The world’s largest investment firm currently tasked with managing bitcoin holdings, Grayscale, has just won an appeal against the United States Securities and Exchange Commission (SEC), the highlight of an otherwise so far quiet start to the week. All the judges agreed that the regulator’s refusal to allow Bitcoin trust funds to become spot ETFs was “arbitrary and capricious.” The court unexpectedly issued the conclusive ruling on Tuesday, 29 August, after the legal dispute that lasted for more than a year. This caused Bitcoin to surge from $26,060 to $28,122 within three hours, an increase of 7.9% and the largest growth rate in the last 12 months.

Nevertheless, the market is optimistic that the recent court decision will still have a favourable impact on the market. Of note, eight major financial institutions have filed SEC applications to enter the cryptocurrency market through spot Bitcoin ETFs this summer. Global fund companies including BlackRock, Invesco, and Fidelity are among them. Concerns have been raised due to the SEC’s previous rejection of all similar applications. However, after the decision of the Grayscale case, things have changed.

Eric Balchunas, senior strategist at Bloomberg, has increased his projection of the likelihood of ETF certification in 2024 to 95% and the likelihood of ETF certification occurring this year, 2023, to 75%. According to various projections, the new fund may generate $5bn to $10bn of institutional investment in the first six months alone, thus likely increasing its quotations. Tom Lee, co-founder of Fundstrat, estimates that the price of Bitcoin could reach $185k, if the spot Bitcoin ETF is approved. On the other hand, Cathy Wood, CEO of ARK Invest, forecasts an increase in the overall cryptocurrency market value to $25 trillion by 2030, an increase of more than 2100%.

Meanwhile, ChatGPT Artificial Intelligence developed by OpenAI have proposed their own optimistic scenario. They expect major cryptocurrencies to grow to $150,000 by 2024, $500,000 by 2028, $1 million by 2032, and $5 million by 2050. However, this growth can only be realised if cryptocurrencies are widely adopted, bitcoin becomes a popular store of value, and coins are integrated into various financial systems. If these conditions are not met, according to AI’s calculations, by 2050 the value of the coin could range from $20,000 to $500,000.

Overall, even the latest data is encouraging for long-term BTC investors, whose numbers continue to rise. This number has just reached a record high, according to research from Glassnode, demonstrating the appeal of the idea of HODLing, the presence of optimism, and potential resilience to market changes.

Nevertheless, despite the aforementioned perspectives, long-term investments made with the “buy on the dip” technique may still perform well in September. Mike McGlone, a senior analyst at Bloomberg, matched the parameters of the first cryptocurrency with those of the stock market and came to the conclusion that a drop to $10,000 would not have a significant impact on the coin’s holdings. The expert used the shares of the giant company Amazon, which has made gains of more than 7,000% over the past 20 years, as an illustration. However, BTC has increased by almost 26,000% since 2011, far surpassing this statistic. According to McGlone, “Even a return to the $10,000 mark would sustain the asset’s unprecedented performance.” He underlined that as exchange-traded funds and other products that resemble traditional markets emerge, the direction of bitcoin’s “mainstream migration” is equally important.

The imminent halving may impact the coin’s growth in addition to the approval on spot bitcoin ETFs. These elements may cause BTCUSD to reach the $50,000 level by the end of this year. In Monday’s trading, the price of BTC was trading around $25,700. The current total cryptocurrency market value is $1.048 trillion (up from $1.047 trillion one week ago). The Crypto Fear & Greed Index is still in the Fear category.

Technical Analysis

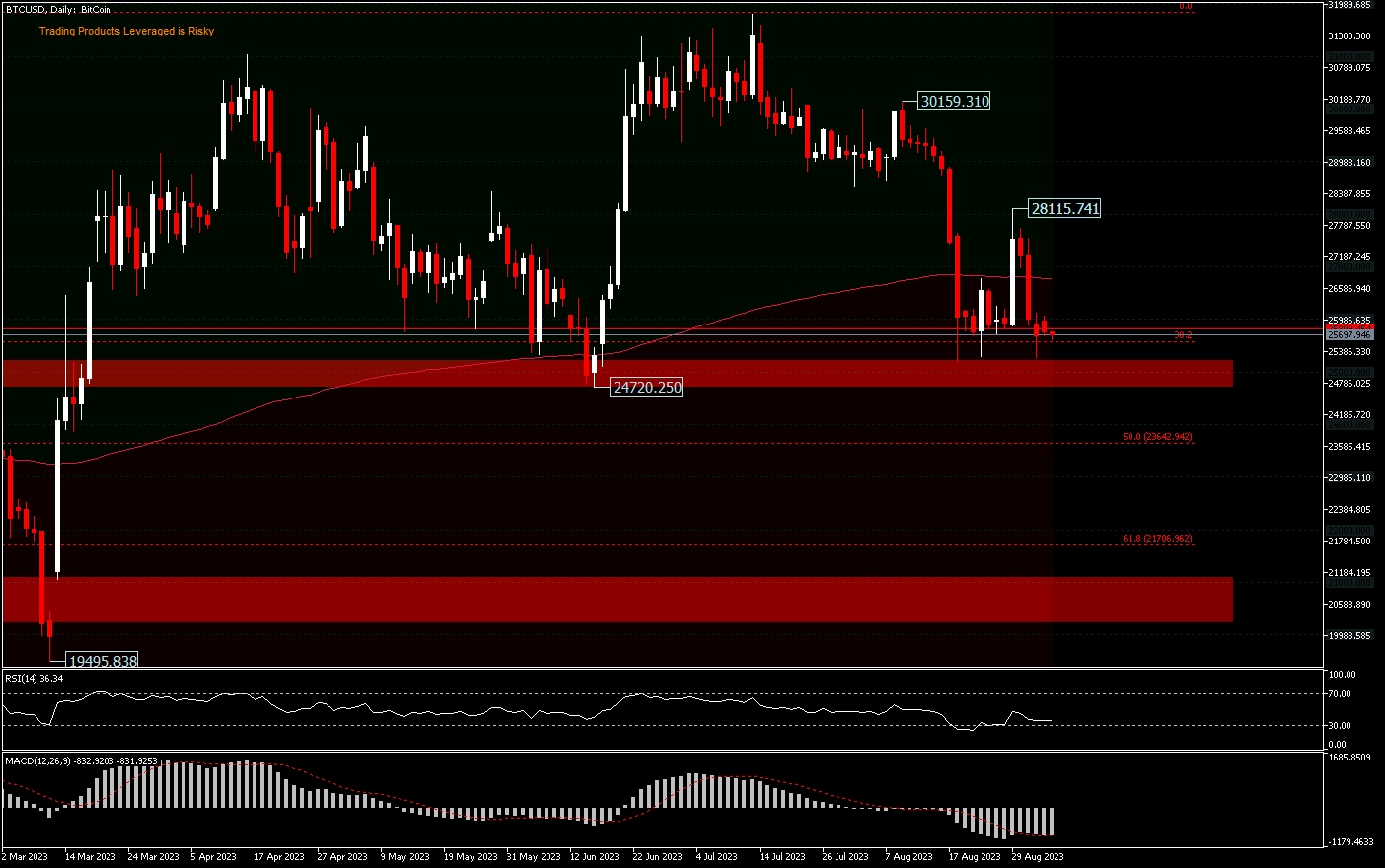

BTCUSD, D1 – Important support is seen at the $24,720 support zone and the $25,000 round figure. A break of $24,720 could signal continued risk asset aversion, which will send BTCUSD to test the 50.0% FR and 61.8% FR support levels $23,642 and $21,705. As long as the $24,720 support holds, further rebounds could test $28,115 and the $30,000 round-figure level.

The daily technical indicators are still validating the recent decline, with the RSI levelling above the oversold level and the MACD still in the sell area. The direction will be determined, whether the price is able to break the $24,720 support or instead bounces to the upside.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.