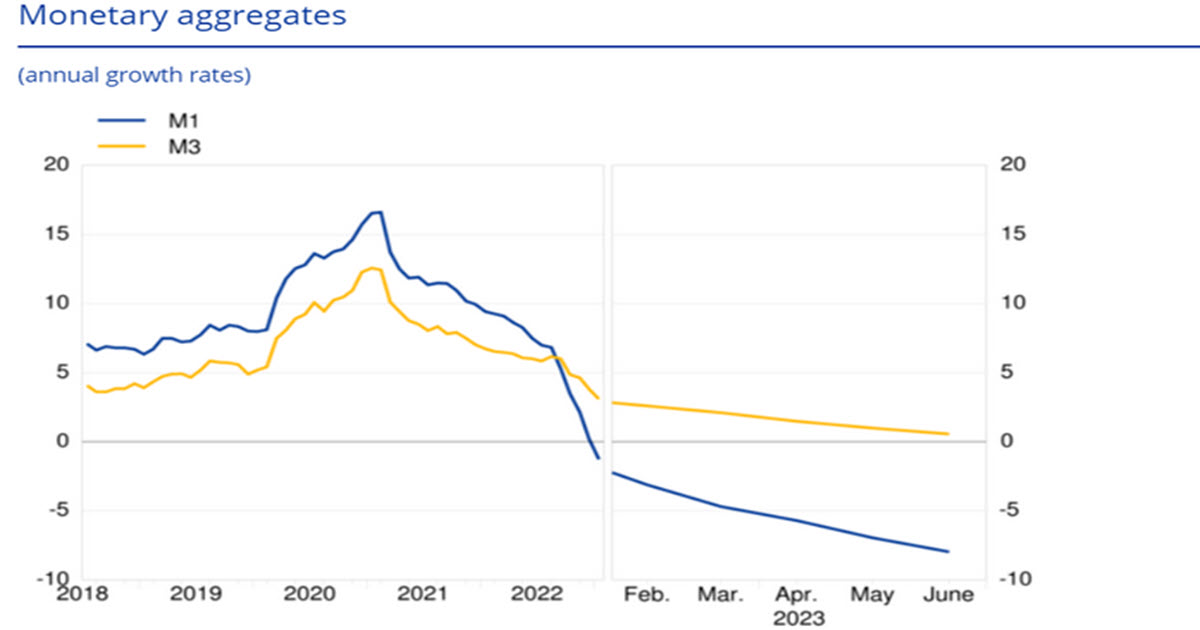

“Firms’ net demand for loans fell strongly in the second quarter of 2023, dropping to an all-time low since the start of the survey in 2003“: this is what the ECB stated in its last quarterly survey of 158 banks just few days ago. This is a key input in policy deliberation for the bank and further proof that the bloc’s economy is struggling to cope with rapid rate hikes. Banking loans are the real money creation mechanism out of thin air; while the percentage of banks reporting tighter credit standards was smaller than in the previous quarter, it remained above the survey’s historical average and banks expect to continue tightening credit standards. The 400 bps combined hikes in the past years are starting to bite. Monetary aggregates growth is cooling down after years of expansion: M1 has been shrinking since late 2022, and just yesterday M3 showed an anemic growth of 0.6% y/y. Money should not contract in an inflationary environment!

Ecb.europa.eu

But perhaps we are placing too much emphasis on the ability of monetary policy to drive the economy, despite being a key driver of it. Money is not the economy, but it’s the oil that lubricates it.

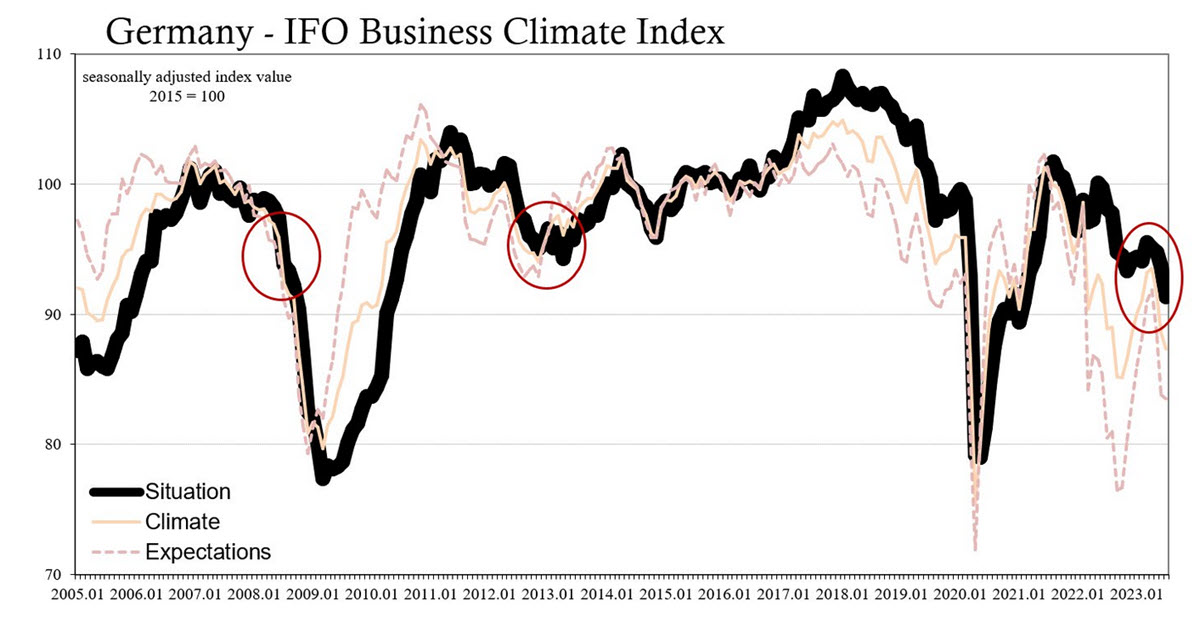

Let’s focus on Germany, the largest economy in the continental bloc: it is in recession (-0.5% and -0.3% growth in the last two quarters), the industrial sector is in trouble, and the latest manufacturing PMI came out at 38.8, a GFC and post-Covid kind of level. Meanwhile, the IFO, the Munich-based research institute and one of Europe’s leading think tanks, in its monthly Business Climate Index stated that the current situation has gotten really bad: the Index is worse than the lowest point of 2012 and accelerating to the downside. The worsening credit crunch and global trade collapse can help explain why.

And so we come to Madame Lagarde: the ECB will today raise its Main Refinancing Rate by 25 bps to 4.25%. But that is not the point, the tone will be. We don’t think she will pre-commit to further hikes in the future, but she will be very balanced with an emphasis on data dependency. Euribor futures currently do not rule out (but do not totally price in) a further rise by December and predict the first cut shortly thereafter, around June 2024 (with a fair chance of this happening as early as spring). However, let us get particularly technical for a moment: in the Euribor options market there has been a lot of movement in recent days on the August versus September/October expiry dates, with traders selling Calendar Spreads on these dates. What this means is that they are not discounting a change in expectations in the coming few weeks – on the contrary, they think it is possible.

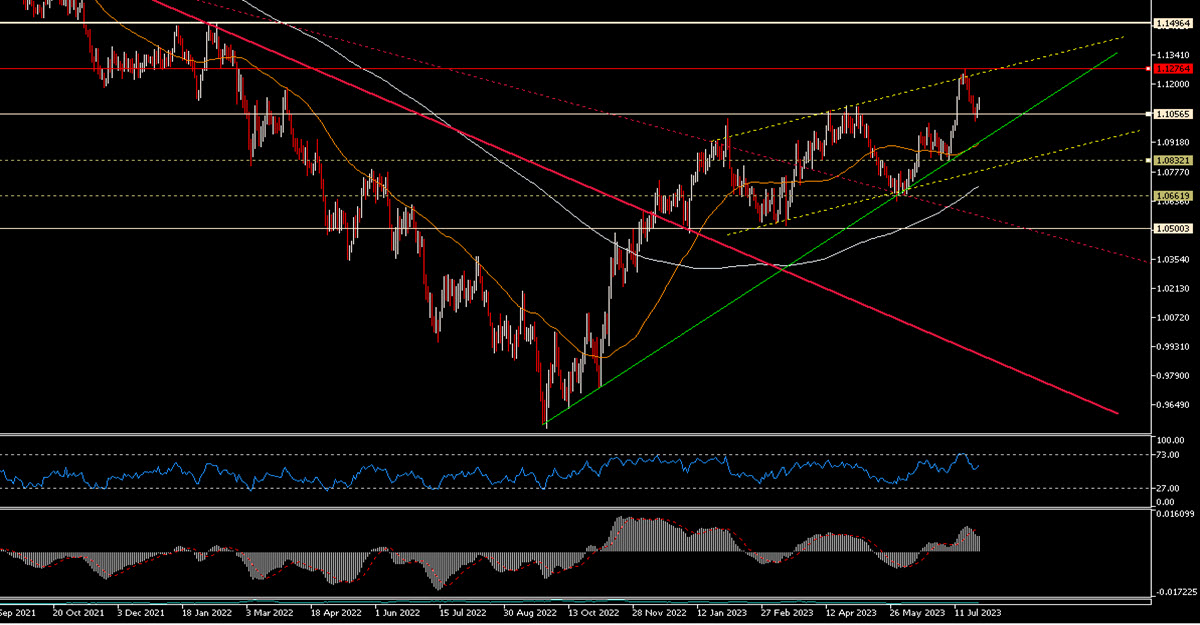

We believe that the ECB President will try to play it safe by being vaguely hawkish so as not to give the market the cold shoulder, even though the Governing Council should know they are on the edge. What this means for the EURUSD is the possibility of an up move in the very short term, aka what is left of this week, which could take the pair to the 1.1150 area again and possibly even towards 1.12. However, as should be clear from the above exposition of the arguments, we believe it is difficult to clearly favour the EUR over other major currencies over the longer term and the already seen 1.1250/1.13 could turn out to be the pair’s highest level for at least a few months to come. All this, of course, USD permitting.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.