Microsoft Corp., an American multinational technology conglomerate currently ranked the second largest company (after Apple Inc.) by market capitalization ($2.452T), which actively engages in the development and support of software, services, devices and solutions, shall report its financial results for FY24 Q1 on 24th October (Tuesday), after market close.

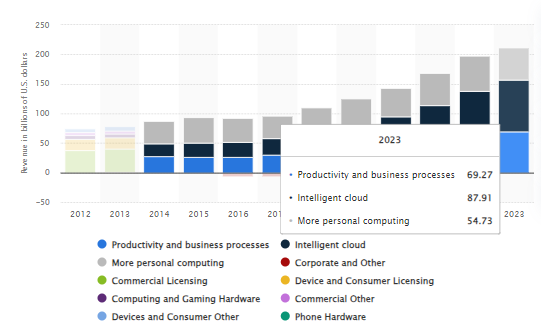

Microsoft derives its revenues from three main segments. The first segment is the Productivity and Business Processes segment, which includes products and services such as Office Commercial, Office Consumer, LinkedIn and Dynamic Business Solutions. The second segment is the Intelligent Cloud segment, including various Server Products and Cloud Services, as well as Enterprise Services. The third segment is More Personal Computing segment, involving Windows, Devices, Gaming, Search and News Advertising. Intelligent Cloud has been the segment that has brought the most revenues to the company for the past four years. In FY 2023, sales revenue generated from the segment was $87.91B, comprising over 40% from the total revenue. Despite the macroeconomic difficulties, the company’s annual revenue for FY 2023 reached over $211B, up nearly 6.9% from the previous year. A decade ago, its total revenue was around $78B.

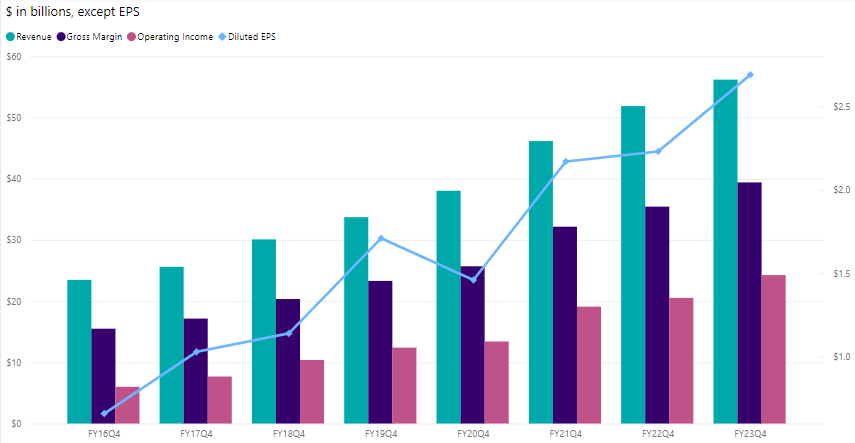

In the previous quarter, the Intelligent Cloud segment continued to contribute the most to the company’s revenue, at $23.99B (+14.7% y/y). Productivity and Business Processes and More Personal Computing drove $18.29B (+10.2% y/y) and $13.91B (-3.2% y/y, mainly driven by declining sales in Windows OEM and devices) in sales, respectively.

Operating income of Intelligent Cloud is up over +19% (y/y) to $10.53B, while Productivity and Business Processes was up +25% (y/y) to $9.05B. More Personal Computing edged up slightly over +4% (y/y) to $4.68B. Net income was $20.1B, up +20% from the same period last year. Similar with operating income, the gross margin of Microsoft has been improving steadily. In the previous quarter, it was $39.4B, up over 11% from the same period last year.

The company has announced recently that it is finalizing its $68.7B acquisition deal with Activision Blizzard (the issue with US FTC is still not done yet regardless). This in turn has made Microsoft the third largest gaming company by revenue, just after Tencent and Sony. It is for certain that winning the deal would mean adding more Activision Blizzard games to Xbox Game Pass in near future, a plus point for improving its overall competitiveness in the gaming market. The Xbox currently offers four different subscription plans (from the lowest at $9.99 to the highest at $16.99 per month) to suit different preferences of its users. In addition, the Game Pass Ultimate and PC Game Pass only cost $1.00 for the first 14 days of sign up, a strategy employed to attract and expand its new user base.

In the previous quarter, Microsoft reported its gaming revenue was up 1% (+$36 million) from the prior year period. The Xbox content and services revenue alone was up 5%, driven by growth in third party content and Xbox Game Pass. Nevertheless, its Xbox hardware revenue declined -13% (q/q), following softer demand for Xbox Series S/X consoles. According to Microsoft CFO Amy Hood, the outlook for Xbox content and services in the coming quarter should be up in the “mid to high single digits”, while there was no guidance provided on the Xbox hardware revenues. The overall gaming revenue is expected to be up “mid single digits”.

On the other hand, there was news that Microsoft is slowly edging away from its partnership with Open AI (by developing in-house a smaller, less costly conversational AI) following the latter’s privacy gaffes, colossal computing costs and mounting losses. Also, Microsoft’s growing collaboration with Meta on Llama 2 models is seen to be contradicting with OpenAI’s interest as well, creating a competitor for its closed source models.

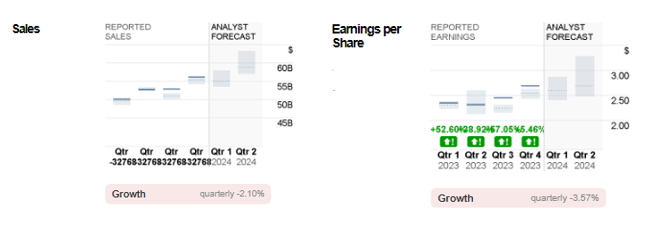

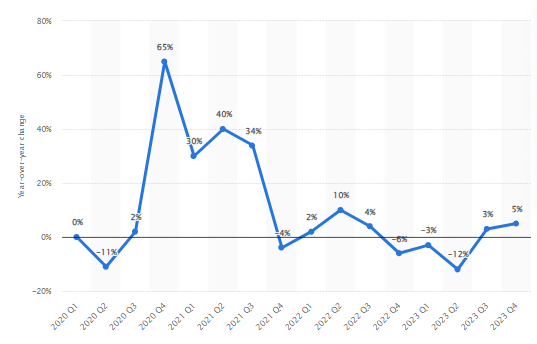

Microsoft: Reported Sales and EPS versus Analyst Forecast. Source: CNN Business

Consensus estimates for Microsoft’s sales revenue in the coming announcement stood at $55.0B, slightly down from previous quarter’s $56.2B, but up over 9% from the same period last year. EPS is expected to hit $2.59, down 10 cents from the previous quarter. It was $2.35 in Q1 2023.

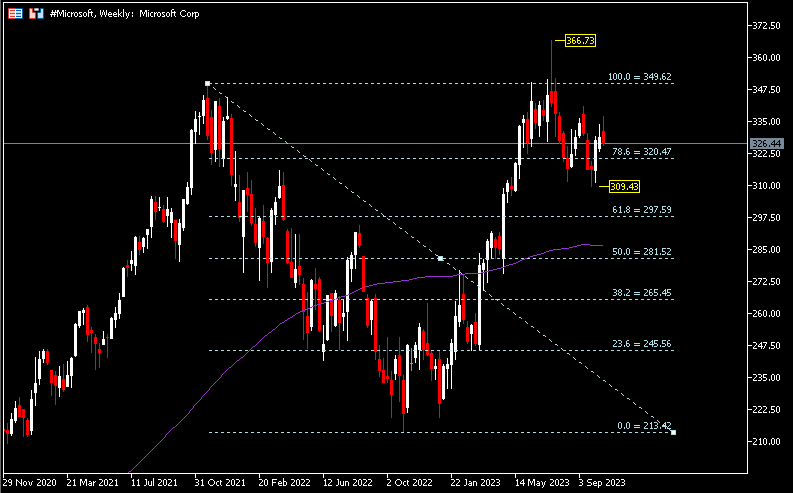

Technical Analysis:

#Microsoft, Weekly: The first half of 2023 has been good for the stocks, until bullish momentum started waning in mid July after hitting an ATH at $366.73. Last week, the company’s share price closed bearish, just above support $320.50 (FR 78.6%). Breaking this level may lead to the bears continuing testing recent lows at $309.43, followed by $297.50 (FR 61.8%) and the dynamic support 100-SMA.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.