“September is the worst month of the year for Equities, period; median return for 500 since 1928 is -1.56% “. This was the warning from the Goldman Sachs research department a few days ago after a difficult month for stock indices. To be fair, the sentiment has improved quite a lot since this note was released and the US500, for example, has risen 3.75% in the last four sessions. It is now down only 1.61% in August, while the US100 is down 1.87% and the US30 is down 1.88%, far from last week’s lows. But our focus is on September.

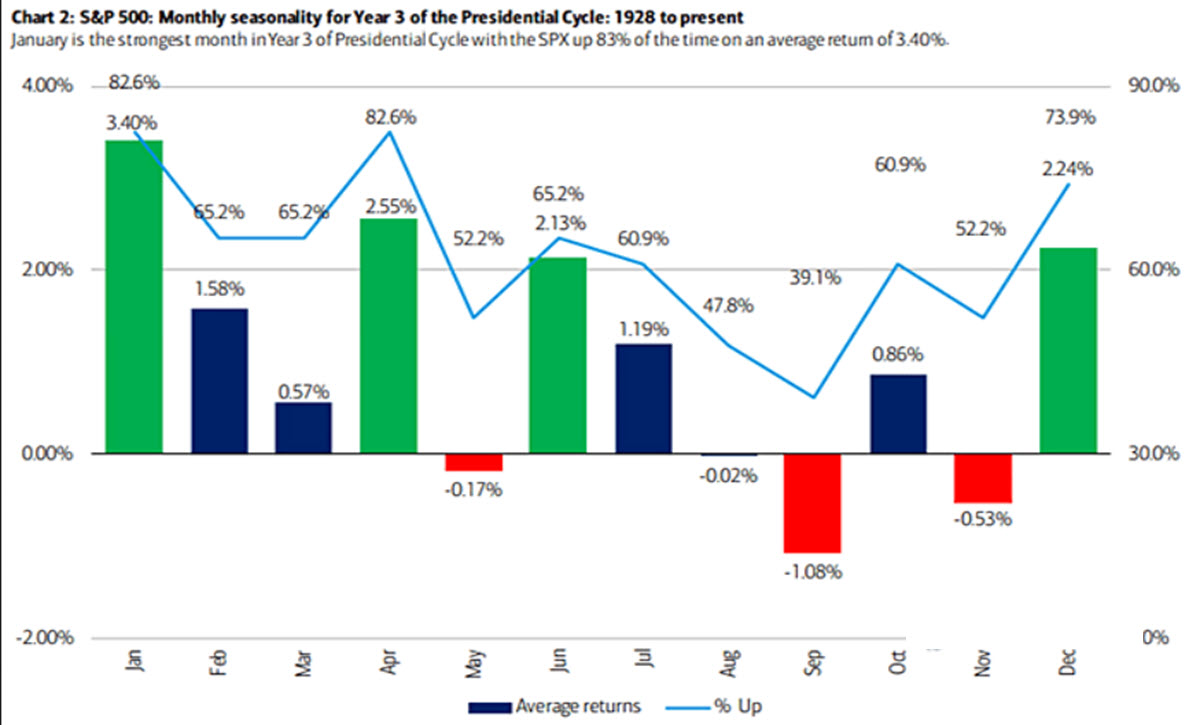

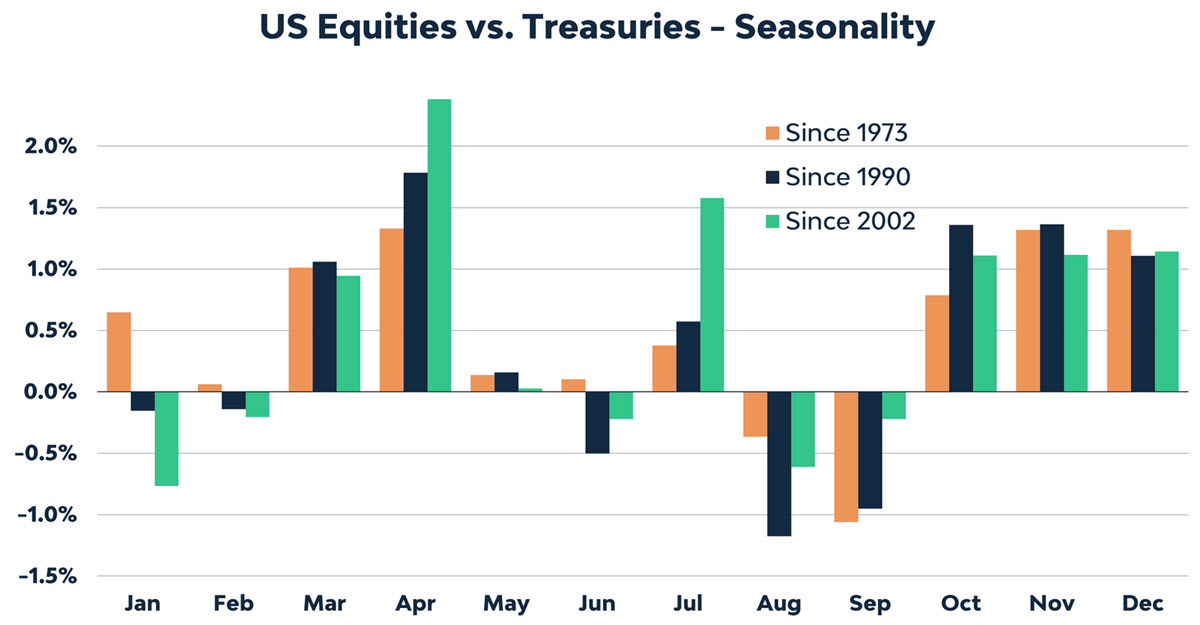

In this regard we found the above interesting study by BOFA ML, which groups the returns of the US500 by month in the 3rd year of a US presidential term, which we are in now with elections coming up next year. As you can see September is definitely the worst performing month with an average return of -1.08% since 1950, and in general – excluding December, the month of the Santa Claus rally – we are not expecting to a particularly cheerful period ahead with November as a negative month. 61% of the time there has been a negative result on the month. More generally, as shown in the chart below, equities suffer when compared to fixed income, bonds – as discussed in our post yesterday – and have a relatively negative performance in both August and September.

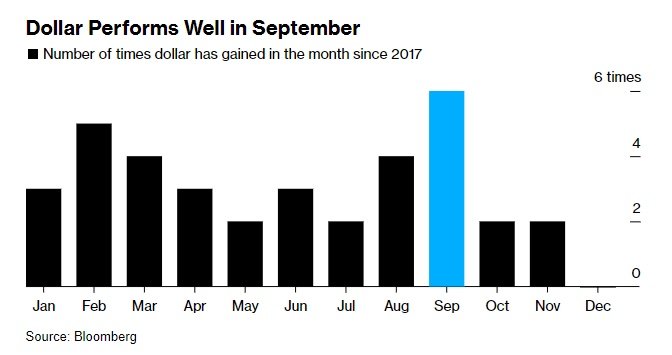

But it is not all bad news, if knowing and understanding data – be it good or bad – can be considered bad news. In fact, in recent years, at least for the USD, September has been a positive month with 6 out of 6 bargains since 2017 ending the month positively with an average gain of 1.2%, according to data provided by Bloomberg. And it all adds up, broadly speaking: race to the safe haven – selling risky assets.

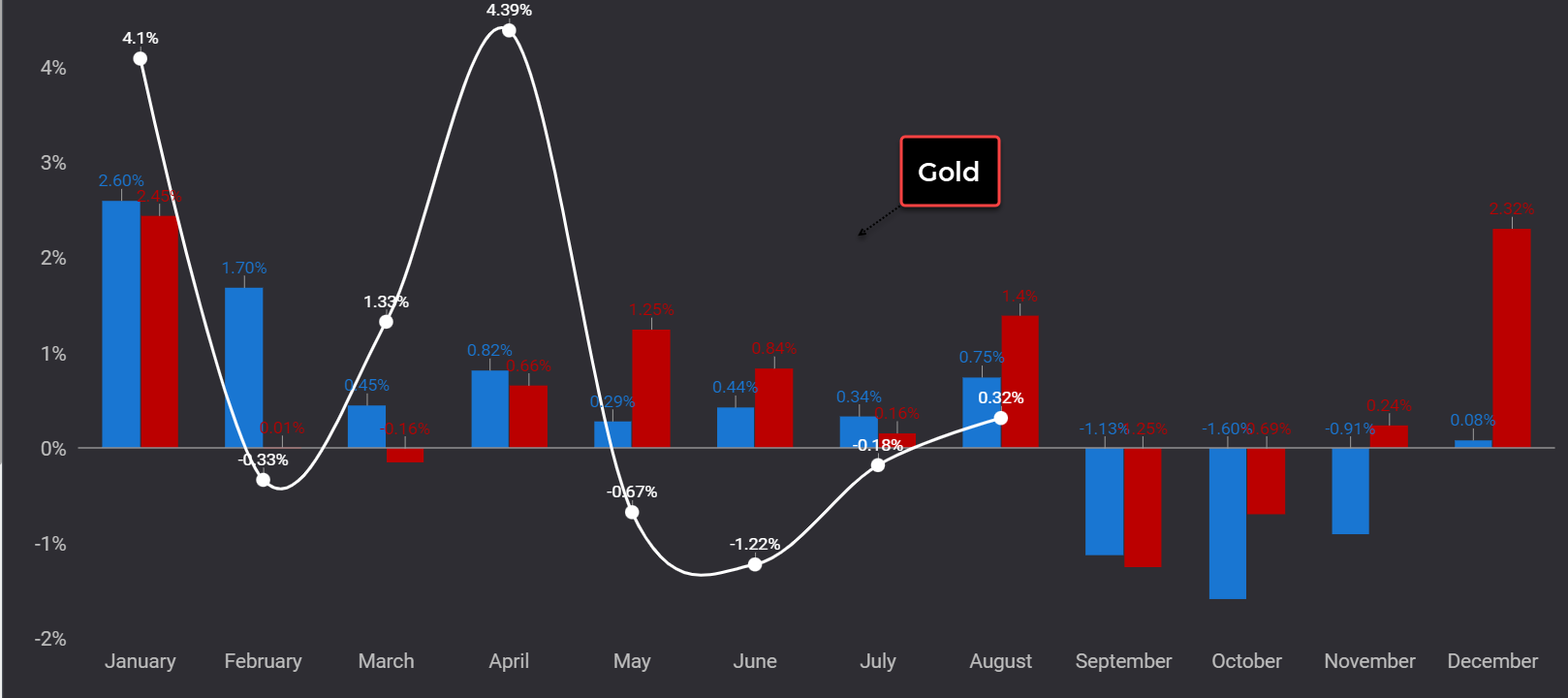

For Gold too the coming months are statistically difficult, at least as far as the last 5 years (blue bars) and the last 10 years (red bars) are concerned. Respectively, as you can see in this in-house study, the average return in September was -1.13% and -1.25% respectively. The white line represents the current performance.

However, whether historical trends are respected or not, the most important thing is to arrive prepared when making your investment decisions.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.