Stock market sentiment has turned sour again, as yields pick up and investors adjust Fed expectations. Hopes of early rate cuts seem to be fading and Asian stock markets sold off overnight. Futures are down across Europe and the US as well, with European and Chinese data weaker than expected.

- The RBA resumed raising interest rates in a widely anticipated move, while signalling a higher hurdle to further policy tightening that pushed the local currency lower.

- German industrial production declined -1.4% m/m in September, more than expected. This was the fourth consecutive month of contraction. The numbers flag recession risks, especially as orders data remains subdued and the Manufacturing PMI in contraction territory.

- China’s trade data showed an accelerated decline in export growth, but imports unexpectedly improved, which is keeping hopes of a stronger recovery alive, especially after efforts from Beijing to boost local demand.

Fed: Implied Fed funds futures dropped further as the market futures prices out Fed rate hike risks and bring forward the chances for the start of rate cuts. The probability for a 25 bp tightening at the December FOMC is less than 10%, while the January contract points to about 13%. The market is building in rate cuts around May, with a 50-50 bet, while the implied June contract trades at 5.007%, with July at 4.84%. The Goldilocks reported that October payrolls would have been up about 180k if the 33k in strikers were added back in, which suggests the economy is slowing as the FOMC wants to see, and is not coming in for a crash landing.

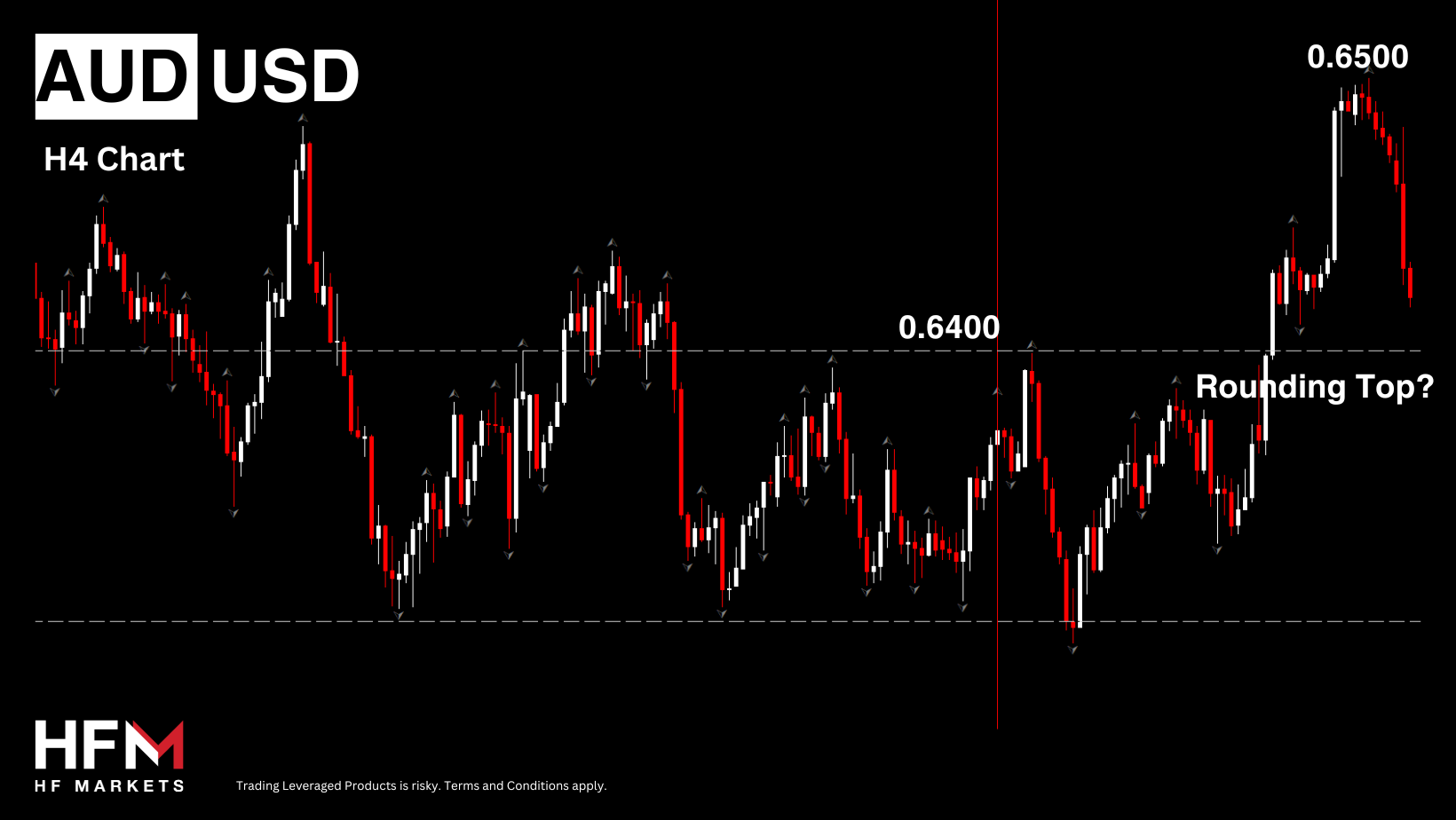

- USDIndex recovered from overnight losses to a session low of 105.35. The buck has not finished below the 105 level since September 13. The VIX dipped -0.07% to 14.90 after rising to an intraday high of 15.58. AUDUSD drifted to 0.6420 from 0.6500. USDJPY reverted to 150.36.

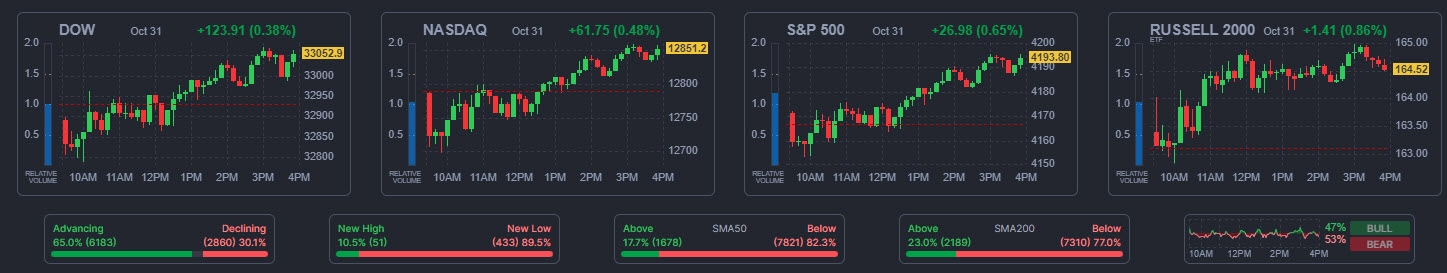

- Stocks: Wall Street closed with fractional gains. The US100 advanced 0.30%, with the US500 up 0.18% and the US30 0.10% higher. S&P sectors were mixed with gains in IT and healthcare offsetting drops in real estate and energy. JPN225 (-1%) snaps 4-day winning streak as US Treasury yields rise.

- WeWork confirmed it is seeking bankruptcy protection, a firm once valued at close to $50 billion.

- Nintendo hikes profit forecast as Switch battles on.

- UBS posts $785mn quarterly loss due to Credit Suisse integration costs.

- Oil declined to $78.83, as uncertain demand prospects and renewed concerns about the Fed’s tightening measures outweighed Saudi Arabia and Russia’s extended supply cuts, leading to a decline in oil prices.

- Gold experienced losses, trading at $1,966, while BTC remained just below the $35,000 mark.

Interesting Mover: AUDUSD (-1%) after RBA hiked rates by 25 bp, which may have acted as a reminder that key central banks still retain a tightening bias. Next Support at 0.6400 & 0.6380.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.