On Friday, the US Dollar hit an almost two-month low against the Euro. This was largely due to growing expectations that the Federal Reserve might be putting the brakes on interest rate hikes, due to a weak employment report. All eyes are now on US central bank officials, as traders look for hints about future interest rate policies.

Federal Reserve Chairman Jerome Powell is set to speak on Wednesday and Thursday. Powell’s words could have a significant impact on the markets and shape future developments. These speeches are closely watched by traders as they often contain crucial hints for currency markets.

However, it’s essential to consider the other side of the equation. European Central Bank (ECB) President Christine Lagarde made waves with her hawkish comments over the weekend. Her assertive stance may act as a buffer for the EURUSD pair, preventing a major drop. Lagarde’s strong words highlight the power of central bank officials in influencing market sentiment.

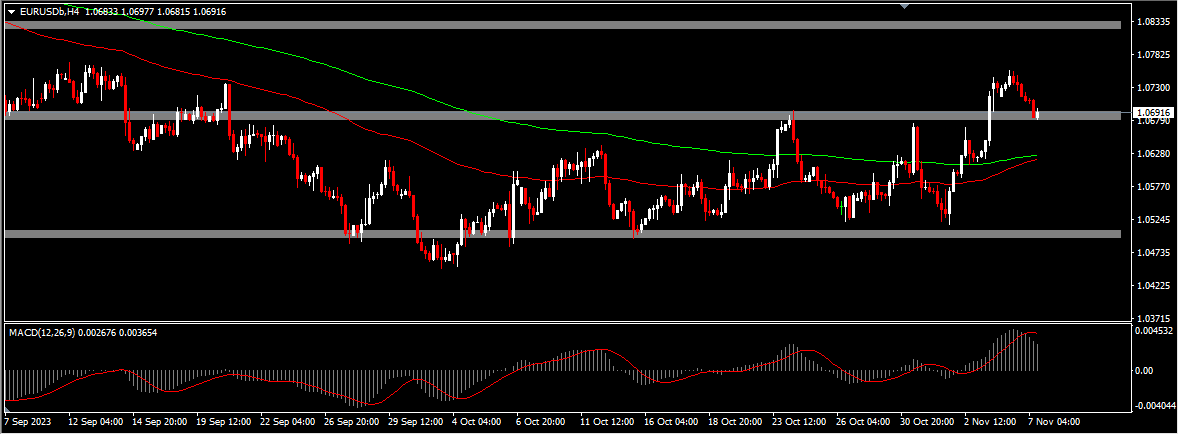

Looking at the technical side, the short-term outlook on the 4-hour time frame shows some key support levels. If the EURUSD pair breaks below 1.0670, it could signal further declines, possibly down to the 200-period EMA at 1.0620 or even the 61.8% Fibonacci retracement level at 1.0607. The MACD indicator, currently below the signal line, indicates a leaning toward bearish momentum.

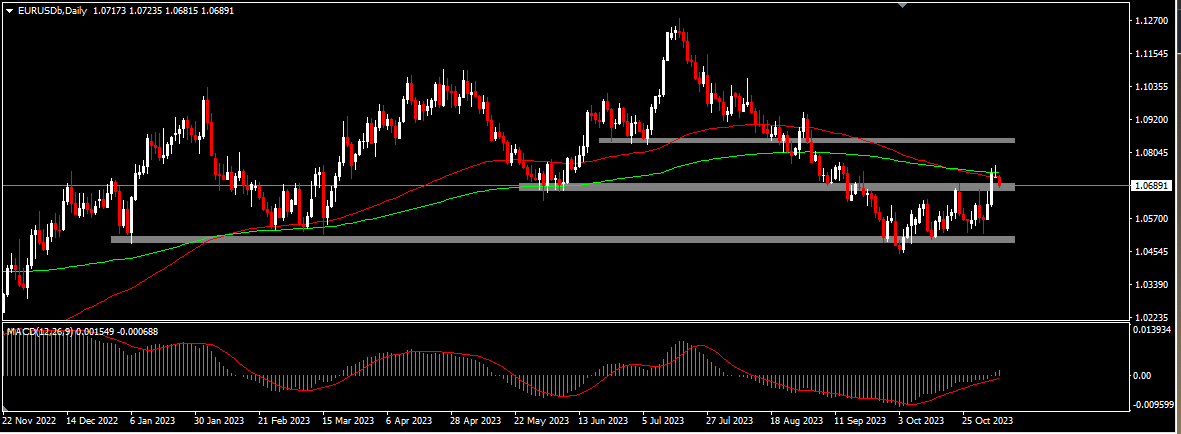

Zooming out to a daily perspective, the 100- and 200-period EMA have formed a “death cross,” typically signalling a bearish trend. However, the MACD, which has crossed above the zero line, hints at a bullish sentiment.

Given these mixed signals, it’s crucial for traders to exercise patience and caution. Before jumping into new long positions, a clear break above 1.0740 would signal a potential shift in momentum, into a bullish one.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.