The DAX index, a European financial staple, tracks 40 prominent companies on the Frankfurt Stock Exchange. These aren’t your average firms; they’re the cream of the crop, representing the European business elite. Calculated meticulously using the free-float market capitalization method, the DAX is a barometer of these industry giants, influencing the pulse of European markets.

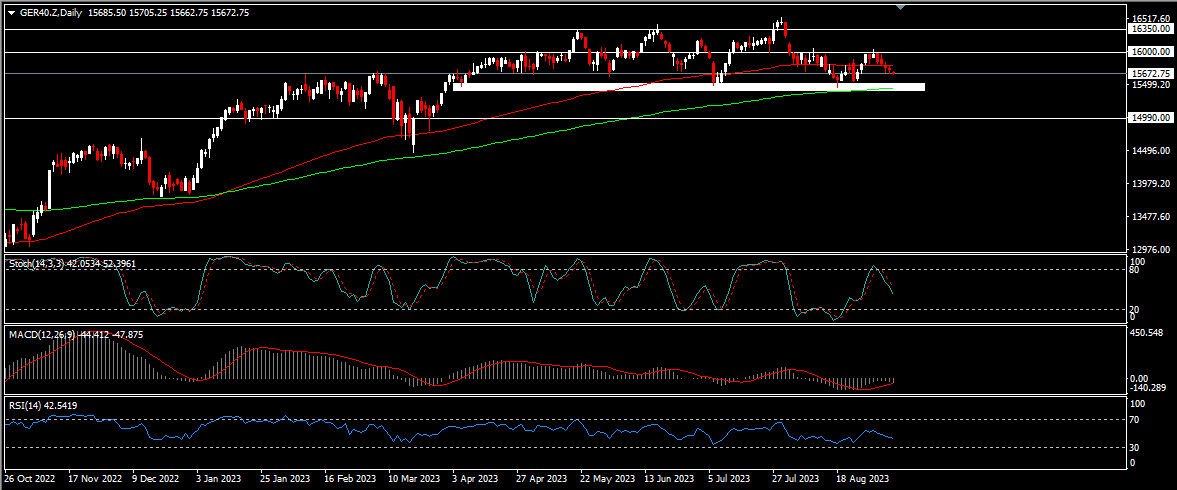

As of September 6, 2023, the DAX index sits at 15,678, bearing the weight of European economic expectations. Its journey since April 2023 has been intriguing. After touching a low point at 15,445, it embarked on a 3.9% ascent, overcoming resistance levels and navigating the complexities of moving averages. Now, it stands at a critical juncture, nearing the 15,500 support level tested in August and July 2023. Will it hold, opening doors to further gains, or will it break, leading to a descent toward 14,990? The 16,000 level and the moving averages await, ready to guide its path.

Examining the technical indicators, we find mostly bearish signals. The MACD lingers below the zero line, signalling negative momentum. The RSI remains below the 50 level, reflecting bearish pressure. Yet, amidst this, a spark of intrigue – the Stochastic indicator flirts with the overbought territory, hinting at a potential reversal or pause.

Fundamentally, the DAX index is influenced by various factors. The performance of Germany, the economic powerhouse of Europe, plays a significant role. Challenges and uncertainties abound, with a negative 0.1% GDP growth rate in June 2023, lower than expected, and a 5.6% unemployment rate in August. Inflation raises eyebrows too, sitting at 6.1% in August.

Fundamentally, the DAX index is influenced by various factors. The performance of Germany, the economic powerhouse of Europe, plays a significant role. Challenges and uncertainties abound, with a negative 0.1% GDP growth rate in June 2023, lower than expected, and a 5.6% unemployment rate in August. Inflation raises eyebrows too, sitting at 6.1% in August.

However, the DAX index’s fate extends beyond Germany, intertwining with global giants like China and the United States. The decisions of the European Central Bank (ECB) and the Federal Reserve (Fed) ripple through its movements. Political stability and fiscal stimulus in Germany and Europe contribute to its story. The shifting sands of global risk sentiment also leave their mark.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.