Stock market sentiment improved overnight, with renewed optimism on the US-Sino trade front helping equities to move higher, particularly in China. US futures as well as European futures are also posting broad gains and at least for now concern about the global growth outlook is receding.

As stated, equities found support from the Treasury yields rise, along with the better risk-on tone adding to some of the erosion in Treasuries. With the bond market having richened dramatically in recent sessions, and with no additional bullish catalysts today, demand for coupons has petered out.

Hence despite yesterday’s rise, and as the overall negative Bund yields and dovish guidance from ECB policymakers have offset the decline in Treasury yields and yield curve inversions in the US Treasuries, Treasuries look a little more attractive than index funds, which could need to be buyers at the close today for month- and quarter-end.

Therefore ahead of the US Market open, and as the 10-year Treasury rose by 0.4 bp higher, while currently the Bond markets globally are retreating from highs as fresh trade hopes helped to underpin broad gains in stock markets, the US 10 Year T-Note Futures seems to ready to open in a bearish mode.

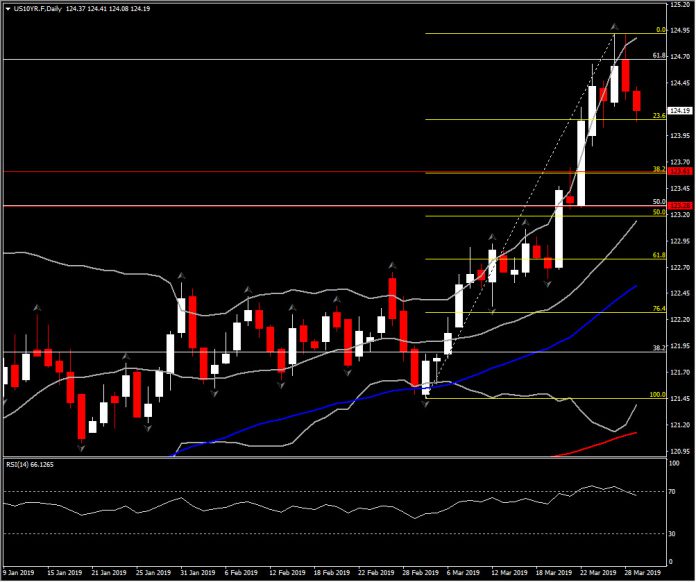

Yesterday’s close for US10YR Future was at 4-day lows at 124.09. This level is close to the 23.6% retracement of the March rally.

Technical analysis suggests that this reversal lower the last 2 sessions was a reflection of the already overbought asset, after it topped at 15-month high area at 124.92. Hence a move southwards on the US open could alert the retest of the next Support level at 123.60, which is set at the 38.2% Fibonacci retracement level. Further losses below this area could lead towards 123.15-123.30 area (confluence of the 50% Fib. level set on 2017 decline, 50% Fib. on March rise and also 20-day MA). Immediate Resistance is set at 124.40-124.50.

On the economic front, today’s data calendar has February personal income and January PCE, with the former seen up 0.3% versus the previous 0.1% drop, and the latter forecast at up 0.4% from -0.5%. The March Chicago PMI is seen at 61.0 from 64.7. The final March University of Michigan consumer sentiment is penciled in at 97.5 from the preliminary 97.8. For Fedspeak, Kaplan speaks at the global asset management conference in New York, while Quarles speaks on macroprudential policy, also from New York.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.