Japan’s Nikkei Stock Average experienced a notable 1.3% surge, last trading at a solid 30,990. This surge in the Japanese index appears to be influenced by the positive performance of US stock index futures, which often serve as a harbinger of improved risk appetite in global markets.

As traders keep a close watch on the economic landscape, US economic data, particularly personal income and spending figures scheduled for release later today, are expected to be a focal point.

Among the stars of the day on the benchmark JPN225 index, we saw Fujitsu soaring impressively by 12.0%. Similarly, Nomura Research Institute secured a 5.5% gain, and SG Holdings also participated in the uptrend, closing 4.5% higher.

However, not all stocks were carried by the rising tide. Takeda Pharmaceutical faced headwinds, recording a 6.4% decline after reporting a net loss for the second quarter and revising its net-profit guidance for the fiscal year.

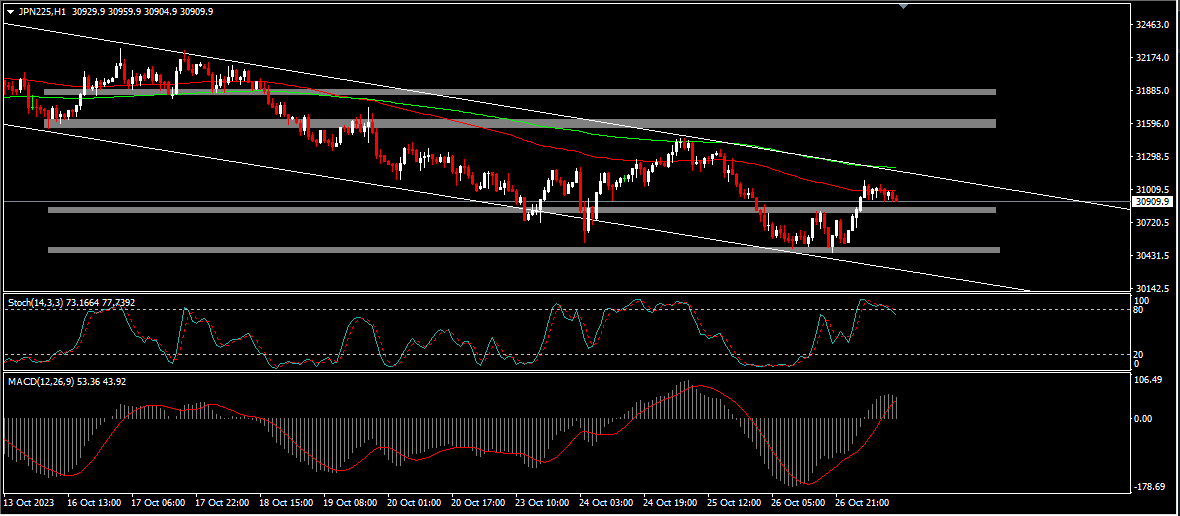

The immediate future for the JPN225 index hangs in the balance, contingent on its next move within its existing trading range or channel. A breach above the upper boundary at 31,200 could signify a persistence of the current upward momentum and pave the way for further advances towards key resistance levels, notably at 31,500.00 and 32,000.00. On the flip side, a breach below the support boundary at 30,780 may mark a reversal, ushering in further downward momentum that could bring the index down to the next support levels at 30,500.00, and ultimately, to the channel’s lower limit at 30,200.

In assessing the technical indicators, we find a mixed picture for the JPN225 index. The Stochastic indicator teeters on the edge of the oversold zone, hinting at a potential shift towards a downward trajectory. In contrast, the MACD (Moving Average Convergence Divergence) sits above zero and the signal line, suggesting a prevailing bullish sentiment. This division underscores the importance of carefully monitoring the index’s movements as it navigates this pivotal juncture.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.