Much stronger than expected retail sales was the main headline and provided a brief spark to Treasury bears. The longer-term Treasury yields hit their highest level this year, i.e. 10-year US Treasury rose to 4.22%, its highest level since November 2022. There was also some offset from disappointing drops in the Empire State index and the NAHB housing index. The Fed’s Kashkari said he is not ready to say the Fed is done. Asian and European bourses lost ground on the worrisome growth outlook. China’s new home prices fell for the first time this year in July. The PBOC unexpectedly cut key policy rates for the second time in three months on Tuesday, while the RBNZ left the OCR unchanged at 5.50% as expected but signaled the risk of another possible hike to tame inflation. In Europe, stubbornly high UK core inflation strengthened bets of another rate hike from the BoE, while German ZEW confidence beat which supported the potential for additional ECB hikes which weighed on Europe bonds.

UK: CPI a tad higher than expected. More importantly core failed to decline slightly, as most had expected. Instead, the core number remained steady at 6.9%. Given that it is holiday season that will be particularly noticeable for many and could underpin inflation expectations, even if headline inflation dropped -0.4% m/m in July. A tricky situation for the BoE, but after yesterday’s higher than expected wage number, the higher-than-expected core reading in particular will likely fuel rate hike expectations further.

- FX – USDIndex hovered either side of 103.000. EURUSD steady below 1.0930, Cable jumped to 1.2738 from 1.2685.

- Stocks – Wall Street was mostly in the red but selling intensified into the close to leave the major indexes more deeply in the red with the US100 and US500 off -1.14% and -1.16%, respectively and the US30 off -1.02%. JPN225 fell 1.5%.

- Home Depot kicked off retail earnings week by beating estimates but warned of “continued pressure” on consumers, as the company said customers are pulling back on home-renovation projects.

- Intel Corp will drop its $5.4 billion deal to acquire Israeli contract chipmaker Tower Semiconductor Ltd once their contract expires later on Tuesday without regulatory approval from China.

- Most bank stocks fell Tuesday. Fitch told CNBC that the agency was considering lowering multiple bank ratings. The Bank of America fell the most, off 3.2%. M&T Bank was down 4.2%. Western Alliance and Comerica fell 4% and 4.5%, respectively.

- Commodities – USOil dropped to $80.06 as China jitters weigh on the demand outlook, which outweighed declining US stockpiles.

- Gold – is hovering at $1,900.

Today: US housing starts, building permits, and industrial production, Fed minutes and earnings from Target, TJX, Cisco Systems, Synopsys.

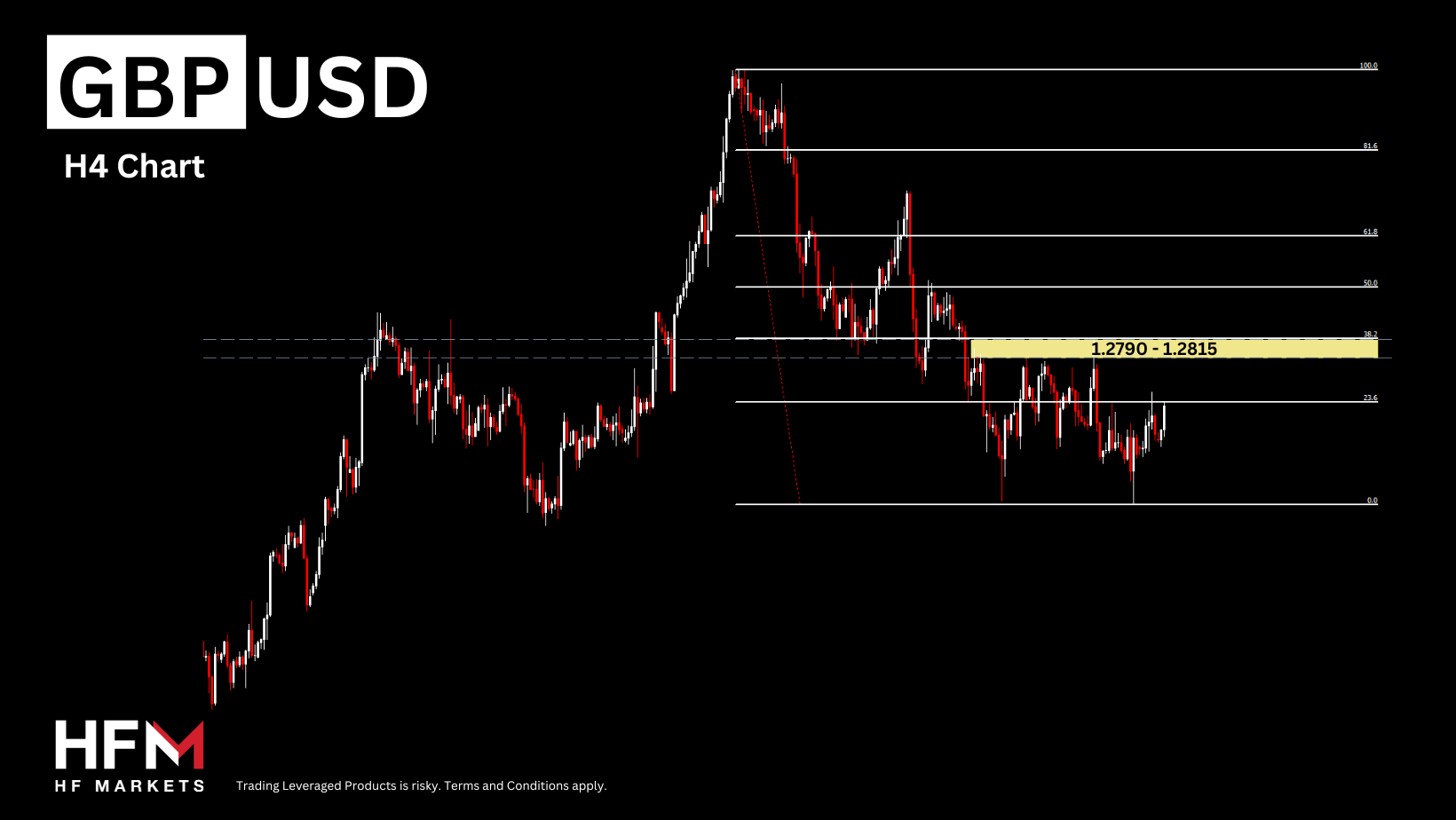

Biggest FX Mover: GBPUSD (+0.26%) spiked to 1.2736 post UK inflation data, with 1.2750 the next resistance level. A break would open the door to the 1.28 area.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.