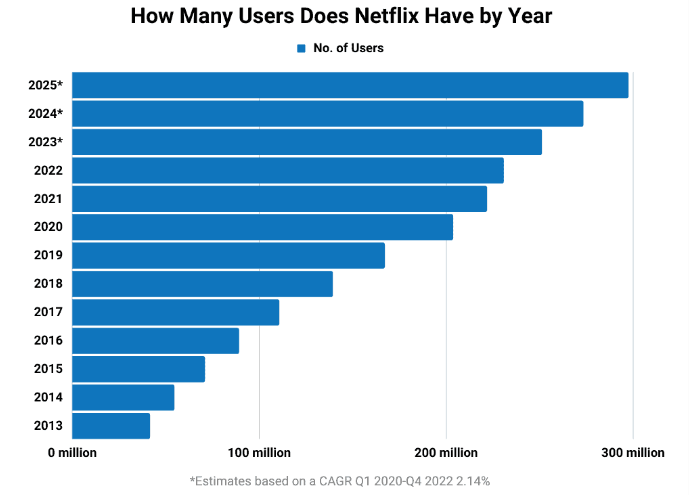

In Q1 2023, Netflix reported 1.75 million quarterly gains of paid subscribers, to 232.5 million. This was boosted by lower-cost, ad-supported tier. Some analysts predict Netflix shall add another 2 million subscribers globally in the coming quarter. According to the graph above, Netflix is projected to reach over 250 million paid subscribers by the end of FY 2023, up nearly 9% from FY 2022.

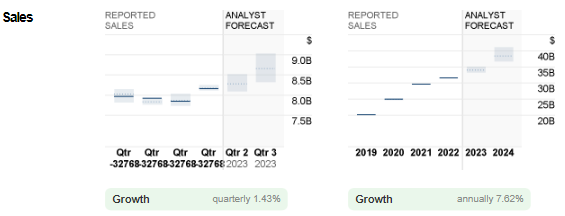

Sales revenue of Netflix remains healthy. Last year, its sales reported at $31.6B, up 6.4% from 2021. In Q1 2023, the figure was $8.2B (first time ever in record which hit above $8B; and higher than the 5-year average at 6.46B (source: Ycharts)), up 3.8% from the same period last year. Nonetheless, the company reported negative net income growth, down -18.3% from the same period last year to $1.31B. This marked the third consecutive quarterly net income losses for the company.

On the other hand, EPS was $9.95 in 2022, slightly down over -11% from 2021. In Q1 2023, it was reported at $2.88, a huge leap from previous quarter $0.12. In the coming announcement, consensus estimates for sales revenue stand at $8.3B, whereas EPS at $2.85.

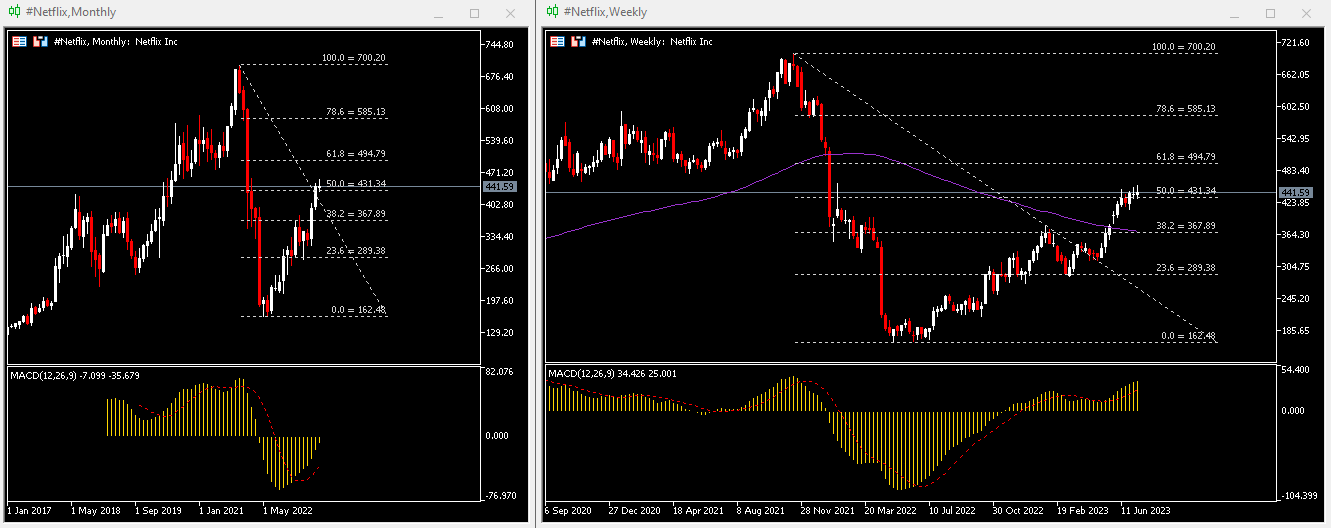

Technical Analysis:

#Netflix share price has been riding upward since the latter half of 2022, leaving lows at $162.48 (a record low since July 2017). It is currently testing key level FR 50.0% (extended from ATH in Nov 2021 to the session low in May 2022), at $431. A successful bullish break above this resistance may attract more buyers, pushing stock price higher to test the next resistance at $495 (FR 61.8%), or psychological level $500. Otherwise, if earnings result disappoints the market, stock price may slump below $430, to test the next support at $368 (FR 38.2%). MACD indicator shows positive configuration.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.