- The Fed is expected to deliver a 25 bps rate hike today, but the future is uncertain.

- The September meeting remains key to shape up future policy.

- The Fed has to maintain the balance between inflation and economic growth.

The financial world is abuzz with anticipation as the Federal Reserve gears up to raise interest rates by 25 basis points today, potentially reaching between 5.25-5.50%.

While market participants are closely monitoring the central bank’s moves, recent signs of decelerating inflation have sparked discussions about whether this rate hike might be the last in the current tightening cycle.

Let’s dive into the key factors influencing the Fed’s decisions, the upcoming data releases, and the economic projections that could impact the future of interest rates.

The Fed’s Cautious Approach Amid Promising Signs of Decelerating Inflation

Despite signs of inflation slowing down, the Federal Reserve is expected to maintain a cautious approach in its tightening cycle.

Fed Chair Jerome Powell will likely underscore the central bank’s commitment to curbing inflation and potentially reaffirm projections for at least one more rate hike this year.

Key Data Releases and Economic Projections: September Meeting Holds the Key

The next FOMC meeting, scheduled for September 20-21, will be critical in shaping the future course of interest rates. The central bank will closely monitor key data releases, including two sets of PCE inflation, CPI, and non-farm payroll figures.

Additionally, updated economic projections from the Fed will offer further insights into the central bank’s outlook.

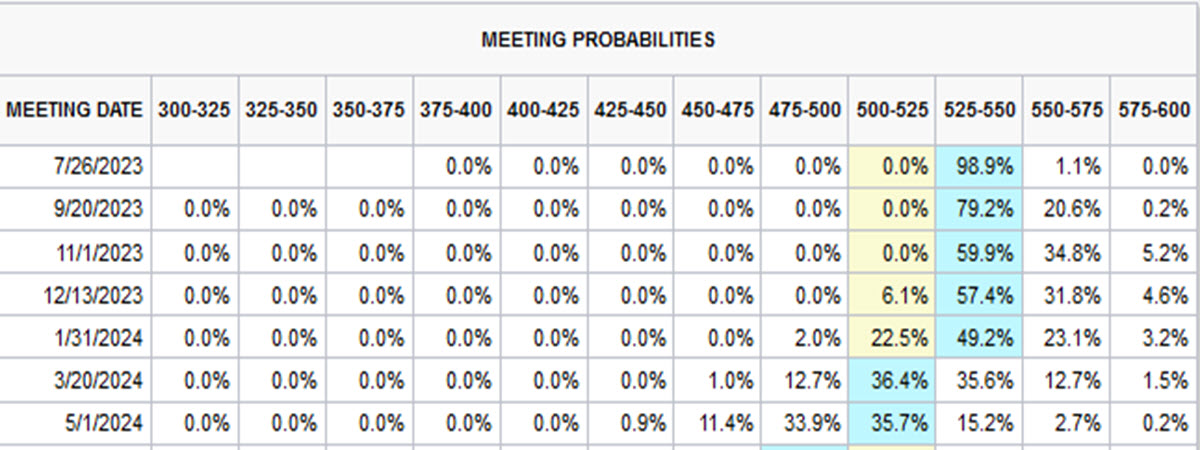

CME Watchtool

Market Expectations vs. Fed Projections: Diverging Views on Future Rate Hikes

Market expectations for future rate hikes are relatively modest. The probability of another rate hike is approximately 20% for September, 40% for November, and 36% for December.

Surprisingly, the first rate cut for 2024 is already priced in for as early as May, with an estimated probability of about 81%.

This divergence between market expectations and Fed projections adds to the uncertainty surrounding future monetary policy decisions.

Reaching the “Sufficiently Restrictive” Level: Balancing Inflation and Economic Growth

Since March 2022, the Federal Reserve has raised its benchmark rate from near zero to over 5%, approaching a level the central bank deems “sufficiently restrictive” to bring inflation down to its target of 2%.

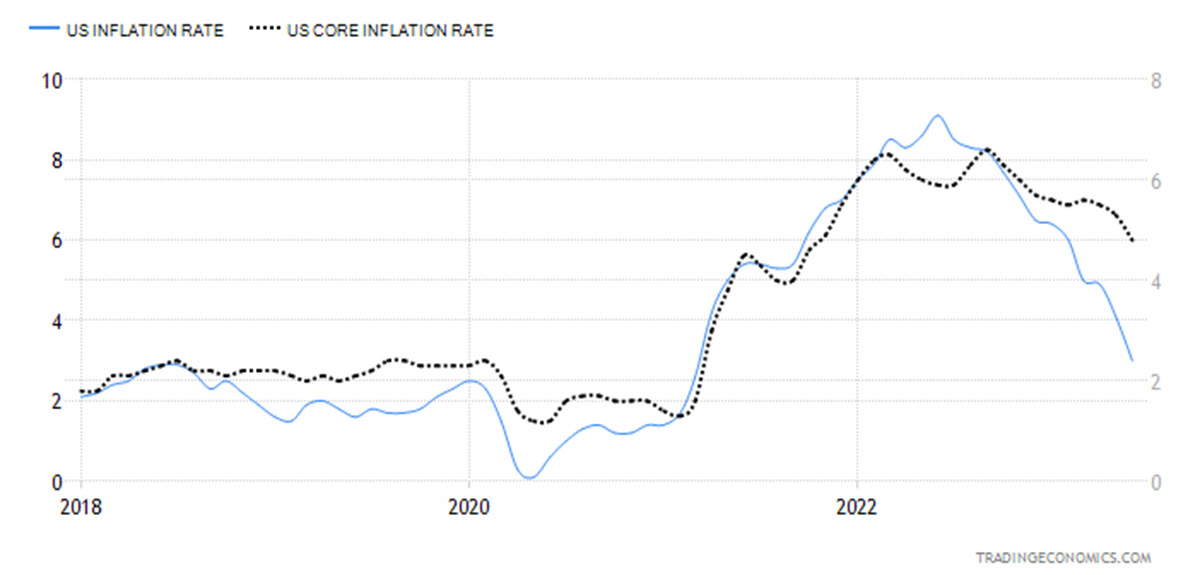

While headline inflation has eased to 3% in June, core inflation measures continue to hover above the Fed’s target. Officials closely monitor these trends to balance inflation control without hampering economic growth.

Headline / Core Inflation Rate

The Tug of War: US Economy Defies Expectations Amidst Inflationary Pressures

The US economy has proven resilient, defying expectations of a sharper slowdown. Despite cooling off, the labor market remains robust, bolstering consumer spending. While headline inflation has shown some signs of relief due to eased energy and food prices, core inflation measures remain elevated.

This discrepancy led officials to revise their forecasts for core inflation, potentially impacting the level at which the fed funds rate will peak this year.

Uncertain Path Forward: Assessing Future Rate Hikes

Market participants and economists remain skeptical about the likelihood of further rate hikes this year. With some officials deeming the September FOMC meeting “live,” the Fed could raise rates then. However, the central bank has a high bar for further tightening in September.

Most analysts anticipate that if data necessitates another rate rise, it would likely be implemented at the November meeting.

Bottom line

As the Federal Reserve readies for another interest rate hike amid promising signs of decelerating inflation, the financial world awaits its decision with bated breath. Striking a delicate balance between controlling inflation and supporting economic growth remains challenging for the central bank.

The coming months, marked by crucial data releases and economic projections, will determine whether the Fed can steer the economy toward its long-standing inflation target while avoiding potential recessionary pressures.

Click here to access our Economic Calendar

Adnan Rehnan

Market Analyst – Educational Office / Pakistan

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.