The USDZAR pair is perched near the 19.00 level, awaiting the South African CPI (Inflation) Report due on Wednesday, 20 September 2023, at 08:00 GMT. This report, a compass in the realm of economics, promises to unveil the intricate tapestry of inflation’s past, present, and future and how it casts its shadow over consumer welfare, economic activity, monetary policy, and market movements.

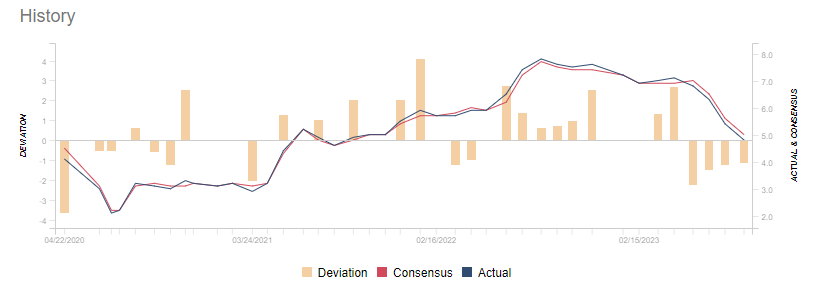

According to consensus forecasts from analysts surveyed, we anticipate the annual inflation rate to remain at 4.8% in August. Concurrently, the monthly inflation rate is projected to ease to 0.4% in August, down from 0.9% in July. There are various factors affecting this outlook, including fuel prices, food costs, the rand exchange rate, and supply chain disruptions.

According to consensus forecasts from analysts surveyed, we anticipate the annual inflation rate to remain at 4.8% in August. Concurrently, the monthly inflation rate is projected to ease to 0.4% in August, down from 0.9% in July. There are various factors affecting this outlook, including fuel prices, food costs, the rand exchange rate, and supply chain disruptions.

The impending inflation data is crucial for the USDZAR pair as it influences the South African Reserve Bank (SARB). The SARB’s primary goal is to keep inflation within the target range of 3% to 6%. During its July 2023 meeting, the SARB maintained its key repo rate at a 14-year high of 8.25%, signalling a pause in its tightening cycle after 10 consecutive rate hikes. The SARB has hinted that it will only raise its interest rate if it sees sustained progress toward its inflation target.

The impending inflation data is crucial for the USDZAR pair as it influences the South African Reserve Bank (SARB). The SARB’s primary goal is to keep inflation within the target range of 3% to 6%. During its July 2023 meeting, the SARB maintained its key repo rate at a 14-year high of 8.25%, signalling a pause in its tightening cycle after 10 consecutive rate hikes. The SARB has hinted that it will only raise its interest rate if it sees sustained progress toward its inflation target.

Should the inflation data align with or fall below expectations, it could signal lower living costs and increased purchasing power for consumers. This could stimulate consumer spending, bolster economic growth, and relieve pressure on the SARB to raise interest rates, benefiting the bond market and lowering borrowing costs. However, a weaker Rand may result, potentially reducing foreign investor interest in South African assets and raising future import costs and inflation.

In contrast, if the inflation data exceeds expectations, it may lead to higher living costs and reduced consumer purchasing power. This could dampen consumer spending and economic growth, increasing the pressure on the SARB to raise interest rates, impacting the bond market and borrowing costs. On the positive side, a stronger Rand may attract foreign investors and reduce future import costs and inflationary pressures.

In the coming days, the USDZAR pair is likely to experience volatility as investors react to the inflation data’s implications for the South African economy and financial markets. The pair’s movements will also be influenced by factors such as US economic data, the Federal Reserve’s policies, global sentiment, and technical levels.

Currently, the pair is trading above the 50-day, 100-day, and 200-day moving averages, suggesting a bullish trend. Resistance lies ahead at the 19.13 to 19.23 zone and the psychological level of 19.00. A breach of these levels could propel the pair towards 19.50 to 19.80. Conversely, a drop below 18.80 may open the door to further losses towards 18.60.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.