There has been a lot of fuss lately among pundits and analysts about the declining inflation. The peak in the US was actually recorded in June 2022 – 13 months ago – and even in the UK, the developed country with the highest price growth, the inflation rate is back below 8%, giving hope to the most optimistic that the target announced a few months ago by the Sunak government, to halve this indicator by the end of the year (to finally see 5% by December 2023), can be achieved. The fall in consumer prices driven by the decrease of commodity quotations and PPI led a move that was actually faster than the previous rise. Of course, there is still a lot of concern about second-round effects such as rising salaries (sometimes what is good for people is not good for economic theory) and growing margins of companies that want to make up for the previous squeeze they suffered to maintain sales volumes, but there is generally a certain ‘’optimism’’.

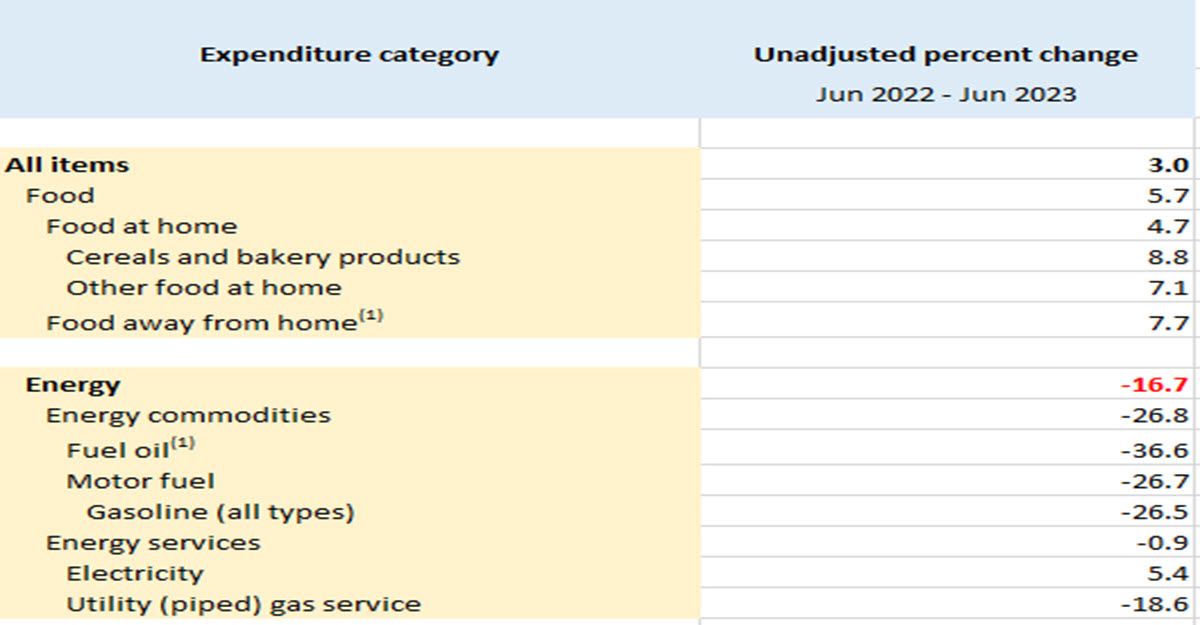

US BLS data, Prices

The biggest contributor to this drop was the energy component: using the easily available data from the American BLS we can see that the year-on-year change was -16.7%, with fuels down -36.6%; something very similar can be seen in Europe as can be seen on the Eurostat or Destatis websites. Oil and Natural Gas have all dropped during the last months; and so have – for example – other basic commodities like wheat (food).

But a combination of events, generally geopolitical, are threatening to change all this and cast doubt on our near-certainty for the future and perhaps the course of monetary policy and world economies.

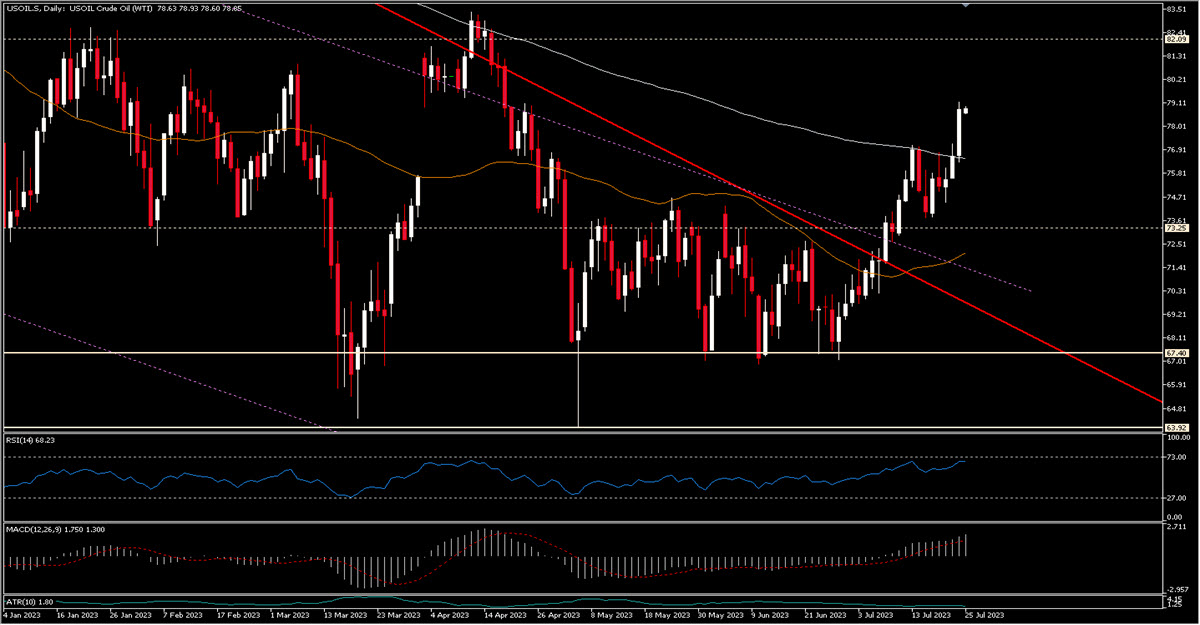

Crude Oil, Daily, breaking higher

Thanks to OPEC+ action, the price of Crude Oil has risen 17.43% in the last 18 sessions. Oil also has to be refined and the bottleneck of refineries can greatly influence the price of final distillates. The RBOB Gasoline Future is up 43.3% from its December 2022 lows, Heating Oil is up 24.89% from its lows on May 03 this year. The Henry Hub Natural Gas is back in its comfort zone between $2 and $3, but it’s up 27% since the beginning of June. The other day, the EIA warned of the risk of non-supply for Europe next winter despite the recent favourable weather conditions. Then there is the war in Ukraine and the suspension of the grain deal. Russia will probably be careful not to undermine some of its Southern ”allies”, but in the meantime Wheat is up 32% since the beginning of June and Milling Wheat is up 17.61% in the last 11 sessions. If only they were the only ones: Soybean Oil futures increased 45% in 37 sessions, Oats are more expensive by 50% over a similar period, while Live and Feeder Cattle futures are at an ATH, with Lean Hogs up 35% since 29th May.

Cocoa, daily, pushing close to 7 years highs

It is clear that producer input prices, both energy and agricultural are rising again, even if this is not yet in the headlines. We really have to hope that this is something temporal, otherwise that old slogan ”higher for longer” (we’re talking about interest rates of course) that has fallen into oblivion will be resurrected with all the consequences.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.