The US banking groups JPMorgan Chase, Citigroup and Wells Fargo are set to report their third quarter 2023 earnings before the market opens this Friday (13 October).

S&P 500 and Dow Jones US Bank Index performance. Source: SPGlobal

For 2023, the year-to-date performance of the S&P 500 remains above 10%, in contrast to the Dow Jones US Bank Index, which is down nearly -15%. The latter’s decline has been significant, falling below 100 following multiple local bank failures. The index touched a year-to-date low of 81.71 in early May, then rose at a moderate pace throughout July (but remained below the 100 threshold) before falling again.

JPMorgan Chase

JPMorgan Chase is the world’s largest bank by market capitalisation (over $416bn). It offers a range of financial and investment banking services and products across all capital markets, including advising on corporate strategy and structure, equity and debt market financing, risk management, market making in cash securities and derivatives, broker-dealer and research work.

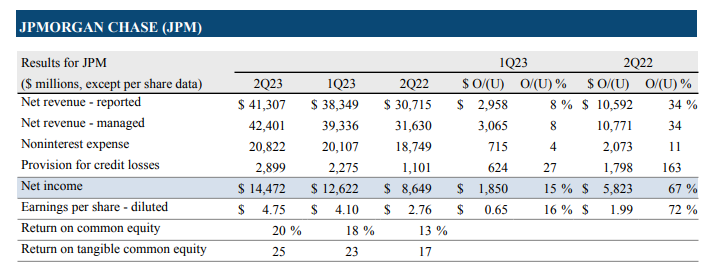

JPMorgan Chase: financial measures. Source: Earnings Press Release

In the second quarter of 2023, JPMorgan Chase achieved net income of $41.3 billion, up 7.7% sequentially and over 34% year-over-year. Excluding First Republic acquisitions, net income was $42.4 billion. Net income was $14.5 billion, up more than 14% from the previous quarter and more than 67% from the same period last year.

By business segment, Consumer and Community Banking was the largest contributor to Bank revenues ($17.2 billion, driven by higher net interest income), followed by Corporate and Investment Banking ($12.5 billion), Asset and Wealth Management ($4.9 billion, driven by lower balances and higher deposit margins, strong net inflows and higher management fees), Commercial Banking ($4.0 billion, driven by higher deposit margins, partially offset by lower deposit-related fees), and finally Corporate Banking ($3.7 billion).

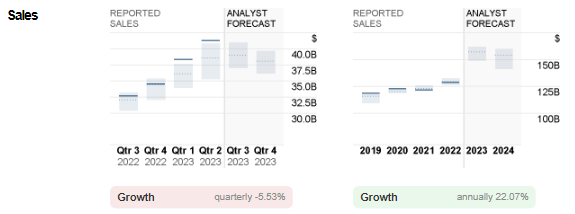

JPMorgan Chase: reported sales vs. analyst forecasts. Source: CNN Business

JPMorgan Chase: reported sales vs. analyst forecasts. Source: CNN Business

For the first half of 2023, JPMorgan Chase reported sales of nearly $80 billion, or more than 60% of total 2022 revenues. The prevailing forecast for JPMorgan Chase sales in the upcoming announcement is $39 billion. Overall, the bank’s sales outlook for 2023 remains positive (which could be due to trading volume, investment banking fees, net interest margin, mortgage banking revenue – and perhaps AI?), and analysts expect the bank’s gross sales to grow revenues in the range of $149.3 billion to $162 billion. Last year it was $128.7 billion.

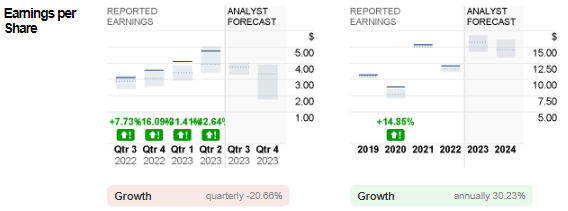

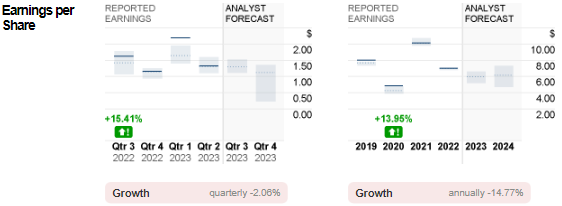

JPMorgan Chase earnings per share: report and analysts’ forecasts. Source: CNN Business

JPMorgan Chase earnings per share: report and analysts’ forecasts. Source: CNN Business

Earnings per share are expected to come in at $3.77, down more than -20% from the previous quarter. It was $3.12 in the third quarter of last year.

Citigroup

Citigroup, formed in 1998 by the merger of banking giant Citicorp and financial conglomerate Travelers Group, has a market capitalisation of more than $76 billion. Its operations include Global Consumer Banking (traditional banking services for retail customers), Institutional Clients Group (fixed income and equity research, sales and trading, foreign exchange, prime brokerage, derivatives services, investment banking and advisory services, private banking, trade finance, and securities services), and Corporate and Other (which includes unallocated global employee function costs, other corporate expenses, and unallocated global operating and technology costs).

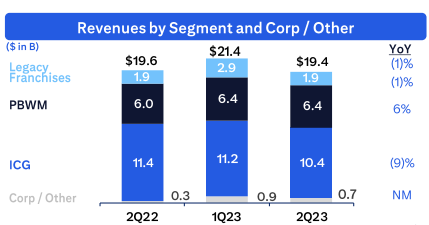

Citigroup: revenue by segment. Source: Earnings Presentation

Citigroup: revenue by segment. Source: Earnings Presentation

In Q2 2023, Citigroup’s sales revenue was $19.4 billion, down -9% sequentially and -1% year-over-year. In Personal Banking and Wealth Management (PBWM), US Personal Banking showed growth, which was subsequently offset by a decline in Global Wealth Management. Additionally, in the Institutional Client Group (ICG), Services saw growth, which was offset by declines in Markets and Investment Banking. In Traditional Franchising, revenues from exits and closures declined. However, the losses were partially offset by higher corporate/other income.

In addition, net income declined -36% year-on-year to $2.9 billion as a result of higher fees and credit costs and lower revenues. This also resulted in diluted earnings per share declining -39% year-over-year to $1.33.

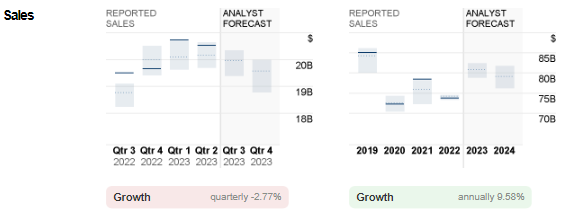

Citigroup Sales: report and analyst forecasts. Source: CNN Business

Citigroup Sales: report and analyst forecasts. Source: CNN Business

The bank’s management team expects revenues to continue to gain momentum, driven by US and non-US interest rates, continued credit card growth (fuelled by a rebound in product investment and consumer borrowing), and fee growth (more new clients coming on board as well as deepening of existing relationships). On the other hand, analysts expect Citigroup to report sales of $19.3 billion in the next quarter, slightly lower than the $19.4 billion reported in the previous quarter. 18.5 billion was reported in the third quarter of 2022.

Citigroup earnings per share: report and analysts’ forecasts. Source: CNN Business

Citigroup earnings per share: report and analysts’ forecasts. Source: CNN Business

Earnings per share for the third quarter of 2023 are expected to remain unchanged at $1.30. In the same quarter last year, the bank reported earnings per share of $1.63.

Wells Fargo & Co.

Wells Fargo & Company is a diversified, community-based financial services company that also offers banking, investments, insurance, mortgage products and services, and consumer and commercial finance. The bank is ranked fifth by market capitalisation (over $142 billion).

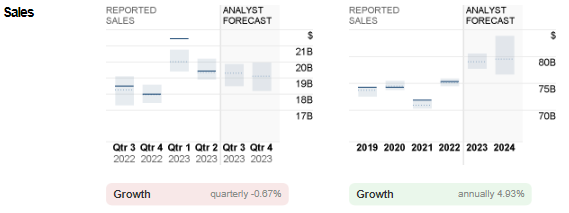

Wells Fargo sales: report and analysts’ forecasts. Source: CNN Business

Wells Fargo sales: report and analysts’ forecasts. Source: CNN Business

Wells Fargo reported sales revenue of $20.5 billion for the last quarter, up more than 20% from the same period last year. Net income was also up more than 57% year-over-year to $4.9 billion. Notably, its net interest income (NII) soared 29% to $13.16 billion as the bank increased its interest payments following the central bank’s rate hike, while expenses remained under control. Management revised its NII forecast for the year to over $51bn (from $45bn previously).

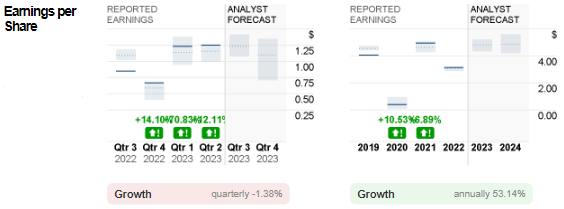

Wells Fargo earnings per share: report and analyst forecasts. Source: CNN Business

Wells Fargo earnings per share: report and analyst forecasts. Source: CNN Business

Earnings per share were $1.25 last quarter. In the third quarter of 2023, it is expected to fall to $1.23.

Nonetheless, management also expressed concern over the backdrop of growing worries about the health of the economy. Rising funding costs and slowing demand could spell increasing trouble for banks. In addition, the ongoing multi-year issue of the false account scandal, which has resulted in the bank still operating under an asset cap until regulators deem the issue resolved, is hampering its growth.

In the upcoming announcement, analysts are forecasting Wells Fargo’s sales revenue to fall -$500 million from the previous quarter to $20 billion. Q3 2022 was $19.5 billion.

Technical Analysis

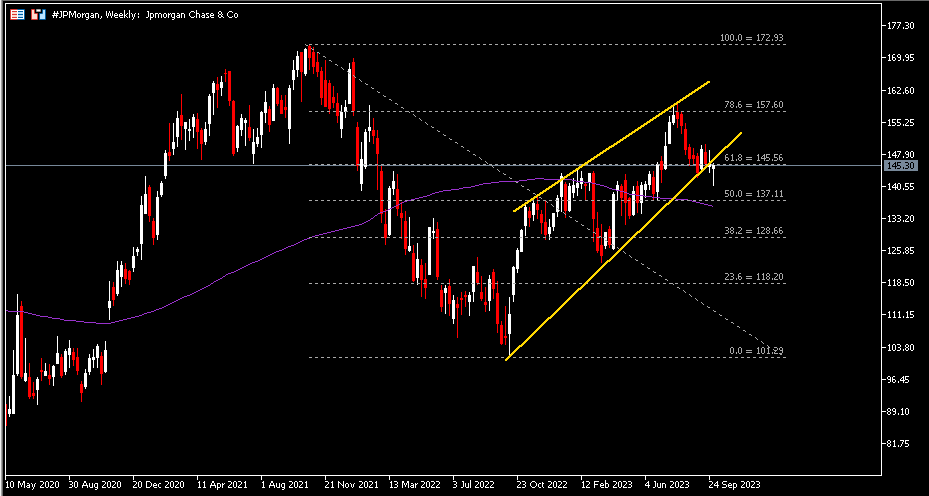

#Jpmorgan Chase shares experienced a strong sell-off from October 2021 to September 2022. It regained support above $101 in October 2022 and has been trading within a rising wedge pattern ever since. The bank’s shares last closed below the previous low of $146 (or 61.8% FR) and the lower line of the wedge. These two points act as solid resistance. As long as this horizontal defence is not broken, further declines towards $137 (FR 50.0%), close to the 100-week moving average, followed by $129 (FR 38.2%) are possible. On the other hand, a close above the resistance level could indicate a false breakout of the wedge structure, with $158 (FR 78.6%) being the nearest resistance level to watch.

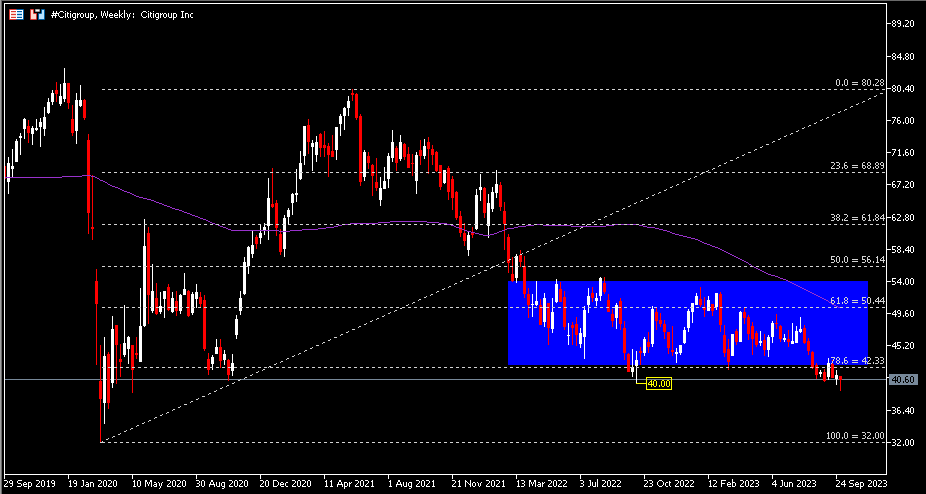

#Citigroup shares began a sell-off pattern at the end of H1 2021 and fell below the 100-week moving average in February 2022 (for the second time in two years). Since then, the asset has generally traded below $56 (FR 50.0%) and the dynamic moving average, indicating a strong bearish trend. The recent close below $42 (FR 78.6%) was a new low since May 2020. Positive earnings results could lead to another challenge to the $42 resistance level. Conversely, if the market reads pessimistic, a bearish continuation is likely, with $32 as the next support level.

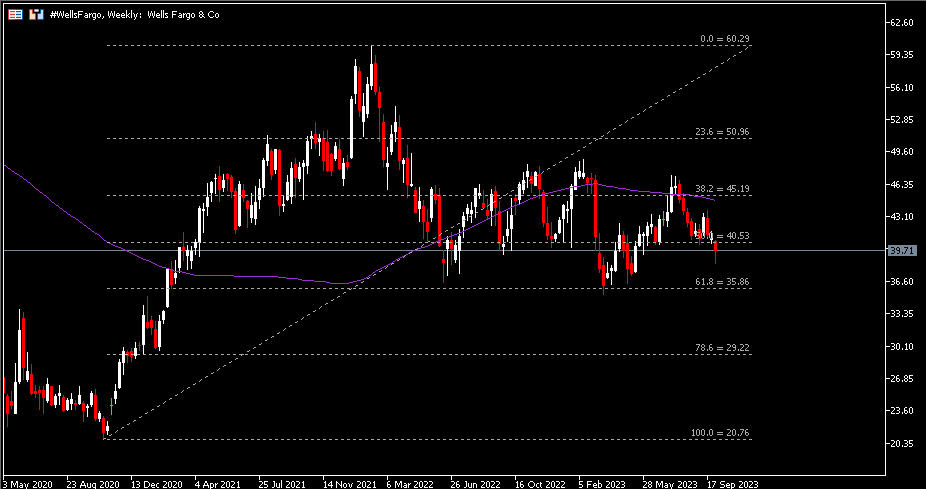

Finally, #Wells Fargo shares ended the day below the FR 50.0% ($40.50) and the 100-week moving average (which intersects the FR 38.2% at $45). Recent price action suggests that the shorts appear to be outpacing the longs. Continued selling pressure could lead the bank’s shares to test the next support level at $35.90 (FR 61.8%) and the year-to-date low at $35.25, followed by a secondary support zone at $33.40 to $34.19.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.