FX News Today

- 10-year Treasury yields are up 0.5 bp at 2.400% and JGB rates lifted 0.6 bp to -0.100% amid a broad move higher in long yields across Asia.

- Hopes of progress in US-Sino trade talks helped to underpin confidence and stock market sentiment improved after Mnuchin said he had a “productive working dinner” in Beijing yesterday with the US Treasury Secretary and US Trade Representative in China to resume trade talks.

- Chinese markets in particular benefited and CSI 300 and Shanghai Comp are up 3.49% and 2.85% respectively. The Hang Seng has risen 0.97% so far, while Topix and Nikkei closed with gains of 0.56% and 0.82% respectively and the ASX lifted 0.08%. US futures are also broadly higher and the front end WTI future is trading at USD 59.54 per barrel.

- The Brexit Vote today, which only includes the Withdrawal Agreement and not the Political declaration, will likely fail, again. The day is largely symbolic as today was supposed to be Brexit Day.

Charts of the Day

Technician’s Corner

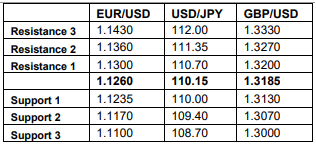

- EURUSD continued its downwards trend, breaking through the 1.1256 Support level. However, it appears to have reached the end of the hill as both the MACD and Stochastics point to the upside.

- GBPUSD keeps declining as fears of no-deal Brexit continue, currently fluctuating around the 1.30 Support. Indicators are registering mixed signals as the MACD is positive and the Stochastics are negative, while the short MA crossed the long MA a couple of hours ago.

- USDJPY gained some despite mixed Japanese data, as the country appears to have been able to maintain its inflation at stable levels. The pair broke through the 110.73 level and is currently trading just below the 200HMA at 110.62. Both MACD and Stochastics are pointing downwards.

- XAUUSD remained flat below the $1300 mark after the drop from the 1311 level yesterday. No particular movements observed from the indicators.

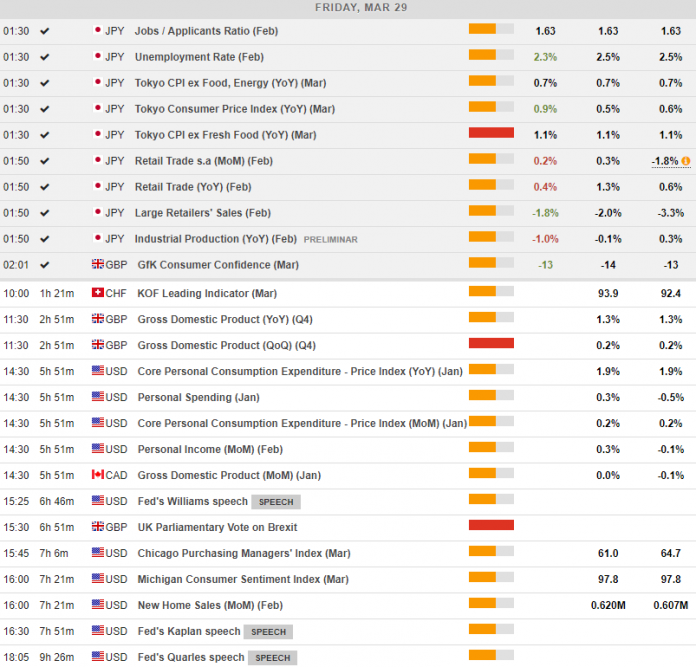

Main Macro Events Today

- UK GDP (GBP, GMT 09:30) – 2018Q4 GDP is expected not to have seen any material changes from its preliminary estimate and remain at 1.3% y/y.

- PCE and PCE Inflation (USD, GMT 12:30) – Personal spending is expected to have increased by 0.3% in January, compared to a reduction of 0.5% last month. PCE inflation is expected to have remained at 1.9%, the same as in December.

- Canada GDP (CAD, GMT 12:30) – Canadian GDP is expected to have registered no m/m growth in January, compared to a 0.1% contraction in December.

- UK Parliament Brexit Vote (GBP/EUR, GMT 13:30) – The final call for Brexit, with MPs having to vote on a deal that is essentially the same as before albeit not defining the UK’s future relationship with the EU.

- Chicago PMI (USD, GMT 13:45) – The Chicago PMI is expected to register signs of weakness in March, reducing to 61.0 from 64.7.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.