FX News Today

- 10-year Treasury yields are down -1.1 bp at 2.513% and JGB yields fell back -0.5 bp to -0.060%, as the stock rally stalled during the Asian session and the USD consolidated overnight.

- Big misses for ADP Jobs (50k) and ISM Non-Manufacturing PMI (19-month low) pressed a pause on Equity rally.

- Parliament passed (by 1 vote) a bill to ask to extend Brexit Day beyond April 12, but it remains unclear whether there is time to get it through by May 22. A longer extension looks most likely while the odds of a full 2nd Referendum odds are also increased.

- Asian markets are mostly trading narrowly mixed, with traders waiting for another catalyst such as tangible progress on the US-Sino trade talks before pushing equity markets out further following the recent rally.

- Topix and Nikkei are down -0.11% and unchanged on the day respectively. The Hang Seng dropped -0.42%, while CSI 400 and Shanghai Comp are up 0.80%, with hopes of government stimulus after the government said it plans to cut some airline fees adding support. The ASX meanwhile lost -0.83%.

- Oil futures are trading at USD 62.37 per barrel.

- German Factory Orders just in and is a big miss it is (-4.2% vs expectations of +0.3%), putting the German Industry in recession territory.

Charts of the Day

Technician’s Corner

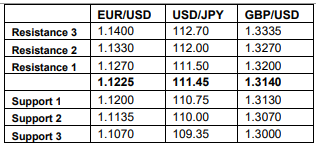

- GBPUSD reacted positively after the UK Parliament asked the government to ask for another extension of the Brexit deadline. Resistance level remains at 1.3184, with a strong one at 1.32, while Support is bounded by the 200HMA at 1.3137.

- EURUSD is trading close to but below its 200HMA at 1.1248, affected by the weaker than expected US data, with indicators not showing a clear direction.

- USDJPY paused its rise after the worsening in US data releases, stabilizing around the 111.40 level. Both the MACD and the Stochastics indicators are suggesting a downturn. Support and Resistance remain at 110.73 and 111.68, although the former could change as the 200HMA could be binding.

- XAUUSD continues trading below 1300, fluctuating around the 1290 mark. Next Resistance point is at 1294.50 with indicators suggesting a mild upwards movement.

Main Macro Events Today

- ECB Monetary Policy Meeting Accounts (EUR, GMT 11:30) – The ECB Accounts, similar to the FOMC Minutes, provide an insight with regards to the policymakers’ thinking about the European economy’s potential.

- Jobless Claims (USD, GMT 12:30) – Continuing Jobless Claims are expected to have decreased over the last week of March, while Initial Jobless Claims are forecast to have increased.

- Canada PMI (CAD, GMT 14:00) – The Canadian PMI is expected to have risen to 51.1 in March, compared to 50.6 in February.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.