USA100 – Alphabet Stocks Rise 5%

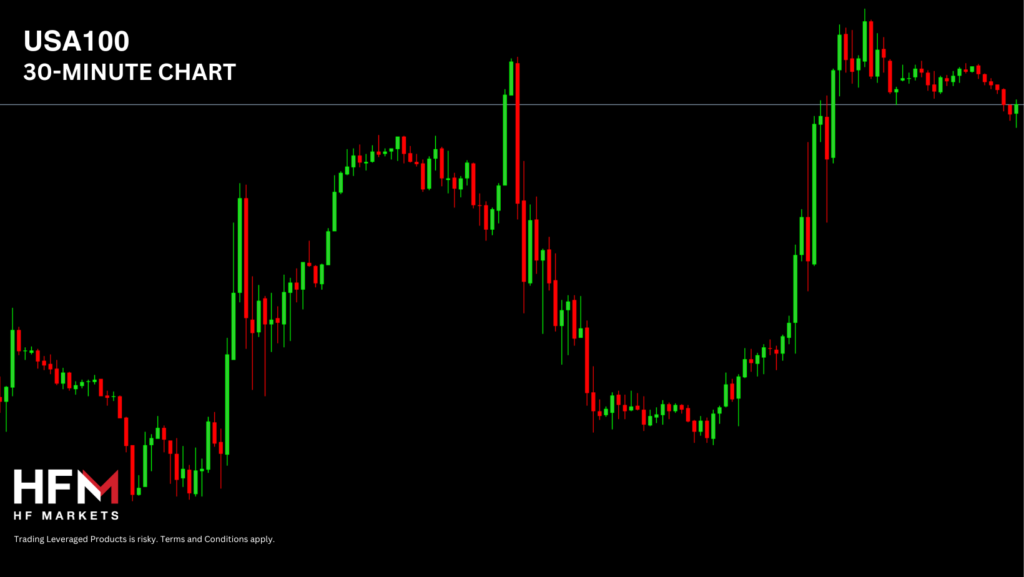

Yesterday’s Market Analysis pointed to the potential for the USA100 to correct and regain Wednesday’s losses. Yesterday’s analysis also mentioned “the index is not within a short-term downward trend and each time the USA100 declines, buyers re-enter the following day”. The USA100 ended Thursday’s trading sessions 1.30% higher and surpassed this week’s previous highs. Therefore, the price action pointed towards a trend rather than a correction.

The higher-than-expected volatility was largely due to Alphabet’s strong bullish trend triggered by a new Artificial Intelligence model ‘Gemini’. Alphabet stocks rose by 5.40% by the end of day, with the instrument rising 4.00% before trading hours and a further 1.35% during the US open session. The company’s board of directors advised Gemini outperforms OpenAI, but they did not show how it compares. The stock has seen an increase in demand and clearly the AI drive continues. However, economists are also concerned as to how new AI products, which are costly to build, will be monetized. Monetizing AI is vital for investors, but so far, the company has not disappointed and continues to beat earnings prospects.

Weekly data on the American jobless claims increased by 220,000, which is in line with expectations and previous announcements, however, the total number of citizens being paid support decreased, from 1.925 to 1.861 million. The report is in line with what stock investors were hoping for. Stock investors are hoping for employment data to show neither growth nor weakness, but stability. By seeing this, the Federal Reserve will likely opt to decrease rates by at least 25 basis points and a “soft landing” becomes more likely.

Both the US Dollar and US Bond Yields are higher today, which may limit prospects of a further bullish trend. However, if the US Dollar Index declines as well as Bonds, the USA100 could potentially push higher. So far, the rise in the Dollar and Yields has resulted in the instrument declining 0.17% over the past 3 hours. The main price driver today will be the US employment data. If the data reads in line with expectations or slightly lower, the stock market potentially could react positively. However, if it is much higher than expected, the results will be less certain.

EURUSD – The Euro Continues to Struggle

The EURUSD is trading within a downward trend and a bearish regression channel. The exchange rate is also trading 0.20% lower during this morning’s Asian session. The Euro is decreasing in value against all major currencies including the Pound, Yen and Swiss Franc. The US Dollar Index on the other hand is trading 0.23% higher than the day’s open price.

The Euro continues to come under pressure from weak economic data and lower inflation. Yesterday the Gross Domestic Product for the past quarter read -0.1% and economists advise economic contraction is likely to be short and shallow. However, Reuters latest poll completed by leading economists advises the ECB may cut interest rates as early as April 2024. If a cut as early as April materializes, it would be somewhat earlier than economists had previously expected.

Nonetheless, the intraday trend and price action over the next week will be largely influenced by today’s Non-Farm Payroll, Unemployment Rate and Average Hourly Earnings. Analysts expect the NFP to read 184,000, the Average Hourly Earnings 0.3% and the Unemployment Rate 3.9%. In order for the Dollar to experience a significant lasting bullish trend, the NFP will need to read higher, the Unemployment Rate lower and the Average Hourly Earnings as expected.