FX News Today

- Stock markets continued to recover during the Asian session, with concerns that the world economy is sliding into recession calmed by better data out of China and trade talk hopes.

- Sentiment was underpinned by a stronger than expected services PMI out of China – Further sign that economic growth is coming back.

- US as well as European equity futures are also moving higher.

- Brexit: UK PM May will sit down with Opposition leader Corbyn to try and break the deadlock. Meanwhile, a new referendum in the UK on EU membership and a customs union are now both looking increasingly likely.

- A compromise needs to be found before the EU emergency summit on April 10 to secure another extension until May 22.

- GBP cleared $1.3100 after PM May talked up another deal, despite Commons failure.

- WTI crude surged clear over $62.87; Gold capped near $1,291 by USD index 1-month high.

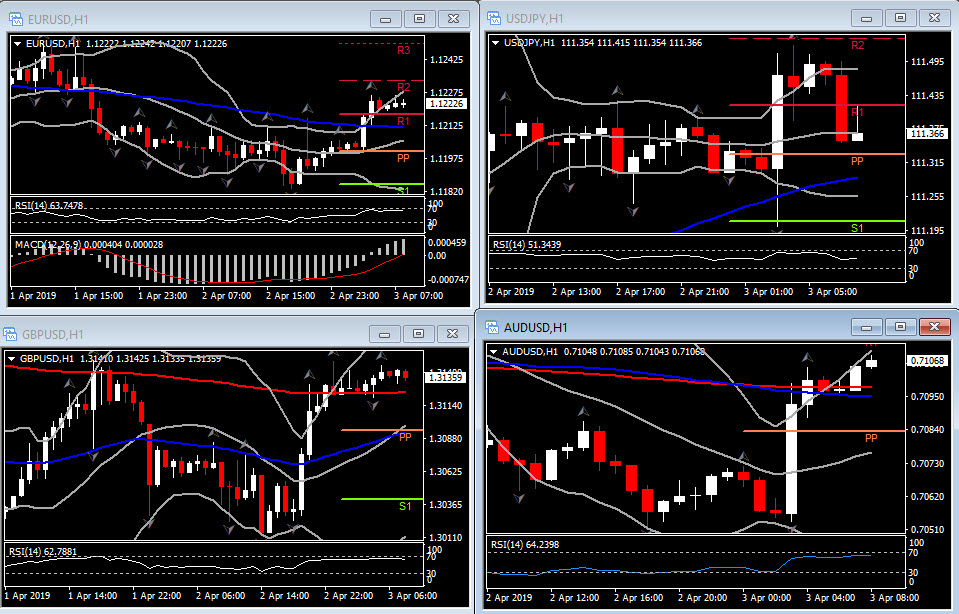

Charts of the Day

Technician’s Corner

- GBPUSD jumped in London open, above latest peak at 1.3150. Next Resistance levels are set at 1.3178 and 1.3230. Support holds at 200-period SMA at 1.3120, for 12 consecutive hourly sessions.

- EURUSD holds Support at 1.1216, which was the initial resistance. With momentum indicators looking to turn southwards, however, a break of this level could shift the asset back to PP level at 1.1200.

- USDJPY probed 111.45 highs amid risk-on, by breaking 2-day peak and R1 for the day. Currently it is retesting 111.56, which is a breath above the upper BB level and coincides with FE161.80 extension (from March rebound) and the latest up fractal. This could be a retracement level for the asset.

- AUDUSD hit 50-day SMA at 0.7117. This area could provide some resistance to the asset, as the asset lacks of positive momentum based on the daily indicators. Abreak however of the latter but more precisely of yesterday’s high at 0.7128, might push Aussie to the next barrier at 0.7160.

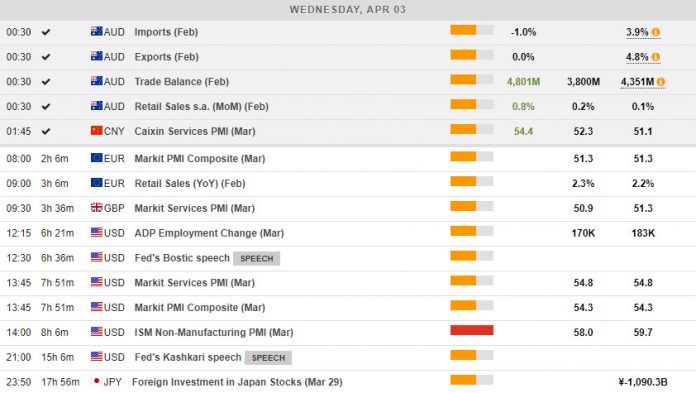

Main Macro Events Today

- Retail Sales and Services (EUR, GMT 08:00-09:00) – Eurozone March Services reading expected to be confirmed at 51.3, while Retail sales could spike to 2.3% y/y for February.

- ADP Non-Farm Employment Change (USD, GMT 12:15) – The ADP Employment survey is seen at 165k for March compared to the 183K in February.

- ISM Non-Manufacturing PMI (USD, GMT 14:00) – The ISM non-Manufacturing PMI in the US is expected to slip to 58.7 in March, compared to 59.7 in February, supporting the strong economic climate despite the small decrease in its value.

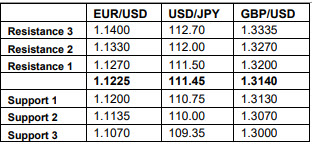

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.