Amazon.com, Inc. is expected to report earnings on Thursday, 03 August 2023, after market close. The report is for the fiscal quarter ended June 2023.

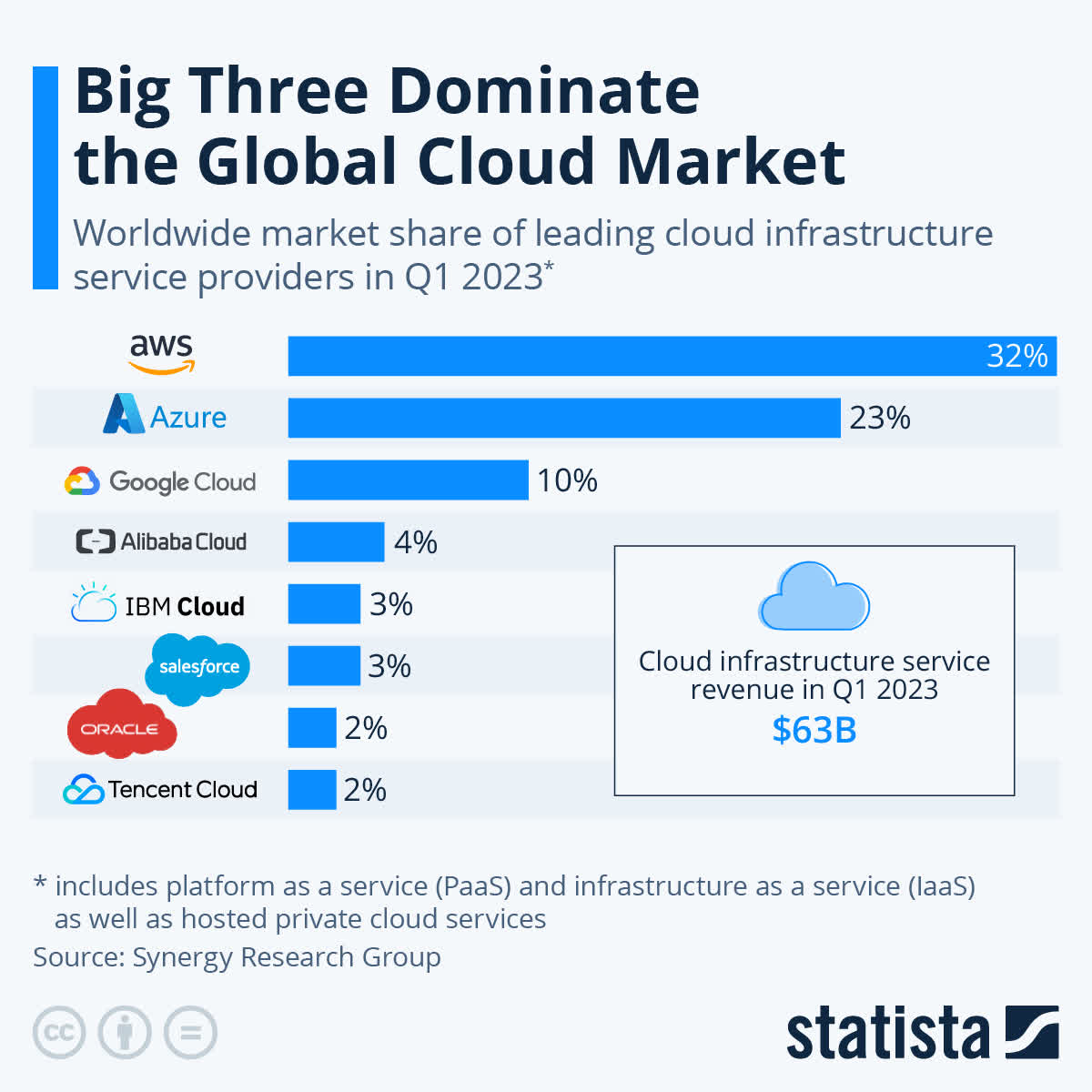

In the second quarter, Amazon said it had achieved record delivery speeds in the United States while continuing to reduce costs. Investors will be looking for evidence of growth in Amazon’s e-commerce business when it releases its Q2 financial results on Thursday. Nonetheless, inflation is still having an impact on consumer and business spending, so investors listening to the earnings call will also want information on the cloud business, advertising revenue growth and indicators of consumer health ahead of the holidays. Of note, last week Microsoft and Google both reported slowing growth in their cloud businesses for the quarter and Amazon previously stated it experienced a decline in AWS growth as well.

JPMorgan and Bank of America are bullish on Amazon stock heading into earnings season and the latter believes that improving retail margins and AWS growth will help expand the stock’s multiple.

The impact of inflation is making consumers overall reduce their spending, while businesses investing in AI and cloud technology are being forced to re-evaluate their costs, which will impact the expansion of cloud computing.

Facing a challenging situation and downsizing costs, Amazon has laid off 27,000 employees. Wall Street analysts anticipate the company’s profits to increase by 121% in 2023 and 50% in 2024 as a result of these efforts, which will improve the company’s profitability. As the pace of growth has slowed, the company’s investment needs will also decline, which will result in reduced capital expenditure and stronger cash flow in the coming years. And the decline in inflation due to rising interest rates will allow Amazon to cut costs. In addition, if its capacity utilisation increases, its earnings will also increase. Source: marketbeat

Amazon anticipates revenue for Q2 in the range of $127-$133 billion. Net sales are anticipated to increase 5%-10% from the amount reported for the same quarter last year. The Zacks Consensus Estimate of $131.54 billion for net sales increased by 8.5% from the amount reported for the same quarter last year. The Q2 Zacks Consensus Estimate for earnings is 34 cents per share, a considerable increase from the 10 cents recorded in the previous quarter.

Amazon’s profit margin was 46.77% in Q1 but analysts expect a margin of 46.53% in the second quarter, according to Refinitiv. Amazon is increasing the number of third-party sellers on its platform, which has helped retailers’ advertising businesses. Vendors can buy ad space in search results and use other tools to grab customers’ attention in a sea of products. Amazon’s Q1 operating income was $4.77 billion, a 74.4% increase from $2.74 billion in Q4 and a 30.1% increase from a year ago. Source:Reuters

Technical Review

#Amazon price, D1 is seen to have rallied over 68% from a low of 81.39 and has recorded an 11-month high of 136.64 in July, however since then it has retreated over -2% ahead of July’s close.

A report that falls short of expectations could lead prices to move to the downside, with the possibility of testing support around 120.63 and further down at 113.95 resistance which is the current support. This is not too much of a difference from the 200-day exponential moving average (red line). Meanwhile a surprise report could also provide support for the stock price going forward, to move higher to 146.54 resistance (Aug 22 peak or 61.8% FR level at 147.65 drawdown from 188.80 and 81.39 peaks.)

The RSI has moved away from the overbought level and back to 59, while the decline in momentum in recent days is reflected by the MACD divergence bias with the histogram tending to thin to the neutral line in the buy zone. Overall, the rise from 81.39 is still seen as a corrective wave from the 188.80 peak decline.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.