GBPUSD, H1

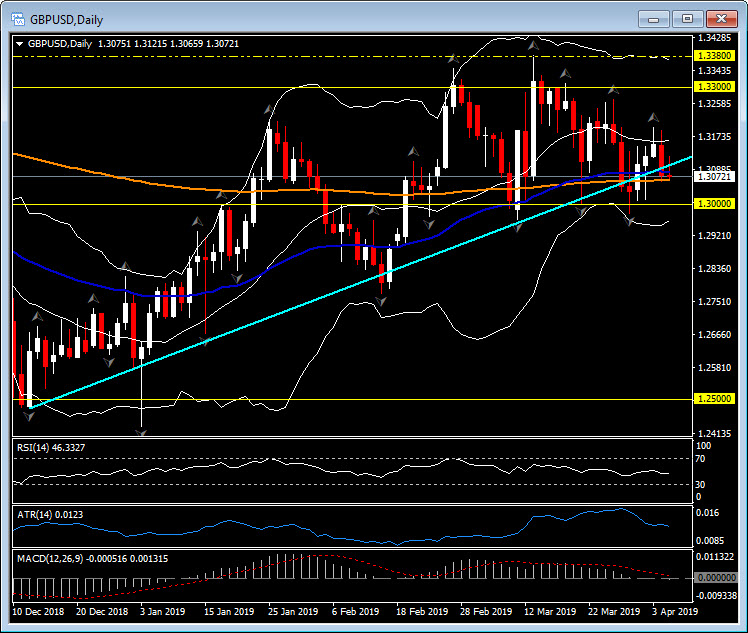

Cable has settled near 1.3070 after rejecting 1.3125 at the 200 EMA and rebounding from the levels near 1.3060 that were seen yesterday. Expectations are that the Pound will continue to trade with a trade-weighted discount of about 10-11% from levels that were prevailing ahead of the vote to leave the EU in June 2016, but the currency is showing about a 4-5% gain on the year-to-date, which reflects a decline in the perceived risk for a disorderly no-deal Brexit scenario.

On the Brexit front, there are reports that it will become clear later today whether Prime Minister May’s endeavours to seek a compromise Brexit deal with Labour will work. She has also written to the EU today to ask for an extension until June 30 this year with the option to leave early if Parliament agrees a Brexit deal before then. If a deal isn’t approved which allows the UK to leave before May 23 the PM acknowledges the UK will have to take part in Euro elections. The May/Corbyn accord, if it is to work, would likely be something along the lines of May’s existing EU Withdrawal Agreement plus a guarantee for the UK to permanently remain in the customs union, possibly subject to a confirmatory referendum. The pressure is on, as May will need to present a plan before the EU at next Wednesday’s summit in Brussels. The EU is looking for signs that there isn’t a “permanent standoff” in Parliament between the two main parties before agreeing on a further delay in Brexit beyond April 12. The EU’s Tusk mooted that a 12-month “flexible” extension would be possible.

Cable is presently nestled near the midway of a choppy range that’s been unfolding since late February, which has been marked by a low at 1.2960 and a 2019 high at 1.3380. More of the same seems likely until the point when a no-deal could be concretely ruled out, which could spark a 5%-plus rotation higher in the Pound, the bias appears to be to the upside.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.