Australian and Canadian Dollars managed to eke out respective 3- and 2-session highs against the US Greenback. This was seen amid a steadying in global stock markets, although sentiment remains fragile as investors continue to fathom the recent sharp dive in US yields and yield curve inversions.

Friday’s 2.5%-plus rout in oil prices coupled with a miss in Canadian retail sales data sparked selling of Canadian Dollars. USDCAD has settled moderately lower after peaking at a 2-week high at 1.3444 yesterday. The broader risk-off theme in global markets had been weighing on Canadian currency, however during London open this picture reversed as it is currently under pressure only against the Australian Dollar bloc.

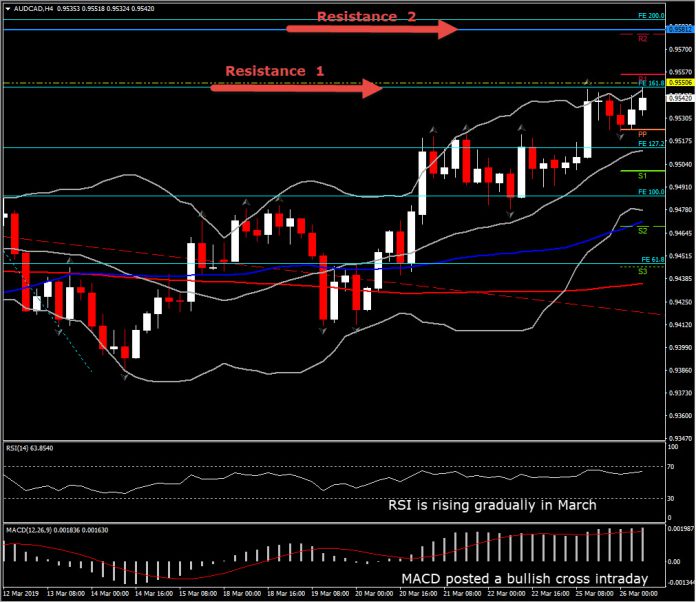

AUDCAD is performing its 5th bullish day, leaving behind the 3-month descending triangle and all the daily SMAs. The increasing positive bias seen since the beginning of March, has put pressure on the nearly 3-year Support which has turned to strong Resistance (i.e. 0.9550 also 50-week SMA and FE161.8).

The failure last week to break this Resistance area, might have raised concerns for a possible reversal of March’s rally, however the positive outlook holds as momentum indicators preserve the bullish sentiment. Intraday there is a notable acceleration in both RSI and MACD (bullish cross). Meanwhile in the daily timeframe, RSI is rising above 50, as MACD turns gradually in to positive and Bollinger Bands extend to the upside, presenting a rising market.

Hence as these bullish signals hold, another leg higher above 0.9550 would likely attract more bulls in the market and the bullish sentiment is expected to rise further. Further Resistance can be found between the FE200 and January’s Resistance, at 0.9580-0.9590. Further gains could breach 0.9610-0.9617. Immediate Support holds at 200-Day SMA and FE127.2, i.e. 0.9513.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.