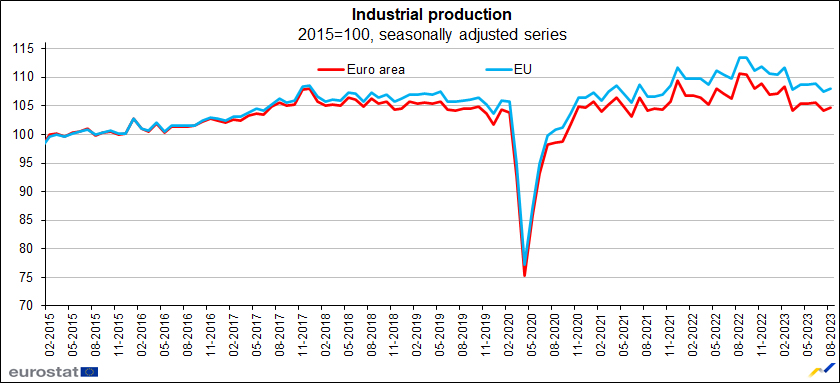

EURUSD on Friday’s trading day [13/10] was down -0.17%. Dollar strength weighed on the Euro. Additionally, comments from ECB President Lagarde on Friday weakened EURUSD, as she signalled additional ECB rate hikes may be on hold. She said that, “We are seeing an unprecedented tightening of financing conditions and the ECB will gauge the impact of previous rate hikes which are still having an impact on the financial system.” The euro’s decline was limited after Eurozone industrial production in August rose more than forecast.

Eurozone industrial production in August rose +0.6% m/m, stronger than expectations of +0.2% m/m and the largest increase in 4 months. Production of durable consumer goods grew by 1.2% m/m, non-durable consumer goods by 0.5% m/m and capital goods by 0.3% m/m, while production of intermediate goods fell by -0.3% m/m and energy rose by 0.9% m/m.

EU industrial production rose by 0.6% m/m. Among the Member States for which data is available, the highest monthly increases were in Ireland (+6.1%), Slovakia (+4.5%) and Lithuania (+3.7%). The largest declines occurred in Hungary (-2.4%), Croatia (-2.2%) and Belgium (-1.8%).

Christine Lagarde is back in the spotlight with her appearance over the weekend likely to attract interest. Nonetheless, there are doubts as to how much we can learn at this point, as we have heard a lot from the ECB President recently. Additionally, the final reading of HICP inflation will be of interest although revisions are common and often small.

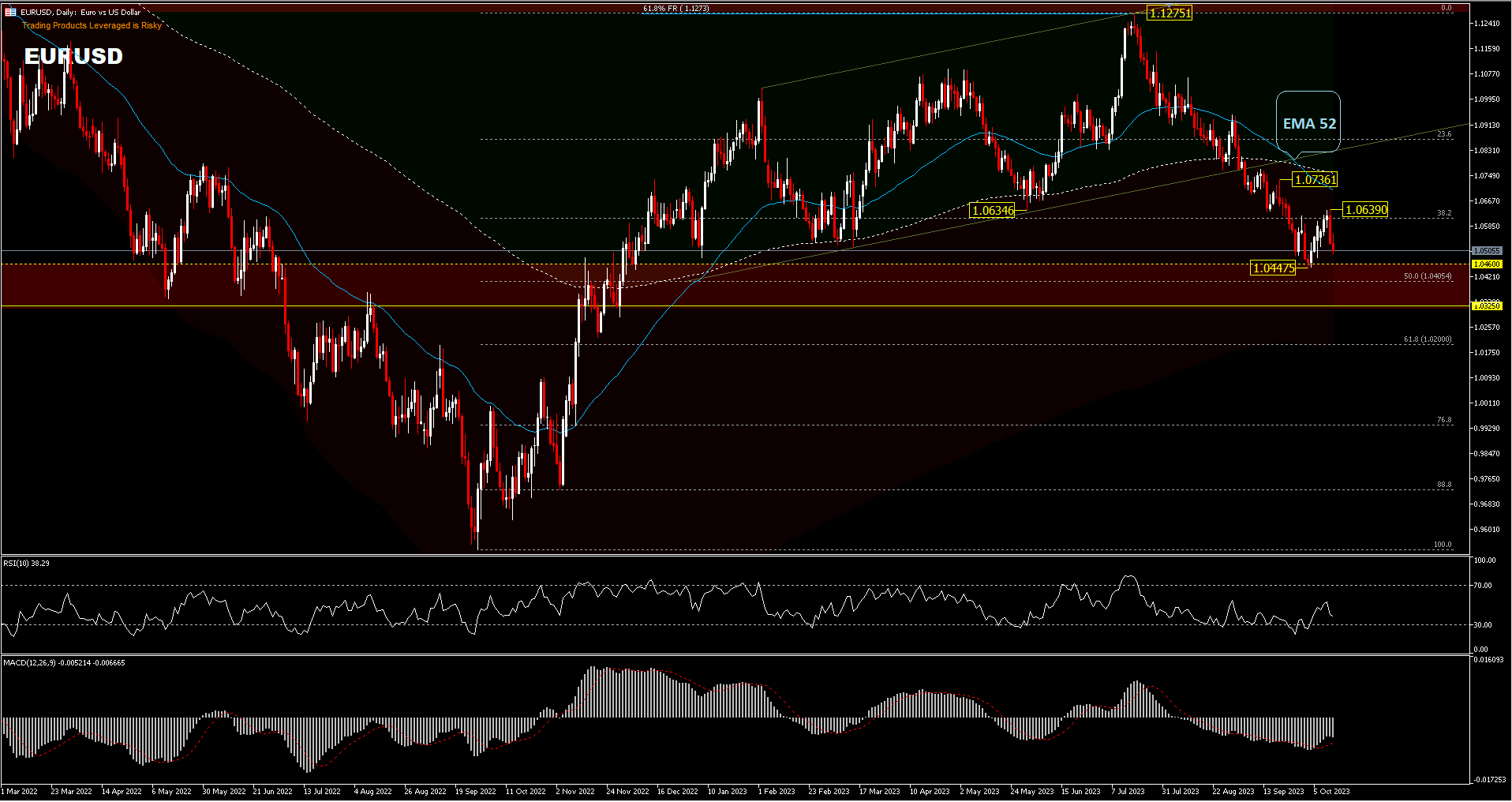

Technical Overview

Technically, EURUSD has moved below the 200-day EMA and has broken the uptrend line. The pair has surpassed the 1.0634 support recorded in May and registered a 10-month low of 1.0447 in the last 2 weeks of trading, while last week, the continuation of the rebound was short-lived to 1.0639. Since then, the price of the EURUSD pair has dropped near the recent low, opening up the opportunity for a double bottom formation.

In the bigger picture, the decline from the medium-term top of 1.1275 (61.8%FR) is seen as a correction to the uptrend from the 0.9535 low seen in 2022. Strong support is seen at the critical zone which is the 2015-2017 low which is likely to bring a short rebound. The current decline will target the 50%FR and 61.8%FR retracement around 1.0400 and 1.0200 respectively [from 0.9535-1.1275 pullback]. For now, risks will remain on the downside as long as 1.0639 resistance and 52 EMA hold, in case of a rebound.

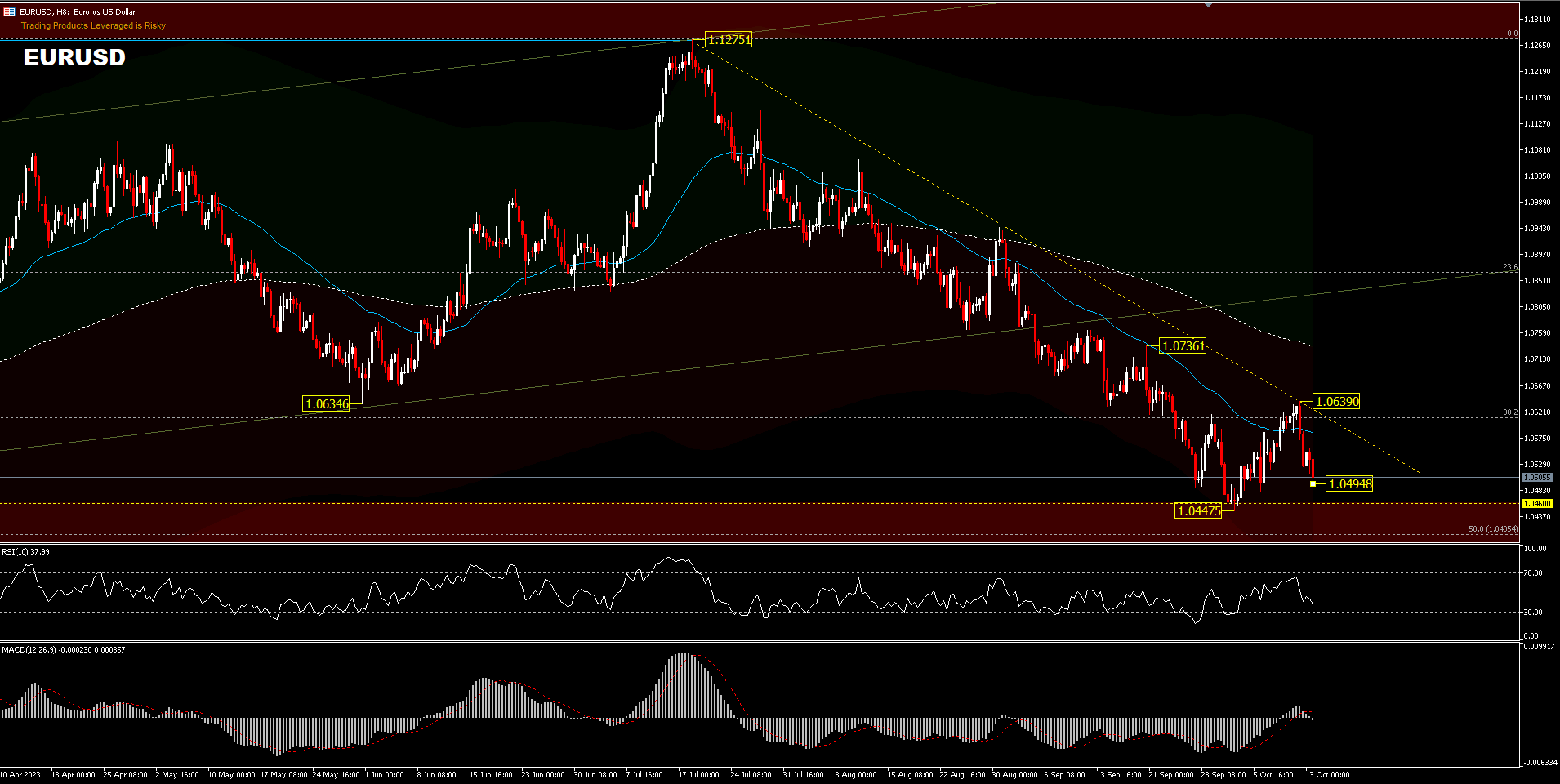

The EURUSD[H8] decline continued to 1.0494 level last week. The initial bias remains neutral at the beginning of this week for some further consolidation. Although a stronger rebound can’t be ruled out, the near-term outlook will remain bearish as long as 1.0639 resistance holds. Nevertheless, a strong break of 1.0639 could test 1.0736 and would confirm the short-term low of 1.0447. The bias is back to the upside for a stronger rebound. However, a break of 1.0447 support will mark the decline unfinished. The RSI at 37 is moving towards oversold levels, while the MACD has just crossed the ”zero” line amid the dollar’s safe haven status that is in demand, due to risk aversion.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.