Better than expected Swedish GDP and retail sales figures yesterday helped the krona strengthen in yesterday’s trade against the US Dollar. The Swedish economy shrank by 0.8% in Q2, much less than the previously reported -1.5% preliminary figure and the consensus estimate of 1.3%. Surprisingly, retail sales increased in July by 1.0% m/m.

Earlier, Sweden recorded a trade surplus of SEK 4.6bn in July 2023, down from a deficit of 3.8bn in the same month a year earlier. Exports fell by 5% to SEK 145.2 billion, due to lower sales to EU (-1.6%) and non-EU countries (-8.5%). Imports fell much faster at 10% to SEK 140.6 billion, weighed down by a sharp decline in purchases from non-EU countries (-31.7%). On a seasonally adjusted basis, the trade surplus widened to SEK 1.0 billion in July from SEK 0.2 billion in June. Considering the January-July period, the country recorded a surplus of SEK 25.9 billion, compared with a deficit of SEK 6.9 billion in the same period last year, as exports grew by 6 per cent and imports increased by 3 per cent.

When compared to other major countries, Sweden’s growth situation is clearly still concerning, but the krona has already taken into account a significant amount of weakness in the domestic economy as well as uncertainties related to real estate.

Other important data releases this week in Sweden include the release of salary data, economic trend polls and some manufacturing surveys later in the week. Of note is that Anna Breman, Riksbank member and one of the dovish dissenters at the April meeting, will take part in a panel discussion on inflation.

The EURSEK pair may face upward pressure from the euro side, if core inflation data strengthens, increasing the chances of an ECB rate hike in September. Otherwise, slightly improved external conditions and better-than-expected Swedish data could help EURSEK trade slightly down from its current highs.

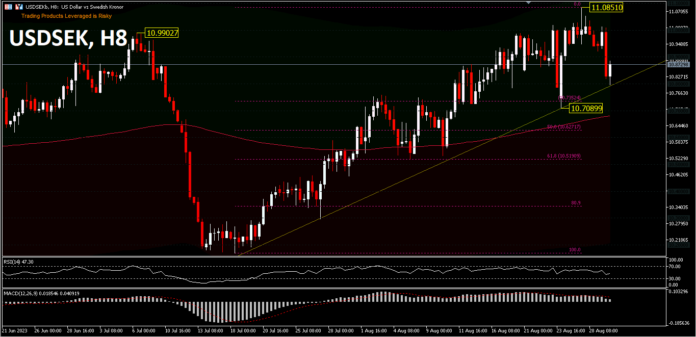

Meanwhile the USDSEK pair still maintains a positive trend bias, despite the previous 2 days of declines. In Asian session trading, the pair is seen gaining +0.5% at the time of writing. Price is still moving above the EMA200, but intraday momentum is neutral. An upside movement could retest the recent high of 11.0851, as long as the price still trades above the 10.7089 support. The weakening momentum of the intraday rally is evident from the validation of the RSI at 47 levels and the divergence in the MACD. A drop below the 10.7089 support would confirm the 11.0851 interim top, and the price could test the 50% [10.6271] and 61.8% [10.5190] retracement levels.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.