Unveiling the layers of Johnson & Johnson’s journey, we delve into a tapestry woven with strategic prowess and an unwavering commitment to innovation.

Operating across Pharmaceuticals, Medical Devices, and Consumer Health, Johnson & Johnson’s trifold approach defines its impact. The Pharmaceuticals wing, contributing over 45% of revenue, offers a diverse array of treatments spanning immunology, oncology, neuroscience, and more. In parallel, Medical Devices caters to orthopaedics, surgery, and vision care, while Consumer Health embraces over-the-counter products, skincare essentials, oral care necessities, and more.

What elevates Johnson & Johnson’s products to prominence is their prowess in tackling pressing health issues. The company’s arsenal of innovative solutions effectively addresses global health challenges, a feat underlined by products like DARZALEX, STELARA, and TREMFYA, showcasing Johnson & Johnson’s far-reaching impact on health worldwide.

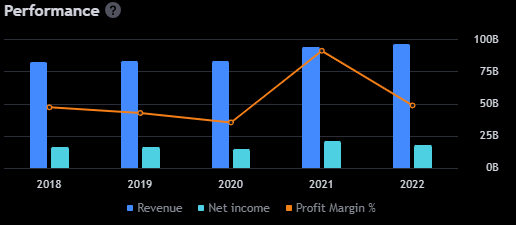

Capitalising on the pandemic’s turbulence, Johnson & Johnson’s 2021 financials showed a 13.6% revenue surge to $93.8 billion. This surge resonated into 2022, with an additional 1.3% growth to $95.02 billion. Over the last six quarters, average earnings per share settled at $2.60. These figures underscore the company’s financial resilience, bolstered by dividend growth, strategic acquisitions, and share repurchases.

Capitalising on the pandemic’s turbulence, Johnson & Johnson’s 2021 financials showed a 13.6% revenue surge to $93.8 billion. This surge resonated into 2022, with an additional 1.3% growth to $95.02 billion. Over the last six quarters, average earnings per share settled at $2.60. These figures underscore the company’s financial resilience, bolstered by dividend growth, strategic acquisitions, and share repurchases.

Looking to the future, Johnson & Johnson’s trajectory paints a picture of diversification and innovation. Anticipating the launch of over 10 new medicines and more than 25 line extensions by the close of 2023, innovation reverberates. The canvas of innovation extends to medical devices, which seek to address unmet needs in heart failure, diabetes, and beyond. Likewise, Consumer Health embraces dynamic evolution, aligning with ever-shifting trends.

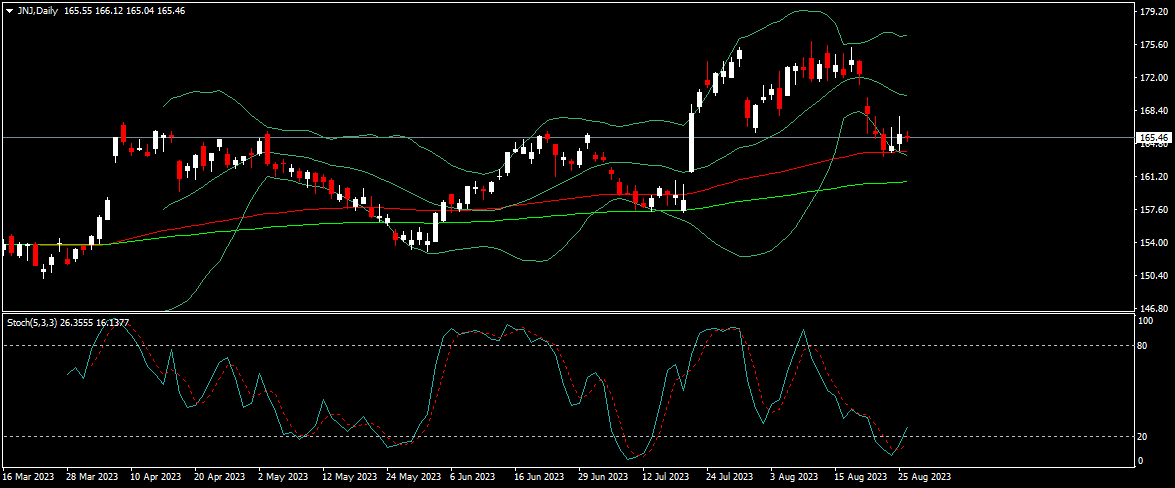

Zooming into the technical analysis, Johnson & Johnson’s stock appears to have found solid support on the 100-EMA, a crucial indicator. Further, the stock’s journey through the Bollinger Bands—breaking out and back in—adds to the intrigue. Finally, the stochastic indicator, casting an oversold signal on the daily timeframe, completes this trio of encouraging indicators. Collectively, these indicators pave the way for bullish sentiments, pointing toward a potential target at the opposite side of the Bollinger Bands, at $177.

Amid this consistency, Johnson & Johnson’s performance has consistently surpassed analysts’ predictions in the past four quarters. Particularly noteworthy is that, the previous quarter showcased an adjusted earnings per share of $2.80, outshining consensus expectations by a notable 7%.

As of August 25, 2023, Johnson & Johnson’s price-to-earnings ratio stands at 33.69—an index reflecting investor sentiment and growth prospects. Notably higher than the industry average, this figure offers a glimpse into potential overvaluation.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.