FX News Today

- 10-year Treasury yields are up 2.8 bp at 2.427%, and JGB yields climbed 1.8 bp to -0.076% amid a mixed session on Asian stock markets.

- Japanese markets in particular rebounded from yesterday’s sell off after sentiment started to stabilize during the US session yesterday and Wall Street closed little changed.

- The sharp drop in US bond yields last week and the shape of the yield curve revived fears of a global recession last week, but while yields remain at low levels for now at least the mood seems to be slowly lifting.

- Markets will continue to keep a very close eye on the spread between the 10-year Treasury yield and three-months bills, which is judged to be a key recession indicator and inverted last Friday. This week’s US bond auctions will be closely watched.

- The UK Parliament took control of the Brexit process after May’s defeat, with a new vote scheduled for tomorrow.

- Topix and Nikkei closed with gains of 2.57% and 2.15% respectively. The ASX gained 0.07%, while Hang Seng and Shanghai comp are down -0.15% and -1.35%.

- US futures are higher as are the European ones. The front end WTI future meanwhile is trading at USD 59.21 per barrel.

Charts of the Day

Technician’s Corner

- EURUSD has been trading around the 1.13 level, breaking below but not maintaining it yesterday. Immediate Resistance is at 1.1338, at the 200HMA. Indicators are also not registering any up or down signals.

- GBPUSD continues to trade around the 1.32 level, in a tight channel between this and the 1.3223 200HMA level. The MACD does not show much action, while Stochastics issue bullish signs.

- USDJPY dropped below the 110.34 level, trading around the 110 level, which appears to hold despite some breakouts below it. Resistance remains at 110.34 and Support, after the 110 immediate level, lies at 109.80.

- XAUUSD broke below the 1320 level early today, with the MACD registering bullish signs as the Stochastics indicator is moving in the oversold region. Support and Resistance levels remain at 1313.8 and 1320 respectively.

Main Macro Events Today

- Housing Data (USD, GMT 12:30) – Housing starts and Building Permits are expected to have increased marginally in February, while the S&P House Price Index is expected to have continued its deceleration, growing by 3.9% in January, compared to 4.2% in December. As in previous occasions, housing market data usually have more impact on the stock market than on the currency.

- CB Consumer Confidence (USD, GMT 14:00) – The Conference Board Index is expected to have increased to 132.1, compared to 131.4 in the previous month.

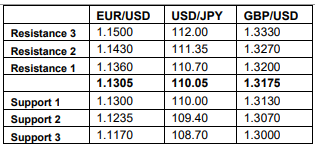

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.