AUDJPY, H1

AUDJPY is registering the biggest movement out of the dollar pairings and associate cross rates we keep tabs on, presently showing a 0.6% gain on the day. The gain is rooted in a rebound from a near seven-week low the cross saw in Sydney trading earlier, when a strong risk-off sentiment had been prevailing. A rebound in European stock markets following above-forecast German Ifo survey data, which was taken as a much-needed tonic by nervy markets, helped prolong the rebound in AUDJPY, which can be seen as something of a forex market proxy on global stock market direction. This put a squeeze on more deeply established short positions after the cross declined on each day of last week, racking up a net 1.5% decline. AUDJPY is presently sitting a 78.20, earlier printing a rebound high at 78.25, and up from the low at 77.52, which was the lowest point seen since February 7. The Crossing EMA Strategy triggered at 10:00 this morning at 77.98, generating T1 at 78.12 and T2 at 78.36, with an initial stop loss at 77.755. Resistance to a further move higher is the 50-period moving average at 78.25 with support at the psychological level of 78.00.

In the bigger picture the cross has been trending lower since early 2018, which largely reflects the impact of China’s sputtering economy on Australia and the RBA policy outlook.

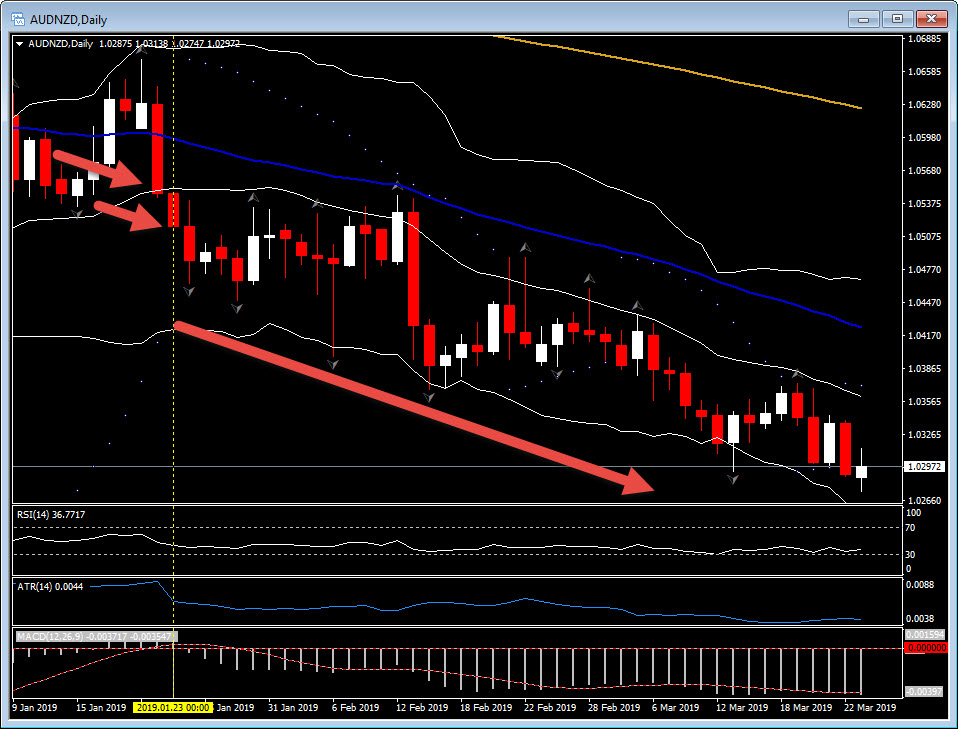

The Trend REALLY can be your friend. The AUDNZD has been below it’s 20-day moving average for 44 trading days, it’s 50-day for 45 consecutive days and it’s 200-day for 103 trading days.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.