BoE and SNB left interest rates on hold, against expectations for additional tightening in both the UK and Switzerland. Both central banks maintained a tightening bias, but the BoE in particular is now expected to peak much earlier than thought just a couple of months ago.

Norges Bank and Riksbank Stay the Course

Both Norges Bank and Riksbank took the expected path by raising interest rates by 25 basis points. These central banks indicated that further rate increases might be necessary to combat rising inflation.

The banks’ decisions were driven by their commitment to keeping inflation in check, citing persistently high wage growth and services inflation as primary concerns. They acknowledged signs of weakening economic activity but pointed to a tight labor market and the possibility of a rise in the medium-term equilibrium rate of unemployment.

Bank of England and Swiss National Bank: Maintained a tightening bias

In contrast, the SNB and BoE kept the door to further tightening wide open. However, SNB in the central scenario is likely to maintain current policy settings for the foreseeable future. The next policy review is only due in December, and by then the outlook should be clearer, not just for growth across Europe, but for the US and China as well. CHF sold off, and if this is maintained it won’t help the central bank, especially if oil prices pick up again.

The BoE’s decision came as no surprise following a weaker-than-expected monthly GDP report for July and an unexpected decline in headline inflation for August. Despite ongoing inflation overshoot and persistently high food prices, the BoE opted to maintain its current policy settings, marking the first pause after 14 consecutive rate hikes since December 2021. This decision leaves the Bank Rate at 5.25%.

However, in the end 5 MPC members, including Governor Bailey and chief economist Pill, argued in favor of maintaining current policy settings, while 4 opted for another rate hike.

BoE Governor Bailey emphasized that “inflation has fallen a lot in recent months, and we think it will continue to do so,” but he cautioned against complacency. He stated that further tightening in monetary policy would be necessary if there were signs of more persistent inflationary pressures. This suggests that UK rates may have already peaked unless inflation unexpectedly surges again.

Markets had been expecting a firmer commitment to another hike in the case of a pause, so the BoE was altogether more dovish than economists and markets had been expecting. The MPC did vote in favor of speeding up the pace of its quantitative tightening program, from GBP 80 bln in 2022-23 to GBP 100 bln in 2023-24, although the BoE stressed that interest rates remain the main policy tool, while suggesting that the effect of asset sales on borrowing costs was likely to be “modest”.

The minutes to the meeting showed that the minority arguing in favor of another 25 basis point hike admitted that there are now some signs of weakening economic activity, but flagged that “the labour market was still relatively tight, consistent with a possible rise in the medium-term equilibrium rate of unemployment”. They also pointed to persistently high wage growth and services inflation.

Still, all MPC members seem to agree that there are now signs that the monetary policy stance is increasingly weighing on economic activity. This, coupled with signs that confidence in future growth is eroding, seems to have been the main reason for the surprisingly dovish message from the BoE. The “higher for longer” message remains firmly in place.

Market Reactions

Gilts didn’t benefit from the BoE decision, and the 10-year rate rebounded from the 2-month low of 4.2% seen in the wake of the weaker than expected inflation print. Sterling sold off, which will not make the BoE’s task any easier, as it boosts the risks of imported inflation. UK100, meanwhile, broke its 9-month triangle higher, extending to 7800 territory, raising questions for a possible return above 8000.

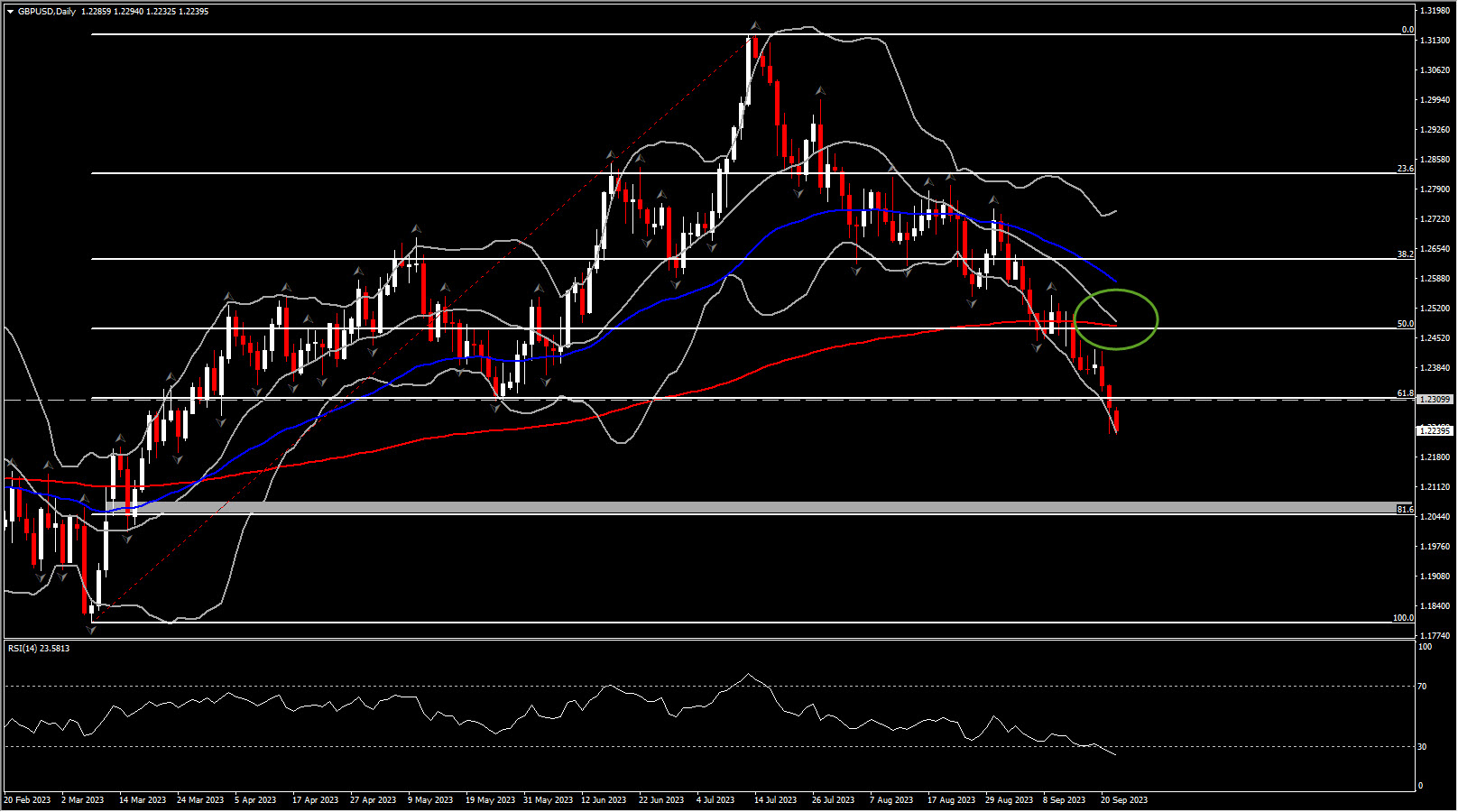

Cable has dropped more than 1% over the week, on the BoE’s dovish turn. Today’s worrying PMI report (Composite PMI dropped to a 32-month low) goes some way to explaining the central bank’s decision to signal that rates may have peaked. Bets on additional hikes have been scaled back sharply and we agree that if growth data doesn’t improve, the chances are that UK rates have peaked already.

Cable drifted to a low of 1.2240 around the lowest level in 5 months. Wider strength in the USD, the dovish surprise from the BoE and weak growth numbers out of the UK have been keeping a lid on the currency. Cable is likely to remain capped as confidence in a soft landing in the US strengthens. Hence attention turns to the 1.21 and 1.20 area.

As we move forward, all eyes will be on growth indicators in the coming weeks, and the BoE’s updated forecasts in its next monetary policy report in November will provide a clearer picture of the rate outlook. The central banks’ actions, while seemingly divergent, all underscore the complexity and unpredictability of global economic landscape.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.